Investors Eye Healthcare Stocks Powering AI Revolution

Graphic processing units (GPUs) and artificial intelligence (AI) are hot topics on the internet, drawing significant attention to companies like NVIDIA (NVDA). Over the past year, NVIDIA’s stock has experienced a remarkable 91.3% rise. This surge has prompted rival chip manufacturers around the globe to ramp up their operations, further intensifying competition within the global GPU market. As AI continues to gain traction across various sectors—from healthcare to finance—investors are keen to seize opportunities linked to this pivotal technological shift.

The Transformative Role of AI in Healthcare

In the last few years, AI and GPUs have been instrumental in transforming healthcare diagnostics, treatments, and operational efficiencies. NVIDIA recently introduced its BioNeMo platform, which aims to enhance the creation, customization, and deployment of AI models for drug discovery and molecular design. The company noted that leaders in the pharmaceutical and TechBio sectors, along with academic innovators and AI researchers, are utilizing this open-source BioNeMo Framework to expedite drug discovery and molecule design. Furthermore, NVIDIA’s Clara platform is receiving accolades for its ability to improve the speed and accuracy of diagnosing serious conditions, including cancer and cardiovascular diseases.

Promising Healthcare Stocks to Watch

Amidst these rapid advancements, we explore three healthcare stocks that demonstrate substantial growth potential in this evolving landscape: Illumina (ILMN), IQVIA (IQV), and Dexcom (DXCM). Each of these companies is leveraging AI advancements to foster innovation in genomics, clinical research, and diabetes management. As AI-driven solutions gain more traction, they stand to benefit from significant investment opportunities in the coming years.

Market Forecast for AI in Healthcare

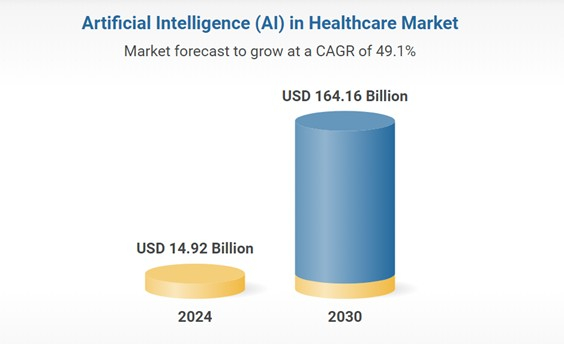

According to a Research and Markets report, the global AI healthcare market is projected to grow from $14.92 billion in 2024 to $164.16 billion by 2030, representing a compound annual growth rate (CAGR) of 49.1% during this period.

Image Source: Research and Markets

The report indicates that the cloud-based segment will see the highest growth due to its advantages such as seamless data integration, cost efficiency, security, and scalability. The rising demand for remote healthcare services and telemedicine will further drive this adoption. AI applications, including predictive analytics and clinical decision support, are also expected to enhance operational efficiency.

Overall, advanced imaging techniques powered by AI and high-performance GPUs are enhancing disease detection in fields like radiology. In drug discovery, AI is shortening development timelines through accelerated molecular simulations. The leap toward personalized medicine is facilitated as AI processes vast datasets to tailor treatments effectively. Additionally, robotics-assisted surgeries are becoming increasingly precise, benefiting patient outcomes. AI-driven administrative tools are streamlining hospital workflows and reducing costs. As both AI and GPU capabilities develop further, the healthcare sector is poised for unprecedented advancements in patient care and operational efficiency.

Spotlight on Key Players

Illumina: In 2025, Illumina announced a cooperation with NVIDIA aimed at improving technology platforms for the analysis of multiomic data. By merging AI advancements with multiomic research, the partnership seeks to refine the analysis of extensive datasets. Illumina intends to integrate models from the NVIDIA Biology Foundation Model Research Team into its offerings, enabling clients to utilize these models alongside their datasets for improved gene transcription analysis. The stock holds a Zacks Rank #3 (Hold) with an expected long-term earnings growth rate of 13.4%, and earnings growth is projected at 83.3% for 2025.

Illumina, Inc. Price

Illumina, Inc. price | Illumina, Inc. Quote

IQVIA: As a leader in healthcare AI integration, IQVIA focuses on enhancing patient outcomes while streamlining life sciences operations. Their healthcare-grade AI promotes data privacy and patient safety. Earlier in 2025, IQVIA partnered with NVIDIA to utilize the NVIDIA AI Foundry, enhancing their capacity to create customized foundation models derived from their extensive data, thus propelling agentic AI solutions across healthcare.

Holding a Zacks Rank #3, IQVIA has a long-term historical earnings growth rate of 12.4%. Expected earnings growth for 2025 and 2026 stands at 6.5% and 11.7%, respectively.

IQVIA Holdings Inc. Price

IQVIA Holdings Inc. price | IQVIA Holdings Inc. Quote

Dexcom: This company, specializing in continuous glucose monitoring (CGM), has launched a proprietary GenAI platform, becoming the first CGM creator to embed GenAI into biosensing technology. The technology is first showcased in Dexcom’s Stelo, an over-the-counter glucose biosensor, developed with Google Cloud using Vertex AI and Gemini models.

Dexcom, also holding a Zacks Rank #3, boasts a long-term historical earnings growth rate of 29.7%, with expected earnings growth of 20.7% and 21.6% for 2025 and 2026, respectively.

DexCom, Inc. Price

DexCom, Inc. price | DexCom, Inc. Quote

DexCom’s Financial Prospects: An Insight into Recent Developments

Explore Zacks’ Investment Picks for Just $1

Don’t miss this opportunity.

In a surprising move, Zacks Investment Research recently offered a 30-day trial for just $1, giving members access to their top stock picks. This unique offer has attracted thousands, while others were skeptical, assuming there was a hidden catch. Zacks aims to familiarize users with their diverse portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and others. Notably, these services facilitated the closing of 256 positions that yielded double- and triple-digit gains in 2024 alone.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Illumina, Inc. (ILMN): Free Stock Analysis Report

DexCom, Inc. (DXCM): Free Stock Analysis Report

IQVIA Holdings Inc. (IQV): Free Stock Analysis Report

For further insights, read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.