NXP Semiconductors Set to Report Q3 Earnings: What to Expect NXPI is scheduled to announce its third-quarter earnings on Monday. Analysts anticipate earnings of $3.43 per share and projected revenues of $3.25 billion after market hours.

The Dutch semiconductor giant is recognized for its cutting-edge products, including microcontrollers and the i.MX family of application processors. Recently, NXP introduced improvements to its eIQ AI and machine learning software.

The new tools, eIQ Time Series Studio and GenAI Flow, aim to streamline AI deployment on edge processors, further establishing NXP’s position in the technology sector.

Over the past year, NXP’s stock has soared by 30.52%, with a year-to-date increase of 7.87%.

Historical Insight: $100 Invested in NXP Semiconductors a Decade Ago Would Be Worth This Much Today

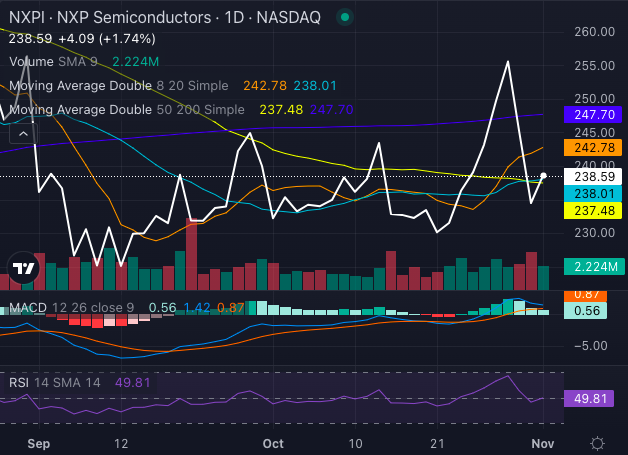

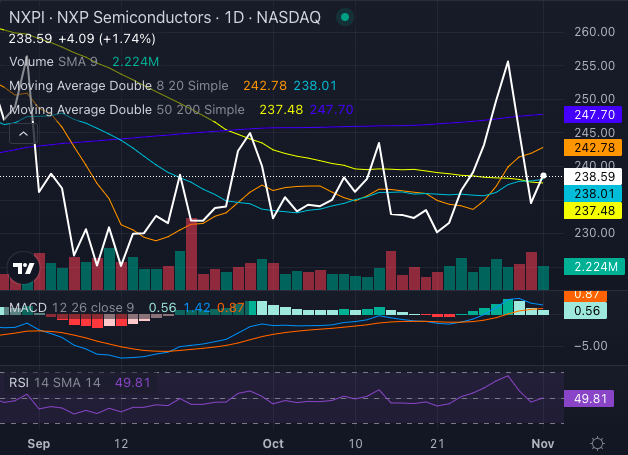

Now, let’s explore the stock charts for NXPI and how they align with Wall Street’s expectations.

Bearish Trends in NXPI Stock as Earnings Approach

Currently, NXPI stock is in a bearish trend, with its share price at $238.59 positioned below the five, 20, and 50-day Exponential Moving Averages (EMA), indicating ongoing selling pressure.

Chart created using Benzinga Pro

Analyzing short-term trends presents a mixed picture. The eight-day Simple Moving Average (SMA) is at $242.78, reflecting bearish sentiment. In contrast, the 20-day SMA, just below the current price at $238.01, indicates potential bullish momentum, along with the 50-day SMA of $237.48, which suggests a slight rebound. However, the long-term 200-day SMA at $247.70 reinforces an overall bearish outlook.

The Moving Average Convergence Divergence (MACD) indicator at 1.42 hints at bullish momentum, while the Relative Strength Index (RSI) at 49.81, and trending downwards, suggests that NXPI might be nearing oversold levels. This combination implies that patient investors may see potential gains if buying pressure can break the prevailing bearish trend.

Analysts Predict Significant Upside for NXPI

Current Ratings & Consensus Estimates: Analysts currently rate NXPI stock as a Buy, with a price target set at $273. Recent evaluations from firms such as Stifel, Cantor Fitzgerald, and UBS give an average price target of $271.67, indicating a potential upside of 13.85%.

Market Movement: NXPI stock ended Friday’s trading session at $238.59, an increase of 1.74%.

Next Up:

Image: NXP Semiconductors

Market News and Data brought to you by Benzinga APIs