Ocean Power Technologies’ Q3 2025 Results Show Mixed Performance

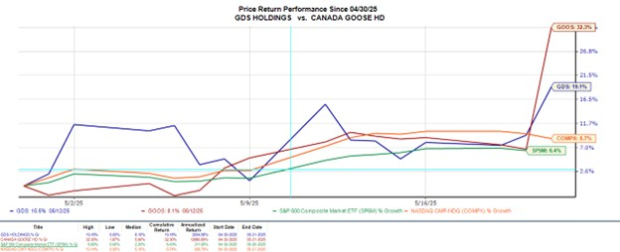

Shares of Ocean Power Technologies, Inc. (OPTT) have experienced a significant drop of 22.7% following the announcement of its financial results for the third quarter of fiscal 2025. This decline stands in stark contrast to the S&P 500 index, which saw a marginal 0.2% decrease during the same period. Additionally, the stock plummeted 24% over the past month, while the S&P 500 fell 5.3%.

Earnings and Revenue Overview

In the third quarter, which ended on January 31, 2025, Ocean Power reported revenues of $0.8 million, marking a steep decrease of 54% from $1.8 million in the same quarter last year. The company’s net loss widened slightly to $6.7 million, compared to $6.5 million a year earlier. However, the loss per share improved to 4 cents from 11 cents due to a notable rise in average shares outstanding.

Operating expenses dropped by 29% year over year, totaling $6.1 million, which contributed to the narrower loss. Over the nine months ending January 31, 2025, revenues climbed 15% to $4.5 million while net loss decreased 27% to $15.1 million, down from $20.8 million.

Stock Performance and Analysis

Ocean Power Technologies, Inc. price-consensus-eps-surprise-chart | Ocean Power Technologies, Inc. Quote

Business Metrics and Backlog

Ocean Power reported a record backlog of $7.5 million at the conclusion of the third quarter of fiscal 2025, significantly up from $3.3 million the previous year. This increase is primarily attributed to $5 million in new purchase orders from a partner in Latin America for Next Generation PowerBuoys and WAM-V Unmanned Surface Vehicles. Although revenue saw a sequential decline, the trailing 12-month revenues rose by 24% to $6.1 million compared to the prior year.

The company recorded a gross margin of $197,000 for the quarter, down from $813,000 in the same quarter last year, reflecting lower sales volume and potential changes in the sales mix. Cash utilized in operating activities was $3.7 million for the quarter and $14.6 million for the nine-month period, indicating a 41% improvement from the $24.7 million used last year. This improvement was attributed to restructuring and streamlining efforts.

At the close of the quarter, Ocean Power held $10.2 million in cash and cash equivalents, a substantial increase from $3.3 million as of April 30, 2024.

Management Insights

CEO Philipp Stratmann highlighted the company’s operational and commercial progress despite facing macroeconomic and political challenges. He referenced the company’s showcase at NAVDEX 2025 in Abu Dhabi, successful offshore testing of the WAM-V 22 in California, and strong momentum in Latin America. Stratmann noted a 59% decrease in cash used for operations year-over-year, underlining the company’s focus on operational efficiency. He expressed optimism about converting backlog into revenues while advancing autonomous ocean security and AI-powered maritime technologies.

Revenue Influencing Factors

The revenue decline year-over-year in the fiscal third quarter was primarily due to reduced lease activity and a decrease in product shipments compared to the prior year. This was somewhat balanced by an increase in contracted backlog, which management anticipates will convert to revenue moving forward. The company indicated that geopolitical uncertainties, including delays during the recent U.S. election cycle, hampered project activities across key sectors.

Significant reductions in operating expenses resulted from decreased external expenditures and lower third-party costs, directly linked to restructuring efforts to align costs with current revenue levels.

Future Guidance

Ocean Power intends to sustain its focus on growth within defense, security, and commercial maritime applications, as well as expanding its fleet of AI-capable autonomous systems.

Developments and Initiatives

During the quarter, Ocean Power actively sought international expansion. In February 2025, it showcased its technologies at NAVDEX in the UAE through its regional distributor, Remah International Group. The demonstrations included WAM-V vehicles integrated with underwater sensors and drones, alongside the AI-enabled Merrows system.

In March 2025, the company explored defense opportunities by participating in the NDIA Pacific Operations Support Team conference. To enhance its growth in federal markets, Ocean Power appointed a dedicated sales executive focusing on the Department of Homeland Security and Department of Defense.

In December 2024, Ocean Power entered a strategic partnership in Latin America, securing orders worth $5 million for PowerBuoys and WAM-V units, aimed at supporting hydrographic applications and extended maritime monitoring powered by renewable energy sources.

Overall, Ocean Power’s performance in the fourth quarter highlights a transitional phase characterized by enhanced contract momentum and better cost control. However, ongoing revenue volatility and losses remain critical considerations for investors.

Insight from Chief Research Analyst

From an extensive analysis of stocks, five Zacks experts have identified their top pick expected to surge over 100% in the upcoming months. Among these picks, Director of Research Sheraz Mian has singled out one for its explosive potential.

With a target market of millennial and Gen Z consumers, the company recently generated nearly $1 billion in revenue in the last quarter. A recent stock pullback presents a favorable entry point. While not all selections are guaranteed winners, this stock may outperform previous top-recommends like Nano-X Imaging, which saw a remarkable increase of +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

Ocean Power Technologies, Inc. (OPTT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.