Old Dominion Freight Line Faces Market Challenges Amid Declining Volumes

Old Dominion Freight Line, Inc. (ODFL), headquartered in Thomasville, North Carolina, ranks among the largest less-than-truckload (LTL) motor carriers in North America. The company, which boasts a market capitalization of $36.3 billion, offers a range of services, including regional, inter-regional, and national LTL services, as well as additional options like container drayage, truckload brokerage, and supply chain consulting.

Recent Performance and Market Comparisons

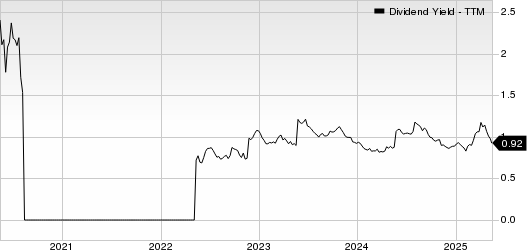

Over the past year, ODFL has underperformed compared to the broader market. Its stock has declined by 7.6% over the last 52 weeks and fallen 3.7% year-to-date (YTD). In comparison, the S&P 500 Index ($SPX) has seen gains of 11.5% in the same period, with a minor 60 basis point increase projected for 2025.

Further examination reveals that ODFL has also lagged behind the iShares Transportation Average ETF (IYT), which experienced a 1.5% rise over the past year and a slight 10 basis point uptick YTD.

Q1 Results and Earnings Outlook

Following the release of its better-than-expected Q1 results on April 23, ODFL’s stock saw a slight increase. Nonetheless, persistent macroeconomic challenges have led to declining volumes. For the first quarter, ODFL reported a 5.8% year-over-year decrease in revenue, totaling $1.4 billion—a figure that did surpass analyst expectations by 50 basis points. The company’s net income fell 12.9% from the previous year to $254.7 million, while earnings per share (EPS) of $1.19 exceeded consensus estimates by 3.5%.

Looking ahead to fiscal year 2025, which ends in December, analysts predict a 4.9% year-over-year decline in earnings to $5.21 per share. On a more favorable note, ODFL has demonstrated a solid earnings surprise history, meeting or exceeding bottom-line estimates in each of the last four quarters.

Analyst Ratings and Market Sentiment

The consensus rating for ODFL stock is currently “Moderate Buy.” Among the 22 analysts covering the stock, there are six “Strong Buy” ratings, one “Moderate Buy,” 13 “Hold” recommendations, and two “Strong Sell” ratings.

This outlook is notably more positive than three months prior, when the consensus was a “Hold” rating, with only two analysts recommending “Strong Buy.”

On April 24, Truist analyst Lucas Servera reaffirmed a “Buy” rating on ODFL, but adjusted the price target downward from $220 to $175.

Currently, ODFL is trading slightly below its average price target of $171.86. However, the highest target on the street of $230 suggests a significant upside potential of 35.3% from its current trading level.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.