Nvidia Stock Performance and Market Outlook

Nvidia (NASDAQ: NVDA) saw remarkable stock growth, rising 239% in 2023 and an additional 171% in 2024. As of now, its market capitalization stands at $4.5 trillion, raising speculation about the possibility of doubling to $9 trillion. Analysts anticipate a 52% growth rate for fiscal year 2027, potentially increasing earnings per share (EPS) to $7.66, which could translate to a stock price around $352.36 or even $9.4 trillion if the price-to-earnings (P/E) ratio increases to 50.

Competition and Future Challenges

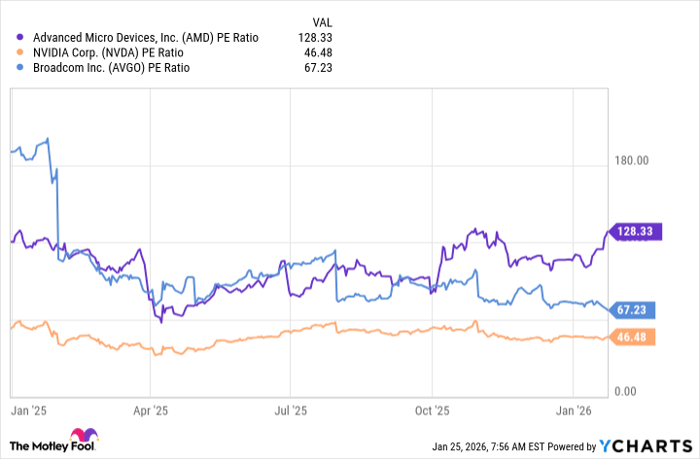

Nvidia’s dominance in the AI GPU market is challenged by competitors like Advanced Micro Devices (AMD) and Broadcom, which are introducing lower-cost alternatives. Investors are cautioned to monitor these rising competitors, as Nvidia’s premium pricing strategy could lead to reduced market share. Despite competition, Nvidia maintains significant sales to AI developers globally, sustaining its growth trajectory.