Editor’s Note: The market may be turbulent, but innovation never stops — and that’s exactly why InvestorPlace Senior Analyst Louis Navellier remains confident. Amazon has recently introduced Ocelot, its first quantum computing chip, joining Microsoft and Google in a race to dominate this emerging technology… and the next significant investing opportunity.

However, let’s be realistic — quantum computing is complex, making it tough to understand its true impact on the market. This is why Louis is holding an urgent briefing on Thursday, March 13, at 1 p.m. ET… just one week before Nvidia’s major “Q Day” announcements. Click here to secure your spot for this free event.

Additionally, Louis and his team have created a special series on quantum investing for his newsletter, and he’s agreed to allow us to feature one of those articles here today.

“Generals always prepare to fight the last war, especially if they won it.”

This quote, attributed to French Prime Minister Georges Clemenceau during World War I, resonates well with the world of investing.

Often, investors reflect on past successes and assume those strategies will remain effective. We’ve seen this play out during the late 1990s dot-com bubble when investors poured money into every company boasting a “.com” domain, leading to significant crashes. Later, in the 2000s, they gravitated towards brick-and-mortar retail giants like Sears and JCPenney, overlooking the rise of e-commerce and Amazon.com Inc. (AMZN).

Similarly, at the initiation of the AI Revolution, a monumental technological transition, many investors remained attached to legacy tech stocks like Intel Corp. (INTC).

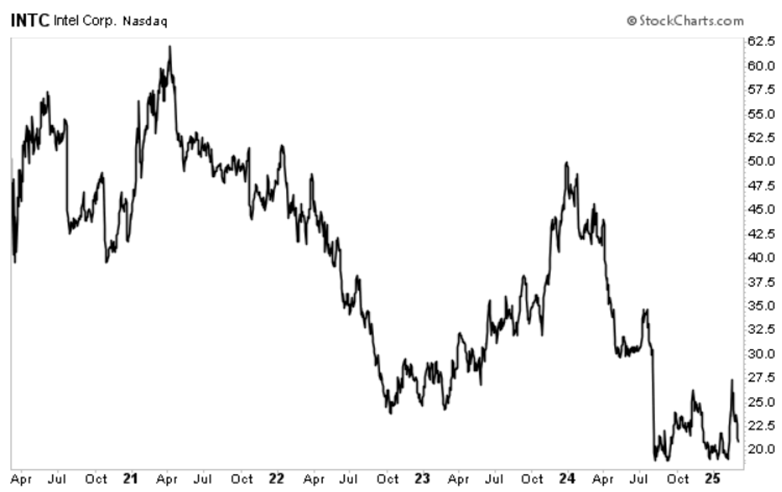

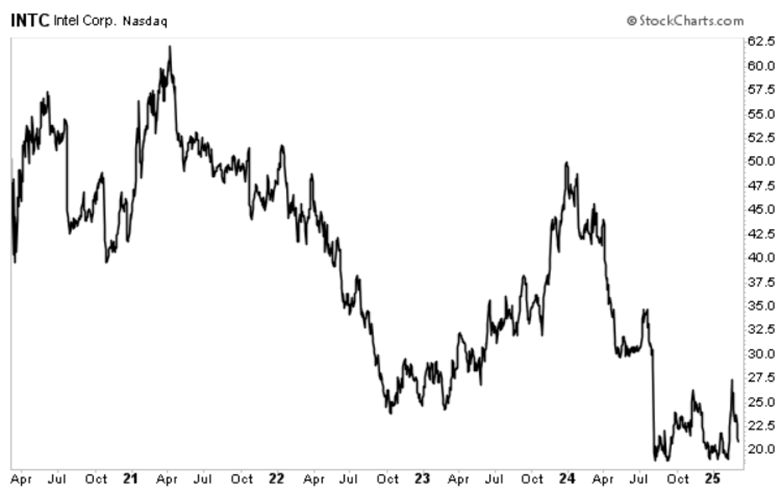

Once viewed as a pioneer in American technology, Intel’s position has drastically changed. As displayed in the chart below, the chipmaker’s stock has dropped approximately 63% over the past five years.

This decline is particularly surprising given it transpired as the AI Revolution gained momentum.

Competitors like NVIDIA Corp. (NVDA) seized the opportunity to transform the semiconductor industry, emerging as the leading figure in the AI sector.

While Intel struggled to adapt, NVIDIA thrived by producing graphic processing units (GPUs) that far outperformed central processing units (CPUs) in AI tasks. The demand for NVIDIA’s chips skyrocketed, marking the beginning of an intense competition in AI.

Consequently, NVIDIA has benefited immensely from this significant industry shift. In my over 40 years of experience, I have rarely seen a company that asserts such a monopolistic hold on its market.

This is why I have declared NVIDIA as the “Stock of the Decade.” Its innovation trajectory surpasses that of its competitors.

However, questions arise: How much longer can NVIDIA sustain this pace?

By the end of this decade, the transistors in NVIDIA’s chips may reach near “atomic” scales, posing limitations under current physical law for further speed enhancements.

So, is NVIDIA merely battling the ghosts of past technology?

My belief is they are not.

I anticipate that NVIDIA intends to leverage quantum computing as a catalyst for the next phase of the AI Revolution.

The excitement surrounding quantum computing is about to escalate. On March 20, NVIDIA will host the inaugural “Quantum Day” at its annual AI conference — what I refer to as “Q Day.”

This event aims to gather experts to explore the future expectations of quantum computing over the coming decades.

I predict this will be the platform for NVIDIA’s most substantial announcement of the year.

This revelation will not only benefit NVIDIA but also positively impact selected “pure play” quantum computing firms collaborating with them.

Remember: The most significant gains will likely emerge from smaller “pure play” quantum computing companies, which may become the next NVIDIA.

Be sure to mark your calendar for Thursday, March 13, at 1 p.m. Eastern. That’s when I will reveal all details regarding Q Day during a special summit – including my top pick, a small-cap Stock with 102 patents and strong ties to NVIDIA.

Reserve your spot by clicking here.

To prepare for what’s on the horizon, I will clarify the fundamentals of quantum computing, including NVIDIA’s strategic involvement. Grasping the nuances of quantum computing and how it functions is crucial.

Additionally, I will present two strategies for potential profits in this evolving landscape.

Let’s dive in…

What Is Quantum Computing?

Imagine navigating a maze for a moment.

A traditional computer would solve the maze by taking one path and starting over each time it faced a dead end. It would repeat this process until it arrived at a solution.

However, if a computer is designed to think more like a human, it could adopt a more efficient approach. In theory, it could automatically eliminate obvious dead ends and optimize simulations even further.

This innovative concept aligns with the vision of British mathematician Alan Turing, who laid the groundwork… (content continuation).

Quantum Computing: Revolutionizing Industries and Investment Strategies

Artificial Intelligence (AI) can be compared to nurturing a child’s mind; it’s all about teaching it to “think.” This level of reasoning encapsulates what we refer to as artificial intelligence.

However, consider a fascinating scenario: what if you could assess ALL paths of a maze simultaneously? This would deliver the correct answer in a fraction of the time—this is the essence of quantum computing. The concept is straightforward: solve complex problems much faster than conventional computers.

The ability of quantum computers to exist in multiple states simultaneously is crucial. It allows them to generate numerous solutions at once. Unlike traditional bits, which are either 1 or 0, quantum computers utilize qubits, which can represent both 1 and 0 at the same time—a phenomenon called superposition.

It’s important to note that many existing technologies already leverage quantum mechanics. For instance, atomic clocks, MRI machines, lasers, and even LED light bulbs depend on these principles to function. This isn’t an abstract concept but rather a technological reality.

Today, we have reached a pivotal juncture where quantum states can be harnessed for computation. This evolution parallels the transistor moment of electricity in the 1950s, which transitioned from merely powering large motors to facilitating the sophisticated semiconductors present in every modern computer.

Quantum computing is on the verge of making a similar leap.

Quantum Computing Moves Toward Mainstream Adoption

Until recently, quantum computing was confined to government agencies and university laboratories due to high costs and instability. However, significant advancements are changing this landscape.

Leading technology companies like Alphabet Inc. (GOOG), Microsoft Corporation (MSFT), and Amazon.com, Inc. (AMZN) are developing specialized quantum chips that can execute computations in seconds that would take classical supercomputers thousands of years to complete. Other breakthroughs have emerged, paving the way for quantum solutions to reach mass-market scalability, something researchers once only envisioned.

Recent progress positions us closer than ever to integrating quantum computing into profit-driven corporate strategies. Major governments, tech firms, and institutional investors are heavily investing in quantum technologies.

The potential implications are significant:

- Biopharmaceutical companies could discover groundbreaking drugs at unprecedented speeds.

- Automakers may successfully develop functional driverless car systems.

- Chemical firms could create innovative materials previously thought impossible.

This is just the beginning. With quantum computing, we could tackle challenges we have yet to even recognize.

Seeking the Next Opportunity in Quantum Computing

As mentioned earlier, I anticipate that NVIDIA Corporation (NVDA) will begin transitioning toward quantum computing soon.

A significant turning point is expected on Thursday, March 20, when NVIDIA will host its inaugural Quantum Day.

This event is noteworthy. My prediction is that NVIDIA will innovate a way to integrate AI with quantum computing in a manner previously unseen. This technological advancement could impact industries valued at a combined $46 trillion.

With this potential, NVIDIA remains a strong “Buy” for long-term investors, which makes it my Profit Idea No. 1.

For those wishing to make significant gains, it’s essential to explore the “pure play” quantum companies collaborating with NVIDIA and other tech giants—this is my Profit Idea No. 2.

To delve deeper into this strategy, join me for my special Next 50X NVIDIA Call on Thursday, March 13, at 1 p.m. Eastern. Click here to reserve your spot now.

This briefing aims to position you ahead of the market and the news cycle.

By the time the larger audience catches up, it will likely be too late.

Secure your spot here NOW.

Sincerely,

Louis Navellier

Senior Analyst, InvestorPlace

Disclosure: As of the date of this email, Louis Navellier, directly or indirectly, owns securities mentioned within this analysis, particularly NVIDIA Corporation (NVDA).