NVIDIA Corporation (NVDA) is scheduled to report its fiscal 2026 fourth-quarter earnings on February 25, 2026, after the market closes. The company anticipates revenues of approximately $65 billion for the quarter, exceeding the $57 billion reported in the prior quarter, and a projected earnings per share (EPS) of $1.52, marking a 70.9% year-over-year increase.

Despite expectations for strong financial performance, past trends show variable stock performance following earnings reports. NVIDIA’s long-term outlook is bolstered by consistent demand for its advanced chips and partnerships, particularly in AI and data centers, with global data center spending projected to rise to between $3 trillion and $4 trillion annually by 2030.

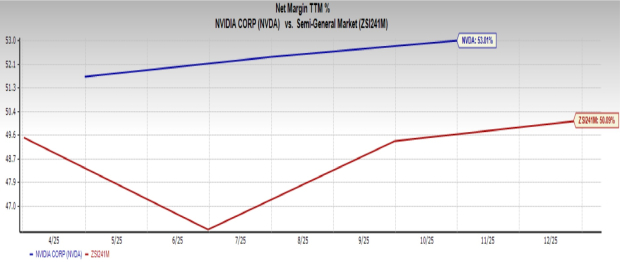

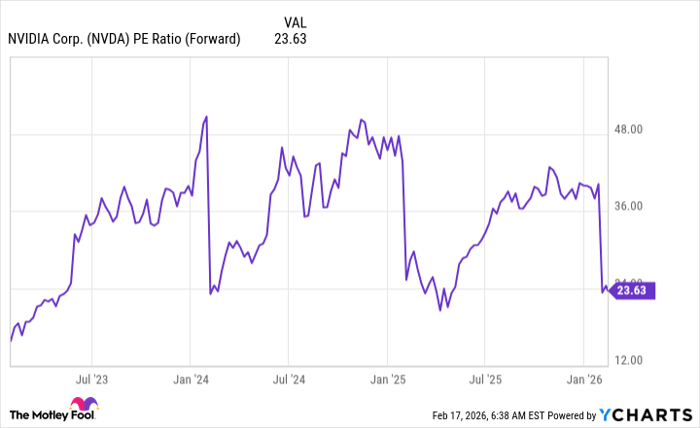

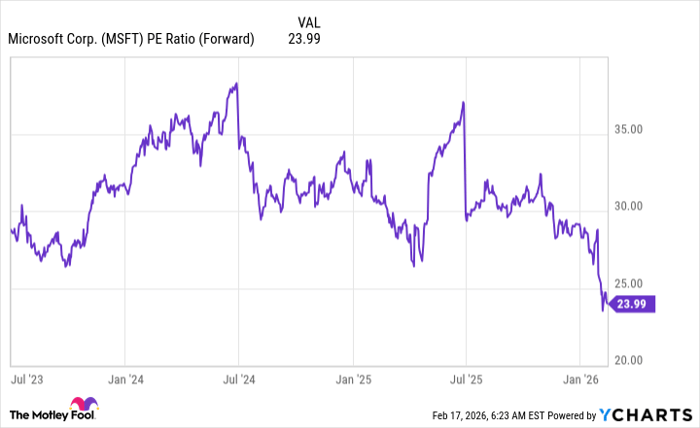

The company currently has a net profit margin of 53%, exceeding the industry average of 50.1%, and features a forward price-to-earnings (P/E) ratio of 25.67, below the industry average of 29.12, suggesting an attractive buying opportunity.