Positive Momentum with a 20.00% Price Target Boost

OKYO Pharma (NasdaqCM:OKYO) has received a significant vote of confidence as the average one-year price target for the company has been bumped up to 6.12 per share, showing a robust 20.00% increase from the prior estimate of 5.10 set on January 16, 2024.

This surge in the price target reflects growing optimism in the company’s potential and solid performance outlook.

Favorable Fund Sentiment Highlights Stability

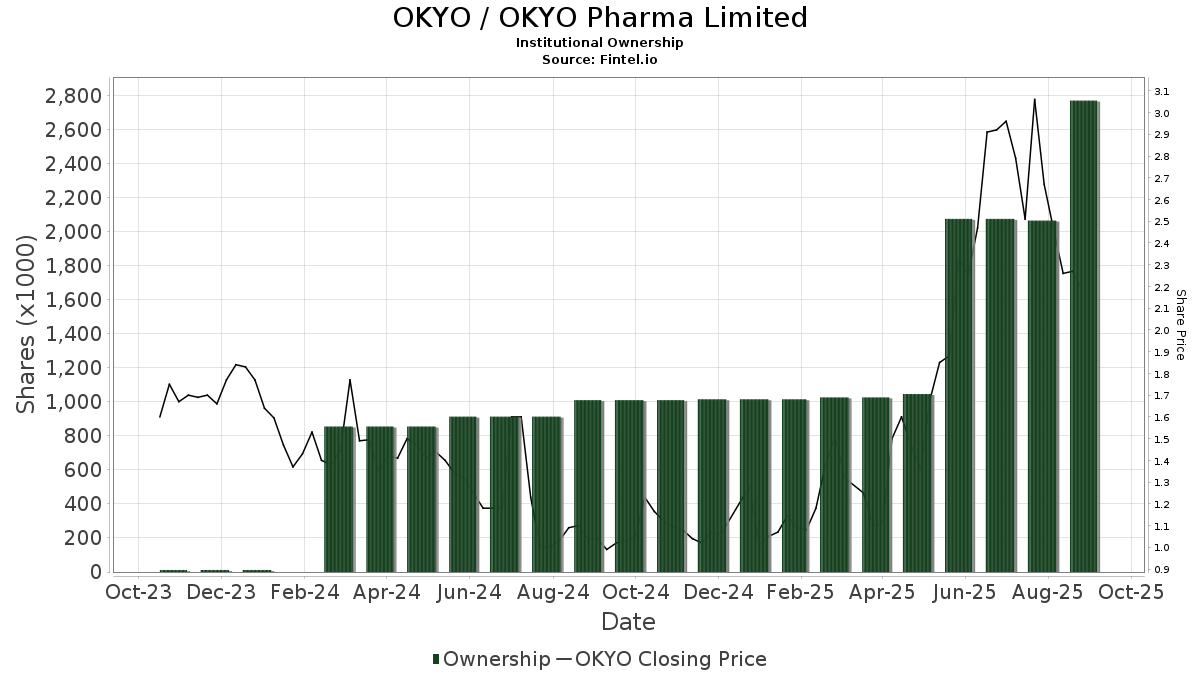

Currently, there are 7 funds or institutions with positions in OKYO Pharma, a figure that has remained steady over the last quarter.

An interesting nugget of data reveals that the average portfolio weight dedicated to OKYO among all funds stands at 0.00%, witnessing a notable surge of 97.94%.

The institutions have shown increased confidence in OKYO, with total shares owned shooting up by a staggering 797.70% in the past three months to reach 855K shares.

Major Stakeholder Movements Signal Investor Confidence

Barclays has upped the ante by holding 758K shares, equivalent to a 2.28% ownership stake in the company.

Noteworthy is their prior position of owning 25K shares, representing a substantial 96.70% increase, and elevating their portfolio allocation in OKYO by an impressive 386.94% over the last quarter.

Other key shareholders include Susquehanna International Group, Llp, Cerity Partners, and Geode Capital Management, all signaling positive sentiment through steady or increased ownership percentages.

The collective investment decisions of these stakeholders paint a promising picture for OKYO Pharma’s future growth trajectory.

HSBC Holdings also holds a stake in the company, demonstrating continued interest and confidence in OKYO Pharma’s potential.

Fintel stands out as a premier investing research platform, offering valuable insights and data to a wide range of investors, traders, and financial experts.

From fundamentals to insider trading, Fintel equips users with comprehensive tools to navigate the complex world of investing with confidence.

For investors seeking analytical edge and informed decisions, Fintel remains a go-to resource for uncovering actionable investment opportunities.