Oklo Inc. Soars 90% Amid Clean Energy Demand: Investing Insights

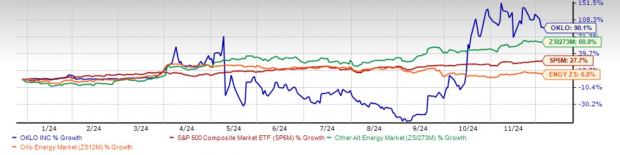

Oklo Inc.’s OKLO shares have soared an impressive 90.1% this year, significantly outperforming the Zacks Alternative-Energy industry, which gained 60.8%, and the broader Zacks Oils-Energy sector, which saw only a 6.8% rise. Additionally, OKLO shares surpassed the S&P 500’s increase of 27.7% during the same time frame.

The uptick in interest for clean energy sources is driving Oklo’s growth, as the company has formed new partnerships and taken initiatives that showcase its commitment to supplying reliable, large-scale clean energy solutions.

Several companies in this sector have also enjoyed remarkable success. Noteworthy performers include GE Vernova (GEV), Constellation Energy Corporation (CEG), and Bloom Energy (BE), with share increases of 148.6%, 119.1%, and 75.4%, respectively, year-to-date.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

With Oklo’s stock performing well, investors may feel eager to buy in. However, before jumping in, it’s wise to carefully analyze the reasons behind the stock’s rise, its growth prospects, and any potential risks. This effort will enable investors to make more informed choices.

Factors Behind the Surge in OKLO’s Stock Price

Global growth in data centers, along with a surge in electricity demand—especially in emerging and developing economies fueled by economic improvement—has driven demand for clean energy. Throughout this demand, Oklo is actively developing next-generation fast-fission power plants, referred to as “powerhouses.” Notably, the Aurora powerhouse line is anticipated to generate between 15 and 50 megawatts electric (MWe) from recycled nuclear fuel, with ambitions to expand capacity to 100 MWe.

Recently, the company has achieved important deployment and regulatory milestones for its Aurora powerhouses, likely enhancing investor confidence. This growth potential is reflected in the rising share price of OKLO.

In September 2024, Oklo signed a Memorandum of Agreement (MOA) with the DOE Idaho Operations Office, allowing them access to explore a site in Idaho for constructing these power plants. The company also signed several non-binding letters of intent with Equinix, Diamondback Energy, and Prometheus Hyperscale, targeting an additional capacity of 750 MWe for data center customers. As a result, OKLO’s total Aurora powerhouse deployment capacity is set to exceed 2,100 MWe, representing nearly a 200% increase since July 2023.

Will OKLO Stock’s Growth Trajectory Continue?

Oklo’s commitment to forming strategic partnerships, like the recent joint effort with Equinix for 500 MW of power, highlights the growing interest and demand for its Aurora product line in the electricity sector.

The United States is a global leader in nuclear power, contributing about 30% of the world’s nuclear electricity generation (according to the World Nuclear Association). This positioning offers substantial long-term growth potential for Oklo.

On the downside, the company has not yet begun generating revenue. The first Aurora powerhouse is projected to launch in 2027, meaning substantial returns are not expected in the immediate future. Meanwhile, Oklo is incurring significant operational expenses while developing these powerhouses, putting pressure on its financial results. As such, its ability to produce meaningful revenue and profit remains challenging in the near term, which could cause concern among investors.

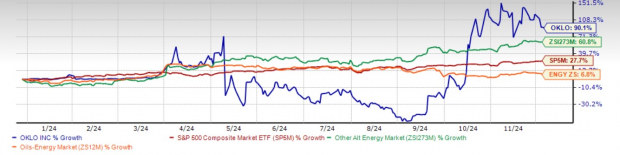

Additionally, a downward revision in earnings estimates indicates a lack of confidence among analysts regarding the stock’s short-term performance.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Concerns Regarding Return on Equity

A review of Oklo’s return on equity (ROE) shows it lagging behind its peers, with a negative ROE indicating ongoing losses, as seen in recent quarterly earnings.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Final Thoughts on OKLO Stock

In conclusion, potential investors in OKLO stock may want to wait for a more favorable entry point considering the recent downward revisions in earnings estimates and the negative ROE.

However, current investors holding this Zacks Rank #3 (Hold) stock may choose to retain their shares, given its long-term growth potential and impressive share price increase thus far this year.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Recently released: Experts have identified 7 top stocks from the current list of 220 Zacks Rank #1 Strong Buys, which they believe have high potential for price increases.

Since 1988, this comprehensive list has outperformed the market more than twice, averaging a gain of +24.1% each year. It’s advisable to give these carefully selected stocks your immediate attention.

Constellation Energy Corporation (CEG): Free Stock Analysis Report

Bloom Energy Corporation (BE): Free Stock Analysis Report

GE Vernova Inc. (GEV): Free Stock Analysis Report

Oklo Inc. (OKLO): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.