Oil-Dri Corporation of America (ODC) reported first-quarter fiscal 2026 results for the period ending October 31, 2025, with consolidated net sales at $120.5 million, a 6% decline from $127.9 million in the previous year. Despite challenges, the company noted a strong operational performance with net income of $15.5 million and diluted earnings per share of $1.06. The strong cash generation continued, with operating cash flow at $10.3 million.

In terms of segment performance, the agricultural sector showed resilience with record sales of $12.9 million, a 12% year-over-year increase, while the Retail and Wholesale segment saw a 4% decline in sales to $76.2 million. Key highlights also included a 14% increase in the quarterly cash dividend, marking the second hike in 2025, reflecting the company’s confidence in its cash-flow sustainability.

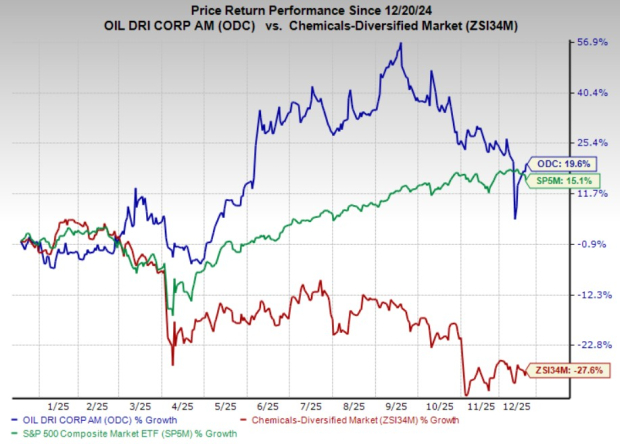

Over the past year, ODC’s stock has gained 19.6%, outperforming the industry at a 27.6% decline and the S&P 500’s 15.1% return. Despite the year-over-year sales decline, management emphasized the durability of its business model amid demand normalization and ongoing investments to enhance efficiency and growth.