Old National Bancorp Preferred Shares Yield Over 7% in Latest Trading

Solid Performance Amidst Strong Dividend History

In trading on Tuesday, shares of Old National Bancorp’s 7.00% Dep Shares Non-Cumul Preferred Stock Ser A (Symbol: ONBPP) yielded more than 7%. Based on its quarterly dividend, which annualizes to $1.75, shares were traded as low as $24.98. This yield significantly outperformed the average yield of 6.38% for preferred stocks in the “Financial” category, according to Preferred Stock Channel. At the last close, ONBPP was trading at a 1.56% premium to its liquidation preference, contrasting with an average discount of 5.59% in the same sector. Investors should note that the shares are classified as non-cumulative. This means if a payment is missed, the company is not obligated to backpay those dividends to preferred shareholders before resuming payments to common shareholders.

Reviewing ONBPP’s Dividend History

Below is the dividend history chart for ONBPP, detailing past payments made on Old National Bancorp’s 7.00% Dep Shares Non-Cumul Preferred Stock Ser A:

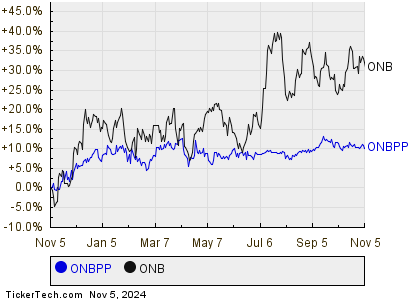

During Tuesday’s trading, Old National Bancorp’s 7.00% Dep Shares Non-Cumul Preferred Stock Ser A (Symbol: ONBPP) increased by around 0.2%, while the common shares (Symbol: ONB) rose by about 0.6%.

![]() Click here to find out the 50 highest yielding preferreds »

Click here to find out the 50 highest yielding preferreds »

Also see:

- ValueForum Discussion Community

- Top Ten Hedge Funds Holding DWTR

- BXSL Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.