Nvidia’s Stock Soars: A Look at 2024’s Impressive Gains

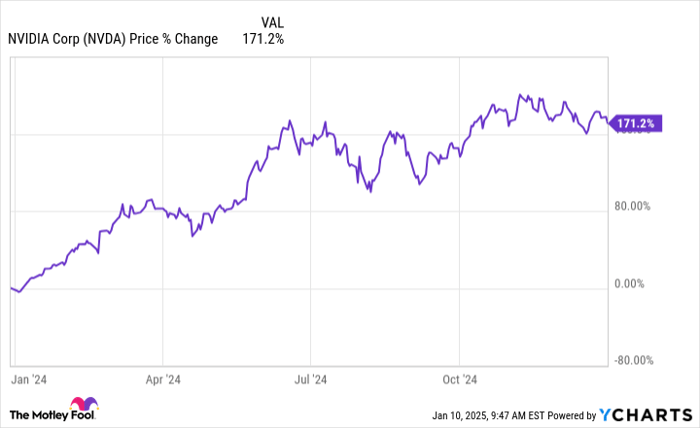

Nvidia (NASDAQ: NVDA) stock achieved remarkable growth in 2024, ending the year with a share price that climbed 171.2%, based on data from S&P Global Market Intelligence.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

NVDA data by YCharts

Throughout 2024, Nvidia experienced robust demand for its graphics processing units (GPUs) used in artificial intelligence (AI). The company consistently exceeded expectations in sales and earnings, buoyed by analyst enthusiasm, new growth opportunities, and a strategic stock split.

Impressive Performance: Nvidia’s Success in 2024

Nvidia maintained its stronghold in the AI processor market, as tech firms significantly increased their investment in AI infrastructure. The company reported impressive sales and earnings results across all four quarters of the year.

Each of Nvidia’s quarterly reports in 2024 beat Wall Street’s average expectations, as shown in the table below:

| Fiscal Quarter | Wall Street Consensus Revenue Target | Actual Revenue | Percentage Beat |

|---|---|---|---|

| Q4 2024 | $20.62 billion | $22.1 billion | 7.2% |

| Q1 2025 | $24.65 billion | $26.04 billion | 5.6% |

| Q2 2025 | $28.7 billion | $30.04 billion | 4.7% |

| Q3 2025 | $33.16 billion | $35.08 billion | 5.8% |

Data sources: Nvidia and CNBC.

The company also reported earnings that exceeded Wall Street’s projections, supported by its strong profit margins.

Nvidia’s stock gained additional momentum from a 10-for-1 stock split announced on May 22, which went into effect on June 10. While the stock did not see an immediate surge post-split, it eventually benefited from an overall increased valuation.

Challenges Ahead: Nvidia’s Stock in 2025

Initially, Nvidia’s stock continued to rise into 2025, spurred by news from Microsoft. On January 3, Microsoft announced plans to invest about $80 billion this year in its AI data center capabilities. Nvidia’s GPUs are fundamental to many leading AI systems, positioning the company to gain significantly from Microsoft’s investments.

However, shares have faced setbacks due to broader economic factors and geopolitical risks. As of now, Nvidia’s stock has declined approximately 1.5% in 2025’s trading.

On January 10, the Bureau of Labor Statistics released U.S. employment data for December, revealing that 256,000 jobs were added, significantly exceeding the forecast of 155,000. This labor growth raised concerns about potential inflation, leading investors to speculate on the Federal Reserve’s interest rate strategies, which could impact growth stocks.

Nvidia faces further market pressure due to new plans from the U.S. government to broaden restrictions on exporting advanced AI chips to China and other countries. Although previous restrictions were already stringent, upcoming changes may significantly deepen these limitations.

Is Nvidia a Worthy Investment Now?

Before considering an investment in Nvidia, take note:

The Motley Fool Stock Advisor team recently shared their top 10 stocks to buy, and Nvidia did not make the list. The stocks selected could potentially yield significant returns in the near future.

Reflect on when Nvidia was recommended on April 15, 2005… if you had invested $1,000, your investment would now be worth $832,928!*

Stock Advisor offers insights for investors looking to build a successful portfolio, featuring regular analyst updates and two new stock picks each month. Stock Advisor has reportedly outperformed the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.