“`html

The average one-year price target for Octave Specialty Group (NYSE:AMBC) has been increased to $15.30 per share, marking a 20% rise from the previous estimate of $12.75 made in November 2025. This estimate is based on analyst targets ranging from a low of $15.15 to a high of $15.75, representing a potential 60.71% increase from the latest closing price of $9.52.

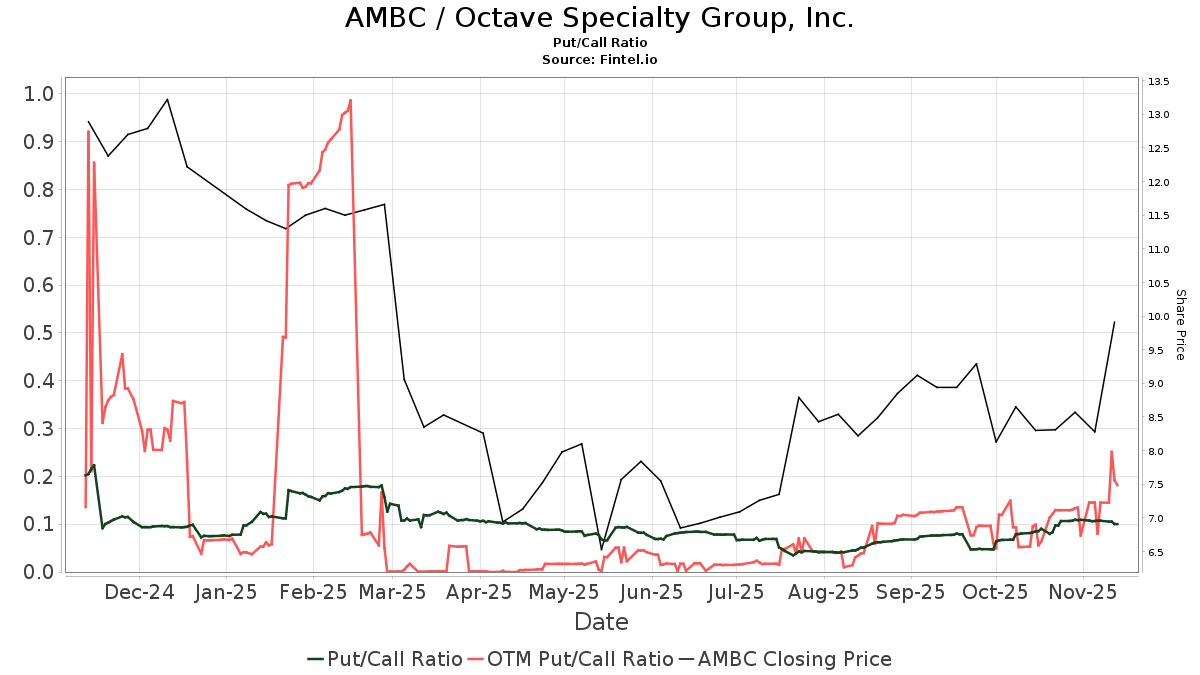

There are currently 290 funds or institutions reporting positions in Octave Specialty Group, a decline of 64 or 18.08% in the last quarter. Institutional ownership has decreased by 7.23% to 43,752K shares, with an average portfolio weight of 0.20%, increasing by 28.72%. The put/call ratio stands at 0.10, indicating a bullish sentiment.

Western Standard has increased its holdings to 2,641K shares (6.03% ownership), up 100% from previous filings. Continental General Insurance holds 2,068K shares (4.72% ownership), up 41.10%, while Gendell Jeffrey L owns 1,865K shares (4.26% ownership), an increase of 35.72% despite a 29.81% decrease in portfolio allocation.

“`