Nvidia CEO Signals Major Shift in AI Landscape with New Deal

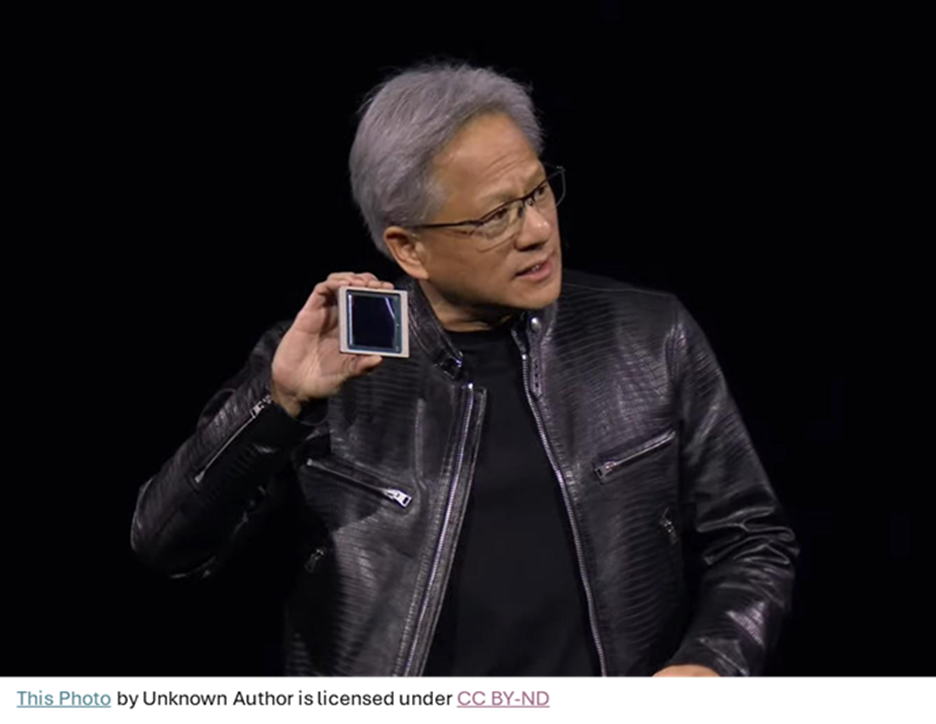

The recent behavior of Nvidia Corporation’s (NVDA) CEO, Jensen Huang, suggests significant changes ahead for AI investment. Huang appeared in a suit and tie while meeting Saudi Arabia’s Crown Prince, breaking his usual leather jacket tradition.

This shift marks the unveiling of a substantial partnership between Nvidia and HUMAIN, an AI firm in Saudi Arabia. Nvidia will supply 18,000 Blackwell chips for a 500-megawatt AI data center.

“AI, like electricity and internet, is essential infrastructure for every nation. Together with HUMAIN, we are building AI infrastructure for the people and companies of Saudi Arabia to realize the bold vision of the Kingdom,” Huang stated.

This initial phase is set to expand, with plans for hundreds of thousands of Nvidia GPUs over five years, establishing “AI factories” for cloud computing, robotics, and other AI technologies. This strategy positions Nvidia as a key player in the global AI market.

Saudi Arabia aims to diversify its economy beyond oil, leveraging AI as a cornerstone. HUMAIN is backed by the Public Investment Fund, highlighting the country’s commitment to becoming an AI leader. Nvidia is gaining a competitive edge in this global race for AI dominance.

New Developments Boost Nvidia’s Portfolio

In addition to the Saudi deal, Nvidia introduced DGX Cloud Lepton, a cloud service providing easier access to its AI chips for developers. This move strengthens Nvidia’s position in the AI ecosystem.

Moreover, Nvidia is reportedly in talks to invest in PsiQuantum, a startup focused on quantum computing. This potential investment could be pivotal as quantum technology may redefine future computing challenges.

Nvidia’s solid growth, driven by AI advancements, positions it well despite market pressures. The company continues to show strong earnings and institutional support, maintaining its status as a market leader.

In summary, Jensen Huang’s recent actions indicate a strategic pivot that may influence Nvidia’s role in the future of AI and technology broadly. With ongoing plans and investments, Nvidia continues to be a major stock to watch in the evolving tech landscape.

# Nvidia Leads AI Revolution with Robust Growth and Opportunities

## Nvidia’s Continued Dominance

Nvidia remains a leader in the AI sector and shows no signs of slowing down. The company garnered significant success since 2016 when it was trading for a split-adjusted $1. Investors who acted on this opportunity have seen gains of approximately 7,000%. Currently, Nvidia is still categorized as a “Buy” according to financial analyses.

## Transforming the Tech Sector

Recent developments include Nvidia’s deal in the Middle East and advancements in quantum computing. This aligns with President Trump’s economic strategy referred to as “Liberation Day 2.0,” which emphasizes **Tech Liberation**. The administration is reversing regulations on artificial intelligence, cryptocurrency, and cloud infrastructure to facilitate growth.

Private investment in domestic tech projects has surpassed $2 trillion. These policies indicate a shift back to innovation-focused strategies, with significant potential impacts on the U.S. economy, possibly creating a $10 trillion effect on the markets.

## Upcoming Summit

On **Wednesday, May 28, at 1 p.m. Eastern**, a summit titled **Liberation Day 2.0** will unveil further elements of Trump’s three-part economic approach and identify key companies poised for success.

Interested participants can reserve spots for this free event through the provided link. Proper positioning in this evolving market could result in substantial financial rewards.

—

**Disclosure:** As of the date of this report, the editor holds shares in Nvidia Corp. (NVDA).