“`html

Oil Markets React to New Sanctions; Nvidia’s Caution Stalls Quantum Stocks

Oil prices surged Friday after the U.S. Treasury Department announced new sanctions on Russian oil, signaling potential shifts in global supply dynamics.

As of Monday morning, prices continue to rise as traders assess how the sanctions might affect exports to both India and China.

According to Bloomberg:

The new sanctions specifically target two companies responsible for over a quarter of Russia’s seaborne oil exports, alongside key insurers and traders linked to numerous shipments. The U.S. also widened sanctions on disruptive tankers…

The main focus is on major Russian energy firms — Gazprom Neft and Surgutneftegas.

In the initial ten months of 2024, these firms exported approximately 970,000 barrels each day, constituting about 30% of the country’s total tanker flows, according to Bloomberg data.

In response to the sanctions, Brent Crude (the European benchmark) climbed past $80, while West Texas Intermediate Crude (the U.S. benchmark) traded at $78. Meanwhile, natural gas futures emerged as significant beneficiaries, jumping over 6% since last Friday.

Recent Insights from Our Digest Highlight Opportunities in Fossil Fuels

Last Thursday, our Digest discussed the promising investment landscape in fossil fuels. Market analysts Louis Navellier, Eric Fry, and Jeff Clark identified routes to profit through Big Oil, natural gas stocks, and pipeline companies.

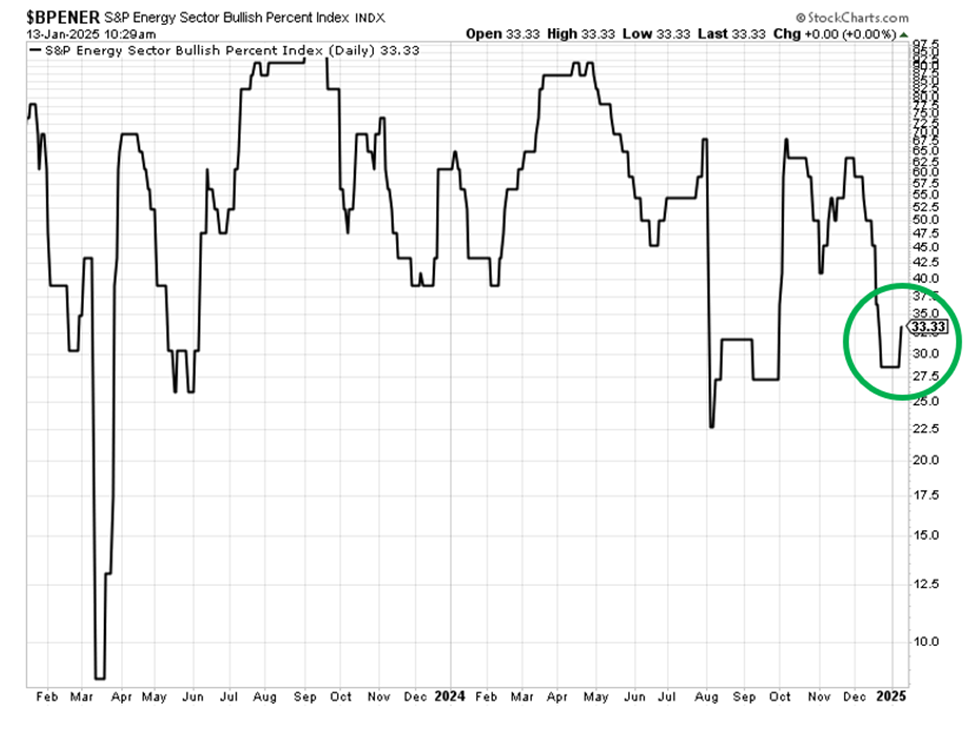

Focusing on Jeff Clark’s analysis, the recent uptick in oil prices activated the Bullish Percent Index for the energy sector (BPENER), which served as a notable buy signal.

For those unfamiliar, Jeff is a seasoned trading expert with 40 years of market experience, adept in leveraging various momentum indicators and moving averages to forecast stock movements.

Reflecting on last week’s developments, Jeff stated:

The BPENER is nearing a buy signal. If it behaves like previous signals, oil stocks may experience substantial gains…

Buy signals suggest upward movement occurs when the BPENER rises from oversold territory [below 30]. While it hasn’t reached that point yet, it’s currently in the oversold range.

This could result in a buy signal any day now.

As it turns out, that day was last Friday. The BPENER jumped from around 28 to 33.33.

Source: StockCharts.com

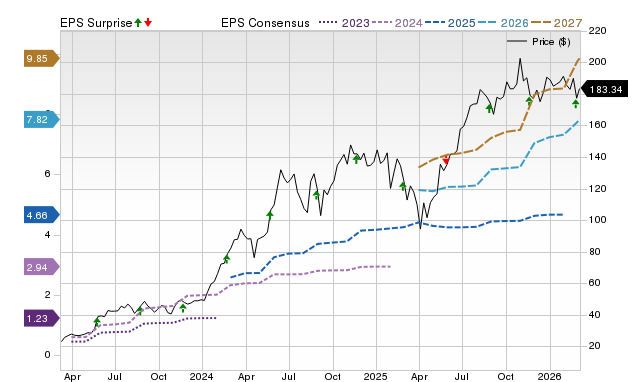

If you read last Thursday’s Digest, you may remember that Jeff has been considering the Energy Select Sector Fund (XLE) as a fundamental play on this movement. He noted the last time a similar entry signal occurred:

XLE experienced an immediate gain of 5%. It then retraced before making a significant rally, ultimately resulting in a 15% increase less than three months later.

Though this isn’t a formal trade recommendation, current conditions are aligned with Jeff’s entry signals. If you’re looking for a trade to consider today, this might be worth investigating.

Additionally, Jeff will be sharing his strategy for navigating Trump’s first 100 days in office, a period likely to be filled with aggressive policy changes and market fluctuations. Expect potential opportunities for traders willing to act quickly.

We’ll provide updates on this topic soon.

A Look at Quantum Computing Stocks: Are They Truly Stalled?

This autumn saw astronomical gains in quantum computing stocks, with some soaring between 500% to as high as 3,500% over a few months.

However, this momentum shifted dramatically last Wednesday when Nvidia CEO Jensen Huang dampened expectations for the timeline of quantum computing development.

Huang articulated his perspective on when quantum computing might reach practical viability:

If you kind of said 15 years… that’d probably be on the early side. If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it.

Following Huang’s remarks, quantum stocks faced sharp declines. Here are the notable losses reported from Wednesday to Monday:

- Arqit Quantum (ARQQ) – down 50%

- D-Wave Systems (QBTS) – down 57%

- Quantum Computing Inc (QUBT) – down 60%

- Rigetti (RGTI) – down 63%

This downturn has collectively wiped out over $8 billion in market cap for the quantum computing sector.

Yet, our technology analyst Luke Lango remains optimistic about the future of quantum stocks. He commented in his Daily Notes for Innovation Investor last week:

We think Huang’s timing estimate is off.

With numerous real-world quantum applications already underway, we believe useful quantum computers are closer to 5-10 years away.

However, Huang’s comments triggered a justified sell-off. The stocks were overvalued and needed to cool down. To take advantage of this dip, patience is key.

Don’t rush to buy immediately. Wait for stability indicators before making any investments in quantum stocks.

D-Wave’s CEO Alan Baratz countered Huang’s caution, declaring him “dead wrong.” Baratz pointed out that their quantum computers are already being utilized by major clients, including Mastercard and NTT Docomo.

This exchange underscores the varying interpretations of practicality in technology. While today’s quantum capabilities may differ, advancements are undoubtedly on the horizon, albeit with uncertain timing. For those believers in quantum technology who can tolerate volatility, this sector remains one to watch.

“`

Preparing for a Shift: AGI and Investment Opportunities

Anticipating the Rise of Artificial General Intelligence

To clarify, “AGI” stands for “artificial general intelligence.” This term refers to a type of machine intelligence that can learn, comprehend, and perform any intellectual task that a human can.

Recently, Sam Altman, CEO of OpenAI, shared some exciting insights in a blog post:

We are now confident we know how to build AGI as we have traditionally understood it.

We believe that, in 2025, we may see the first AI agents “join the workforce” and materially change the output of companies.

We continue to believe that iteratively putting great tools in the hands of people leads to great, broadly-distributed outcomes.

While the specifics are still unclear, industry experts predict that these advancements could lead to significant disruptions and the flow of substantial investment capital.

Our macro expert, Eric Fry, has been keeping a close eye on what he terms the “Road to AGI” for several months. He began a countdown titled “1,000 Days to AGI” this past September.

Given Altman’s recent statements, Eric feels the timeline might need to be adjusted:

I’m convinced 1,000 days is the far end of when we’ll achieve this milestone. AGI could be upon us much sooner.

Immense technological changes are coming. Those who understand and embrace these changes can set themselves up to build wealth on a larger scale than ever before.

Because of AGI, we could be entering into the greatest period of wealth creation that mankind has ever known.

Currently, there are no dedicated “AGI” companies available for investment. As discussed in previous Digest reports, the industry has seen a rise in AI Builders—those developing AI infrastructure—and now AI Appliers—companies deploying applications on this infrastructure. However, companies focused strictly on AGI, like OpenAI, remain private.

Despite this, Eric provides insight into his investment approach:

What the market does offer, though, is an array of indirect plays on the race toward AGI.

My team and I have been identifying “next wave” stocks that have yet to reflect their AI growth potential.

To capitalize on the current “pre-AGI” market, I’ve pinpointed several companies well positioned to benefit from the race towards AGI. Eric has compiled this research in a free video which interested investors can access.

Maximizing Your Investing Potential with TradeSmith’s Seasonality Tool

Wouldn’t it be useful to have a blueprint for investing in 2025? A tool to guide your buying and selling decisions to maximize gains could soon be available.

This opportunity is real, thanks to our corporate partner, TradeSmith, and their recent breakthroughs in data analysis.

TradeSmith’s new seasonality trading system identifies hidden patterns in the stock market that determine the best times to buy and sell based on historical performance.

Here’s what TradeSmith’s CEO, Keith Kaplan, had to say:

You can’t just look at a pattern repeat and apply it to all stocks. Each stock… each signature… has its own pattern.

When we were researching seasonality… testing day after day, month after month… we found that we needed two proprietary signals for each stock to make seasonality a consistent winner.

And we did it running 2.4 quintillion tests in total, using thousands of custom-built algorithms.

In the end, we finally had a tool that could identify the optimal seasonality score for each stock. That helped confirm a buy signal.

Next, we identified the ideal Relative Strength Index (RSI) for each stock.

That breakthrough allowed us to create an effective strategy for consistent gains.

Keith and his team conducted numerous backtests, which showed a win rate of over 80%, significantly outperforming the S&P 500.

Last week, Keith hosted a special presentation detailing how the seasonality trading tool operates, and how it can enhance your investment results in 2025. You can watch a free replay here.

Best wishes,

Jeff Remsburg