Oklo Inc. (OKLO) has experienced significant volatility leading up to 2026, following a major agreement with Meta Platforms (META) to develop a 1.2-gigawatt advanced nuclear power campus in Pike County, Ohio. The deal, which supports META’s data center operations, includes a prepayment mechanism for funding, allowing OKLO to secure nuclear fuel and advance early development milestones. Pre-construction activities are set to commence in 2026, with the first phase expected to be operational by 2030.

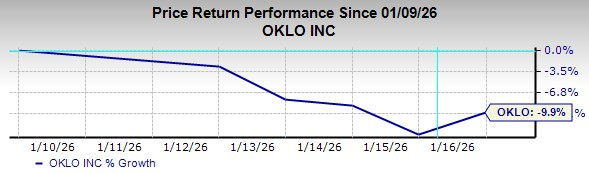

OKLO shares surged over 45% following the announcement of the META agreement but have since retracted approximately 10% as of mid-January 2026. Despite being up 265% over the past year, shares are down about 40% in the last three months. Currently, the company is pre-revenue and reported a loss of 20 cents per share in Q3 2025, with expectations of continuing losses. Valuation remains a concern as OKLO trades at over 12 times book value, in stark contrast to established operators like Constellation Energy (CEG).

While the META agreement bolsters OKLO’s long-term narrative in advanced nuclear power, investors remain cautious due to the company’s ongoing losses and speculative valuation. The stock is best approached as a high-risk, high-reward opportunity as it works toward commercialization.