Nvidia Eyes Top Spot in Market Capitalization, Driven by AI Demand

Nvidia (NASDAQ: NVDA) is poised for significant achievements. As of now, the company’s market capitalization sits at $3.3 trillion, trailing only $150 billion behind the tech giant Apple.

Nvidia has previously reached the top of the list this year, but this time may be different. Analysts speculate that Nvidia could maintain its position as one of the most valuable companies in the world.

What does the future hold for this tech powerhouse? Is now the right moment for investors to jump in? Let’s explore.

Image source: Getty Images.

High Demand Powering Nvidia’s Success

Nvidia’s stock has surged by 1,000% over the past two years, primarily due to one factor: artificial intelligence (AI). The rapid growth in demand for AI applications has surprised many, but Nvidia has been preparing for this shift.

The company’s advanced graphics processing units (GPUs) serve as the driving force behind some of the leading AI tools globally. Furthermore, Nvidia is already engaged in developing new cutting-edge GPUs to fuel the next wave of innovations in AI.

Nvidia’s new Blackwell GPUs are in production and expected to ship to clients in the fourth quarter. These highly sought-after chips are priced between $30,000 and $40,000. Nvidia CEO Jensen Huang stated, “Everyone wants to have the most [Blackwell GPUs], and everybody wants to be the first.”

Strong Fundamentals Fuel Nvidia’s Growth

The high demand for Nvidia’s GPUs has led to strengthening financial fundamentals. In 2022, Nvidia’s annual revenue was $27 billion. Over the last 12 months, that figure has surged to $96 billion, roughly four times its previous total. Analysts project that by 2026, Nvidia could report $178 billion in revenue.

This impressive growth underpins the strong performance of Nvidia’s stock. Moreover, the company’s profit growth is even more remarkable. In 2022, Nvidia reported a net income of $4.4 billion, which skyrocketed to $53 billion over the last year, marking an increase of approximately 1,200%.

What Lies Ahead for Nvidia’s Stock?

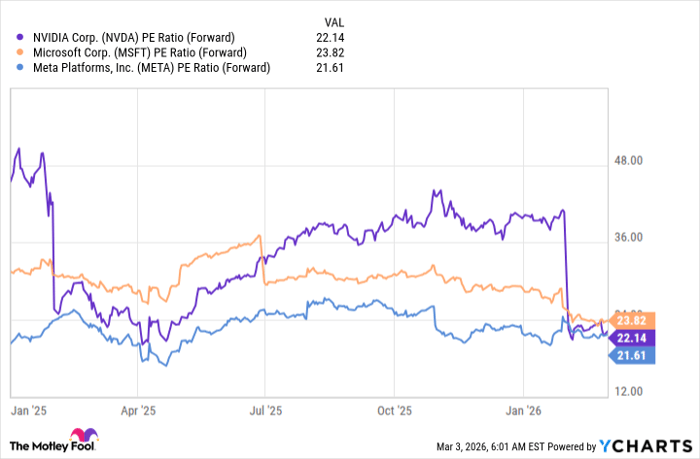

The future trajectory of Nvidia’s stock is uncertain. With such high revenue and earnings growth rates, if the company meets or exceeds expectations, its stock could rise even further. Conversely, any shortfall could lead to a decline in share prices.

Yet, for those with a long-term investment outlook, it’s essential to focus on Nvidia’s position as a leader in the ongoing technological shift driven by AI development. Despite potential fluctuations, Nvidia remains a solid long-term investment, positioned closely to take the lead in market value.

Seize This Unique Investment Opportunity

If you ever thought you missed the chance to invest in top stocks, now is your moment.

Occasionally, our expert analysts identify stocks they believe are set to take off — we call these “Double Down” recommendations. If you think you’re late to the game, now may be the opportune moment to invest before prices surge.

- Amazon: If you had invested $1,000 when we doubled down in 2010, it would be worth $21,122!*

- Apple: An investment of $1,000 from our recommendation in 2008 would now yield $43,756!*

- Netflix: A $1,000 investment when we doubled down in 2004 would today be worth $384,515!*

Currently, we are issuing “Double Down” alerts for three exceptional companies. This is an opportunity you won’t want to overlook.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Jake Lerch holds positions in Nvidia. The Motley Fool holds positions in and recommends Apple and Nvidia. The Motley Fool contains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.