By RoboForex Analytical Department

NZD/USD Hits Seven-Week Low Amid Persistent Sell-off

The NZD/USD currency pair has recently plunged to a seven-week low of 0.6091, continuing the sell-off that began on October 1. This decline in the value of the New Zealand dollar can be largely traced to the Reserve Bank of New Zealand’s (RBNZ) recent interest rate cuts, introduced to combat falling inflation rates.

Recently, the RBNZ has made successive reductions to the key interest rate, most notably cutting it by 50 basis points to 4.75% per annum. This followed a previous reduction in August. These steps are part of the RBNZ’s strategy to maintain inflation within a target range of 1-3%. Anticipation is building around forthcoming consumer price index data, which may indicate inflation stabilizing around 2%, aligning with the RBNZ’s goals.

Focus on US Federal Reserve Meeting Minutes

A worldwide spotlight is now on the upcoming release of the latest US Federal Reserve meeting minutes. Financial analysts closely examine these minutes for insights into the Fed’s future monetary policy. Investors often rely on this information to predict possible changes to the Fed’s interest rates, impacting global currency movements.

Technical Outlook for NZD/USD

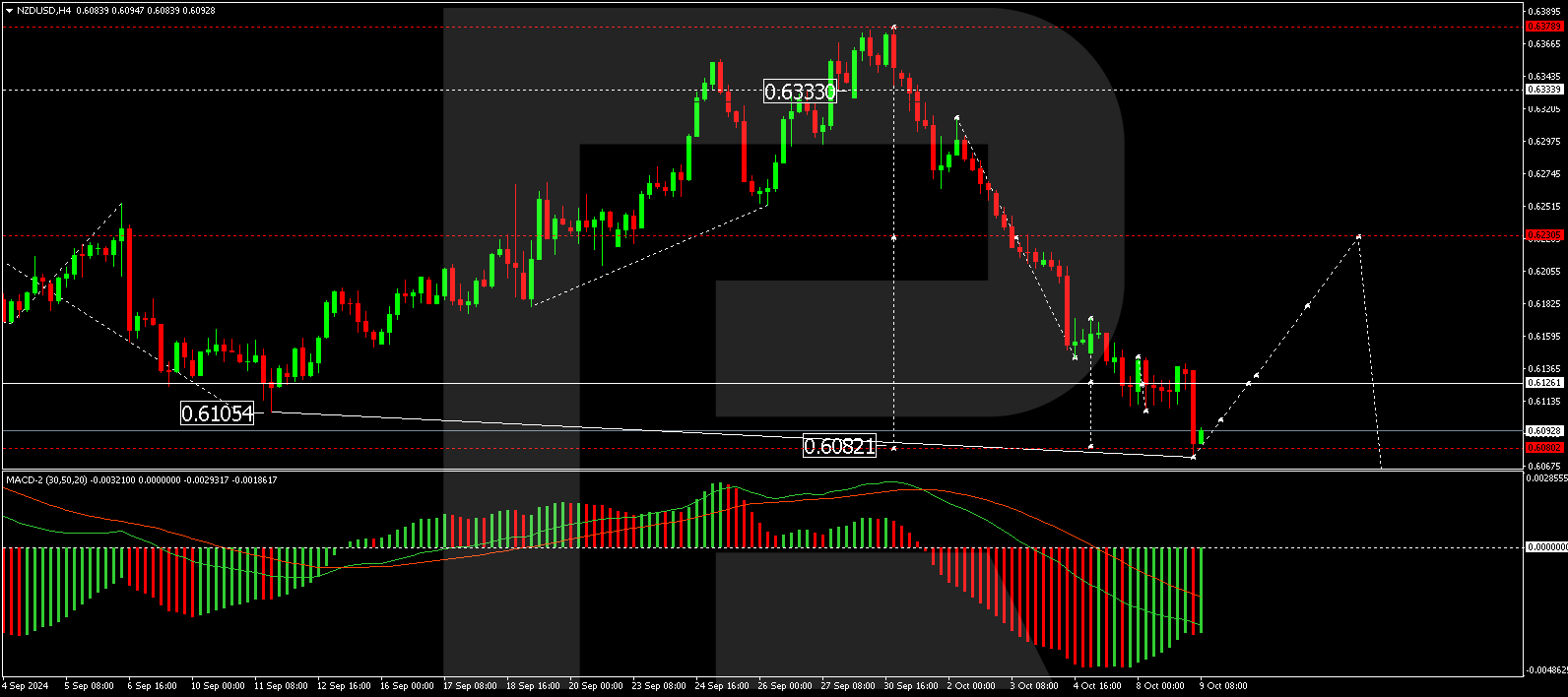

In technical terms, the NZD/USD pair has reached the anticipated target of the downward wave at 0.6080. Traders are currently observing a potential consolidation phase above this level. Should there be an upward breakthrough, a corrective movement towards 0.6230 may occur. However, if this consolidation shifts downwards, a continuation of the downward trend towards 0.5944 could take place. The MACD indicator supports a bearish trend, showing the signal line below zero and moving downwards.

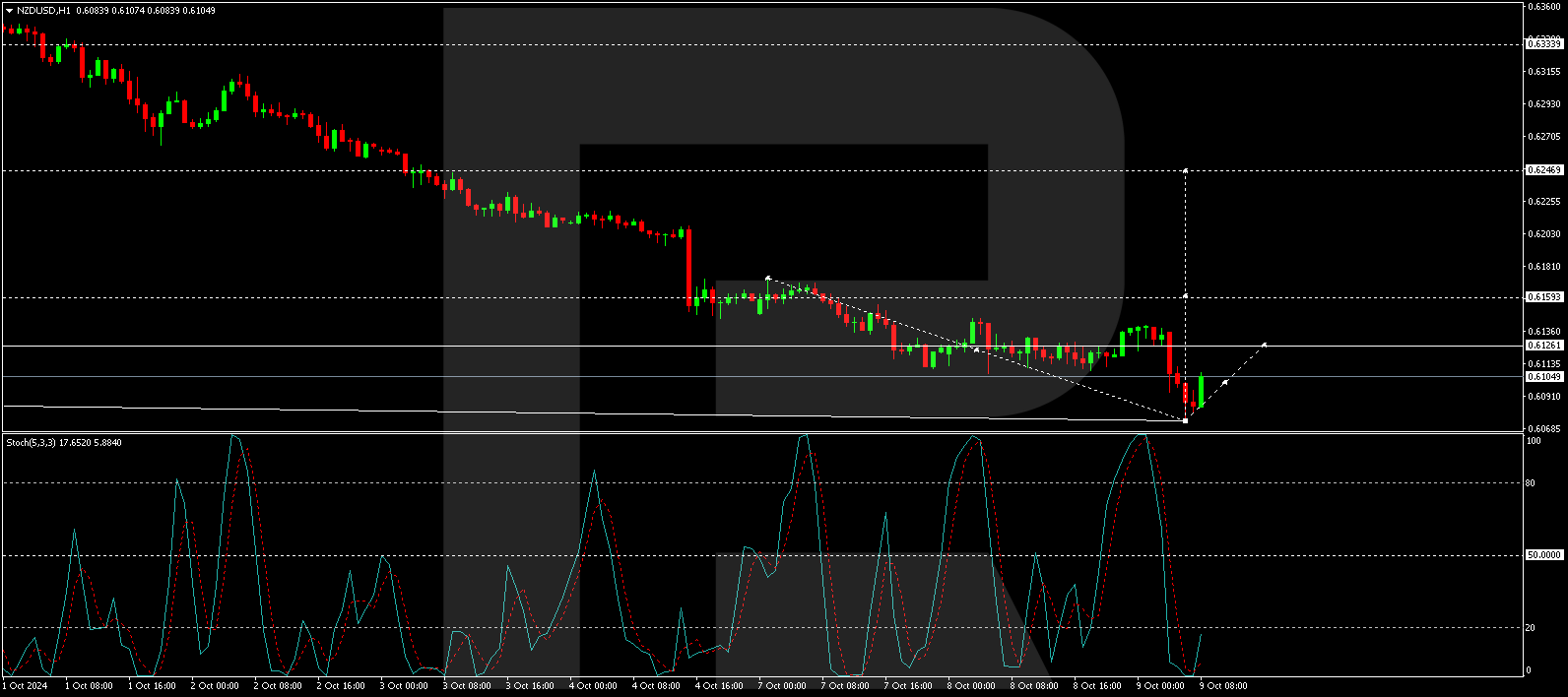

On the hourly chart, after forming a range of consolidation around 0.6126, the NZD/USD pair has reached its downward target of 0.6080. An upward movement to 0.6126 is projected for today, possibly followed by a retest of 0.6100. Markets may establish a new consolidation range at these levels. A successful breakout upwards could trigger a corrective rally towards 0.6230, which would serve as a response to recent declines. The Stochastic oscillator indicates a potential for this upward correction, with its signal line positioned below 20 and moving upwards.

Disclaimer

Any forecasts contained herein stem from the author’s personal opinion and should not be viewed as trading advice. RoboForex does not take responsibility for any trading results resulting from the trading recommendations and reviews provided within this article.

This article is contributed by an external source and does not reflect Benzinga’s reporting standards. It has not been altered for content or accuracy.

Market News and Data brought to you by Benzinga APIs