“`html

Navitas Semiconductor (NVTS) is focusing on high-power markets and has been included in NVIDIA’s new 800-volt AI factory ecosystem. This new architecture shifts data center power distribution to high-voltage DC, necessitating faster, efficient power electronics. Navitas offers both Gallium Nitride (GaN) and Silicon Carbide (SiC) technologies, making it one of the few companies with a comprehensive power path solution from the grid to GPUs.

In Q3 2025, Navitas began sampling mid-voltage GaN devices at 100 volts and SiC modules for grid applications. Significant revenue from AI data centers is not expected until 2027, with 2026 anticipated to be a transition year. The focus is on securing multi-generation design wins as hyperscalers adopt the new architecture, while revenue from low-margin mobile products will be deprioritized.

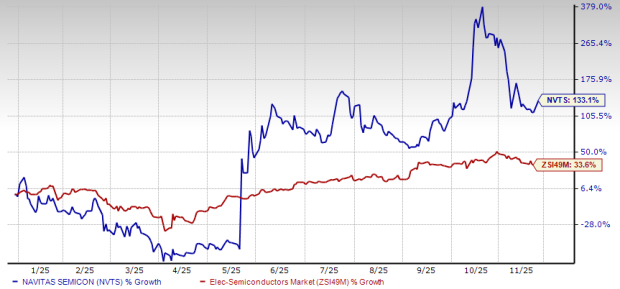

Year-to-date, Navitas shares have increased by 133.1%, outperforming the Electronics-Semiconductors industry that saw 33.6% growth. The company’s forward price-to-sales ratio stands at 44.59X, compared to the industry average of 7.27X. Estimates suggest the loss per share for 2025 will narrow to $0.21 from the previous year’s $0.24.

“`