“`html

Nvidia’s Market Throne Faces New Challenges Amid Rising AI Competition

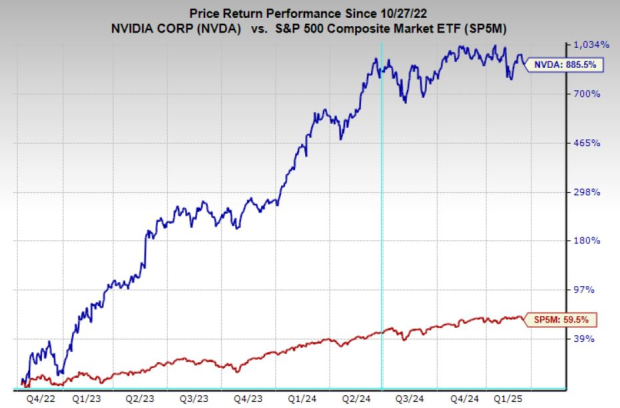

Over the last two years, artificial intelligence has driven a remarkable bull market in stocks, fundamentally altering technology landscapes. The most significant beneficiary of this shift has been Nvidia (NVDA), which evolved from a respected $350 billion gaming chip producer to a formidable $3 trillion market cap company, establishing itself as a leading player in AI hardware.

Yet, as Nvidia prepares to release its quarterly earnings on Wednesday after market hours, investor confidence begins to waver. A significant recent event—the rise of DeepSeek—has initiated discussions about the potential longevity of Nvidia’s market dominance.

This article will explore this dynamic landscape and evaluate how hyperscalers, Nvidia’s primary clients—including Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL), and now Alibaba (BABA)—are adapting. We will also consider Nvidia’s current earnings revisions and assess its stock price trends to develop a strategic perspective.

Image Source: Zacks Investment Research

Does DeepSeek Threaten Nvidia’s Sales?

Recently, DeepSeek, a Chinese AI research firm, introduced a new model that claims to have been trained with significantly fewer compute resources than its U.S. counterparts. This development has raised concerns that the massive investments in AI infrastructure might be slowing and could lead to reduced demand for Nvidia’s advanced GPUs.

However, the situation is multifaceted. While DeepSeek’s advancement showcases the rapid evolution of AI technology, it does not necessarily diminish the necessity for Nvidia’s high-performance chips. Instead, decreasing training costs could foster quicker AI adoption, ultimately expanding the market for AI applications. As AI tools become more accessible, the demand for computational power may rise.

Hyperscalers such as Microsoft, Amazon, and Alphabet continue to plan substantial capital expenditures, with a collective spending goal exceeding $300 billion this year. These long-term investments not only enhance their AI capabilities but also positively impact other sectors of their businesses.

AI Spending Stays Strong, But Economic Concerns Loom

Amid technological advancements, macroeconomic and political factors might significantly influence Nvidia’s future. A transition to a new political environment introduces uncertainties, leading to increased market volatility this week.

The recently established Department of Government Efficiency (DOGE) may impose fiscal restrictions that could slow economic growth in the short term. Additionally, frequently changing trade policies create ambiguity in the market, affecting inflation and employment dynamics.

Despite these challenges, investments in AI remain robust. Microsoft’s collaboration with OpenAI is projected to generate about $11 billion annually. Furthermore, Alibaba recently announced an increase of $52 billion in its capital expenditures, underscoring its commitment to AI infrastructure development. These signs suggest that the AI sector is still in its infancy, even if training expenses are declining.

Nvidia Stock’s Technical Analysis

Examining Nvidia’s stock price behavior offers insights into potential trends ahead. The chart indicates that Nvidia has been trading within a range between $150 and $110 for the past five months, situated within a broader ascending channel.

The $110 support level is particularly noteworthy. Earnings announcements often lead to significant movements in stock prices, raising the possibility that the stock could naturally gravitate toward this support level in the wake of the earnings report. Should the stock retreat to this zone and exhibit buying momentum, it may be an opportune moment for investors. However, a substantial close below $110 could indicate further downside risk.

Investors should also monitor the upper boundary of the trading range. A breakout above $150 could signal the onset of another major bull market.

Image Source: TradingView

Future Growth Outlook for Nvidia

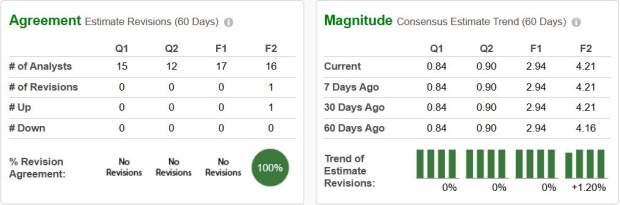

Despite its strong position in the market, analysts on Wall Street are moderating their earnings projections for Nvidia. The company currently holds a Zacks Rank #2 (Buy), reflecting a generally positive sentiment coupled with a cautious outlook. Nvidia maintained a top position on the Zacks ranking for almost two years, with several analysts consistently upgrading its earnings estimates.

“`

Nvidia Earnings Report: What Investors Should Watch For

Nvidia has garnered attention as it approaches its earnings report, with investors keenly focused on evolving earnings forecasts. A slow down in earnings revisions has caught the market’s eye.

Valuation Metrics Present a Mixed Picture

Currently, Nvidia is trading at 31 times its forward earnings, a valuation that seems reasonable considering its rapid growth. This year, sales are predicted to soar by 112%, followed by a 48% increase next year. Earnings are also expected to rise significantly: 126% this year and 43% next year.

As the earnings date approaches, focus will be on AI-related sales and any updates regarding future guidance. Investors will pay close attention to the data center revenue, which is Nvidia’s main growth engine. Additionally, gross margins are crucial, as any declines could signal either pricing pressure or increasing costs. Guidance on AI demand, geopolitical risks, and competition will also play key roles in shaping investor sentiment.

Image Source: Zacks Investment Research

Anticipating Nvidia’s Earnings Report

Nvidia is scheduled to report its earnings on Wednesday evening, and expectations are high. Although a major downside surprise is unlikely, the way investors respond can often be unpredictable. Even strong results may lead to profit-taking if guidance doesn’t meet high expectations.

Market sentiment matters, as a continued downturn can shift narratives quickly. Investors may interpret news from the earnings report in various ways, depending on the wider market context.

Despite uncertainties, the rise of AI technology is still in its initial phase. With developments like DeepSeek and decreasing training costs, there is no indication that Nvidia’s leading position will falter. Instead, these changes highlight an evolving landscape where Nvidia is likely to remain a crucial hardware partner for years ahead.

Discover Zacks’ Latest Recommendations

Consider this an offer you can’t miss.

Years ago, we surprised our members with an exclusive deal: 30 days of access to all our stock picks for just $1. No strings attached.

Many took this opportunity, but some hesitated, thinking there must be a catch. The goal? We want you to explore our portfolio services, like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which collectively delivered 256 positions with double- and triple-digit gains in 2024 alone.

Ready for the latest stock recommendations from Zacks Investment Research? Today, you can download a report on the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.