Stock Market Hits New Highs, But Caution Is Advised

Recent events have driven stock market indexes to new all-time highs. Key factors include a strong economy, anticipated lower interest rates, excitement over a business-friendly administration, and the rising popularity of artificial intelligence (AI). Major tech players like Nvidia and Microsoft also contribute to this bullish trend.

Despite this optimism, investors should remain cautious. The exuberance of 2021 quickly turned into uncertainty in 2022. Currently, certain parts of the market echo that earlier excitement. For example, Palantir trades at 56 times sales and over 160 times forward earnings—remarkable numbers that signal a highly inflated valuation.

In contrast, some companies offer reasonable valuations paired with positive long-term trends. A noteworthy name is highlighted below.

Why Airbnb Should Be on Your Radar

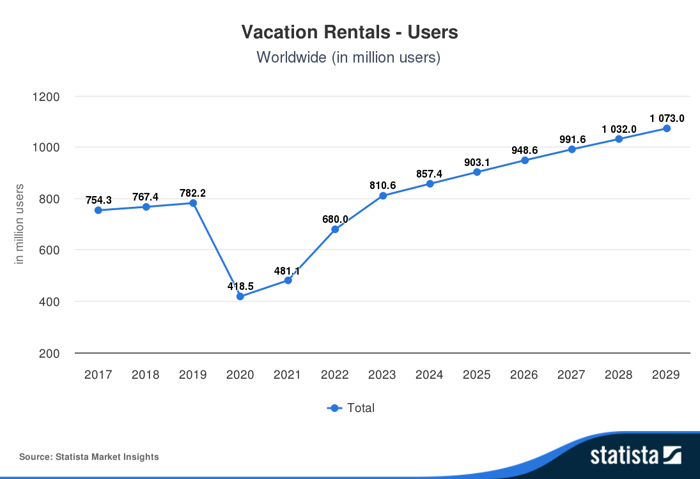

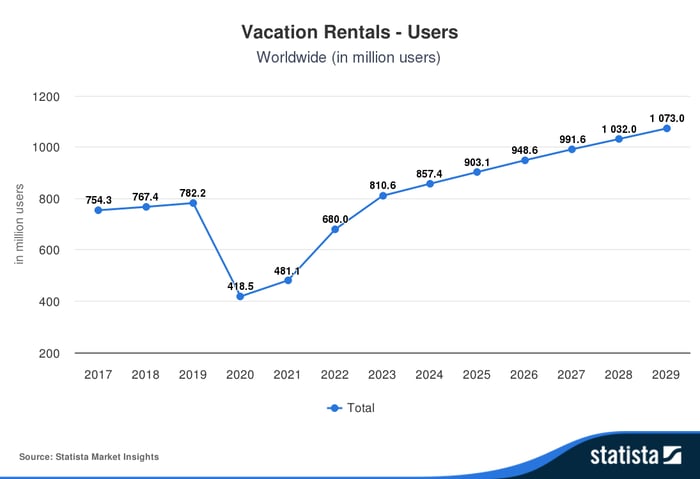

Changes in travel habits are becoming evident. Younger individuals tend to book vacation rentals more often than older travelers, who prefer traditional hotels. Forecasts suggest a 25% increase in vacation rental users from 2024 to 2029, emphasizing this shift.

Chart created by Statista.

Given this trend, Airbnb (NASDAQ: ABNB) is well-positioned for future growth. The company’s current performance showcases their success, with revenue reaching $3.7 billion last quarter—marking a 10% increase year-over-year. Operating income soared to $1.4 billion, reflecting an impressive 37% growth. Notably, Airbnb has a strong ability to generate free cash flow thanks to its efficient operating model, minimizing capital expenditures. Over the past 12 months, $4.1 billion of $10.8 billion in sales transformed into free cash flow, resulting in a robust 38% margin.

This impressive free cash flow empowers Airbnb to invest in growth, uphold a solid balance sheet, and conduct share buybacks. As reported in the third quarter, the company possessed $11.3 billion in cash and investments, with only $2 billion in long-term debt. Through the first three quarters of 2024, Airbnb repurchased $2.6 billion in shares, representing more than 3% of its current market capitalization.

Evaluating Airbnb as an Investment

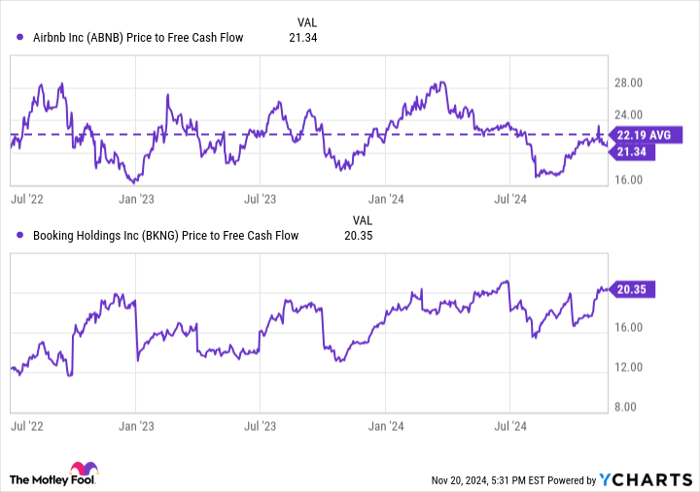

Airbnb’s stock valuation aligns closely with its competitor, Booking Holdings (NASDAQ: BKNG), when assessed based on free cash flow.

ABNB Price to Free Cash Flow data by YCharts

This correlation is logical due to their similar business models and financial outcomes, underscoring the critical role of free cash flow in valuation. Currently, Airbnb trades slightly below its average valuation and far from its recent peaks. While both companies are excellent investment choices, Airbnb’s market cap is roughly half that of Booking Holdings, indicating greater potential for growth.

The primary risk facing Airbnb involves regulatory challenges. Many regions have implemented rules that restrict short-term rentals. Airbnb actively collaborates with regulators to develop solutions that benefit both parties and mitigate this risk.

Airbnb is poised to gain from the long-term trend in favor of vacation rentals. The swift increase in users coupled with strong financial performance positions the stock as an attractive long-term choice.

Smart Investments to Consider with $1,000

Listening to the insights of our analyst team can pay off significantly. For instance, Stock Advisor’s total average return is 908%, a striking contrast to the 174% return of the S&P 500.*

The team has identified the 10 best stocks to consider now, and Airbnb is among them, along with nine other promising options.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024

Bradley Guichard holds shares in Airbnb and Booking Holdings. The Motley Fool has investments in, and recommends, Airbnb, Booking Holdings, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool recommends the following strategies: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. For more details, refer to the Motley Fool’s disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.