Investing Opportunities: Key Oversold Stocks in Consumer Discretionary Sector

Investors looking for deals may find valuable opportunities among the most oversold stocks in the consumer discretionary sector. These stocks are currently undervalued, making them potentially attractive investments.

The Relative Strength Index (RSI) serves as an important momentum indicator. This tool compares how well a stock performs on days when its price rises against its performance on days when it drops. An RSI below 30 generally indicates that a stock is oversold, as explained by Benzinga Pro.

Below, we detail the latest major oversold stocks in this sector with RSIs near or below 30.

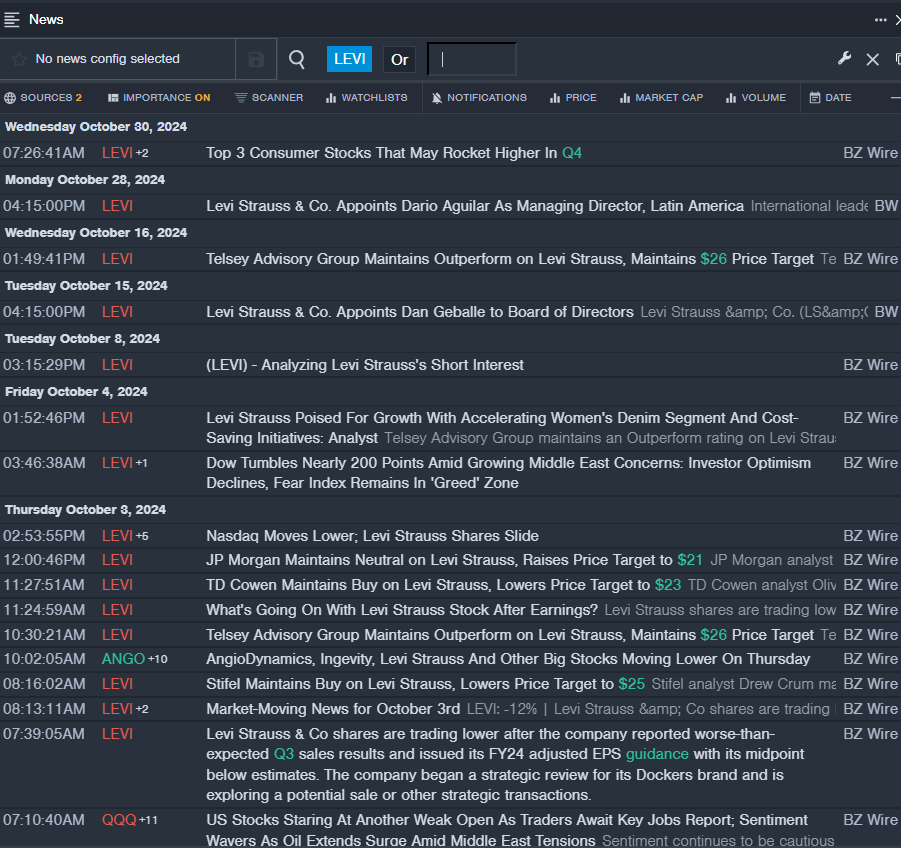

Levi Strauss & Co LEVI

- On Oct. 28, Levi Strauss appointed Dario Aguilar as Managing Director for Latin America. Following this announcement, the company’s stock has decreased about 11% in the past month, with a 52-week low recorded at $13.94.

- RSI Value: 29.52

- LEVI Price Action: Shares ended Tuesday down 0.7%, closing at $16.86.

- Benzinga Pro’s real-time news updates highlighted the latest developments regarding LEVI.

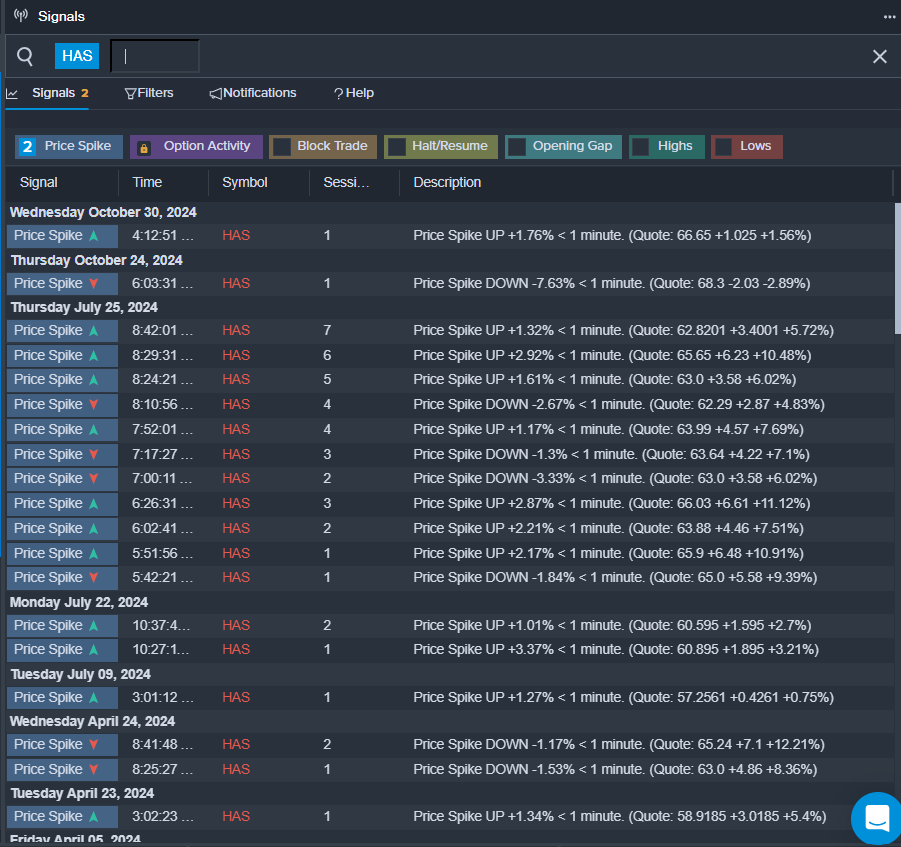

Crocs Inc CROX

- On Oct. 29, Crocs released its third-quarter financial results, along with a warning of lowered revenue expectations for the HEYDUDE Brand. The company reported adjusted earnings per share of $3.60 (+11%), surpassing the expected $3.10. Additionally, quarterly revenues reached $1.062 billion (+2%), exceeding the $1.05 billion consensus estimate. However, the stock has declined approximately 27% over the past month and hit a 52-week low of $77.16.

- RSI Value: 25.13

- CROX Price Action: Shares fell 0.9% to close at $101.98 on Tuesday.

- Benzinga Pro’s charts facilitated the identification of the trend in CROX stock.

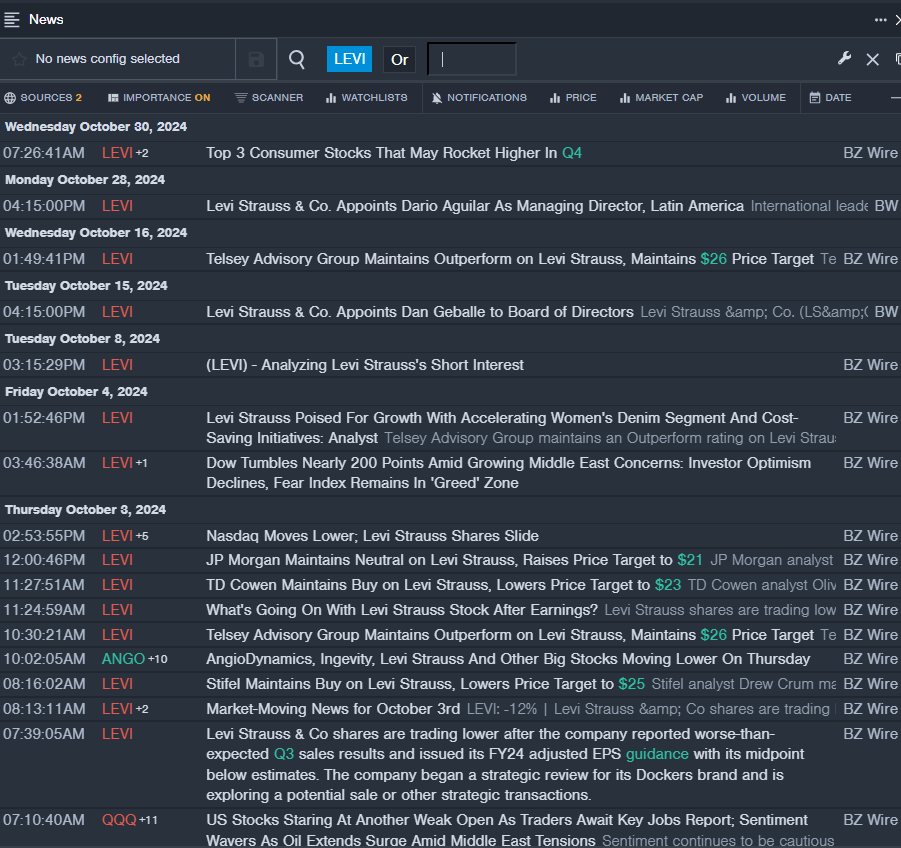

Hasbro Inc HAS

- On Oct. 24, Hasbro unveiled a third-quarter sales drop of 15% from the previous year, reporting $1.281 billion in revenue, just shy of the $1.295 billion forecast by analysts. “We continue to execute our turnaround efforts and anticipate finishing the year with improved profitability, cash flow, and operational efficiency,” stated CFO Gina Goetter. In the last month, the company’s stock has dipped approximately 11%, reaching a 52-week low of $42.70.

- RSI Value: 29.26

- HAS Price Action: Shares decreased by 1.1% to close at $63.42 on Tuesday.

- Additionally, Benzinga Pro’s signals suggested a potential breakout for HAS shares.

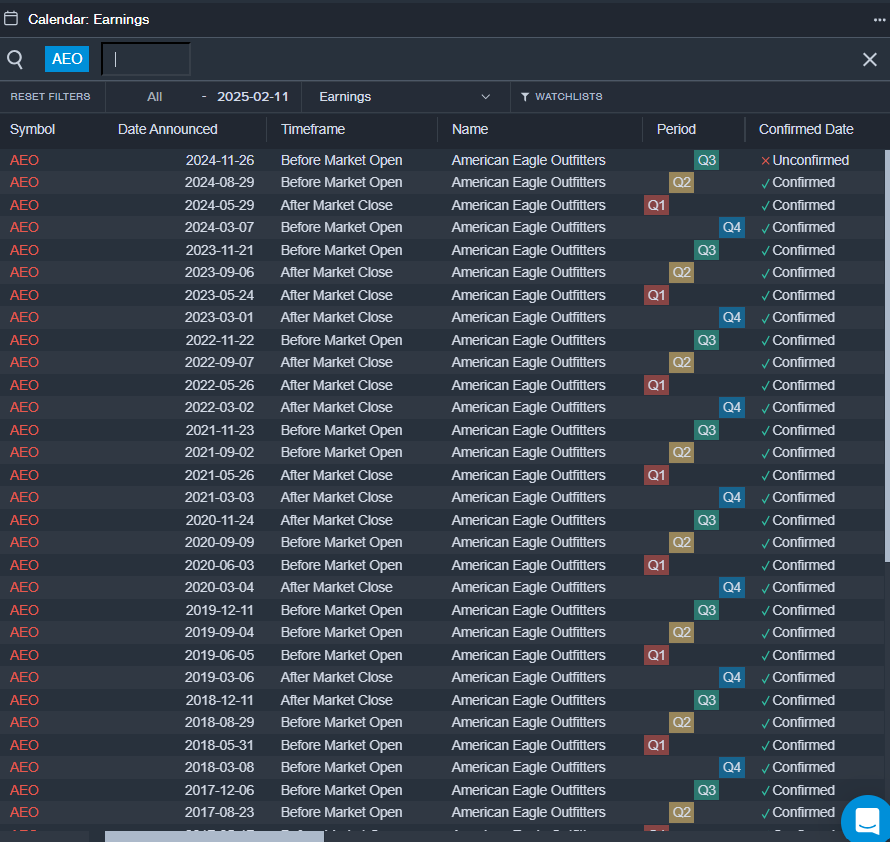

American Eagle Outfitters Inc AEO

- On Nov. 12, analyst Corey Tarlowe of Jefferies kept a Hold rating on American Eagle, adjusting the price target from $22 to $19. The stock’s value has declined about 13% in the past month, with a 52-week low of $73.04.

- RSI Value: 15.92

- AEO Price Action: Shares slipped 1.5% to close at $17.94 on Tuesday.

- Benzinga Pro’s earnings calendar monitored upcoming AEO earnings reports.

Read More:

Market News and Data brought to you by Benzinga APIs