PepsiCo: A Dividend King Amid Economic Volatility

Equity markets have seen significant volatility this year due to uncertain tariff policies and their impact on the global economy.

Investing in a dividend-paying stock that has sharply declined in price can be prudent, provided the company’s long-term fundamentals are solid.

PepsiCo (NASDAQ: PEP) has experienced a nearly 23% drop in share price over the last year, making it an attractive option for long-term dividend-seeking investors.

Image source: Getty Images.

Product Portfolio Faces Pressure

PepsiCo’s brand portfolio includes well-known beverages like Gatorade and Mountain Dew, along with food products such as oatmeal and snacks like Doritos.

However, rising prices have led to consumer fatigue, contributing to a modest 1% growth in adjusted revenue for the first quarter, primarily driven by price increases.

Tariff impacts add uncertainty, potentially increasing costs and affecting profitability. Management now expects adjusted earnings per share to remain flat for this year, down from earlier projections of a mid-single-digit percentage increase.

Stable Dividends and Long-Term Viability

Despite short-term pressures, PepsiCo has a history of stability and resilience. The company recently announced a 5% increase in quarterly dividends, marking 53 consecutive years of growth, qualifying it as a Dividend King.

The new annual dividend rate of $5.69 per share results in a 4.3% yield, significantly higher than the S&P 500’s 1.3% yield.

A 78% payout ratio indicates responsible dividend management, reinforcing investor confidence.

Potential for Growth Amid Challenges

While long-term demand could be affected by a decline in product popularity, PepsiCo’s diverse offerings suggest demand will ultimately recover as economic conditions improve.

The stock is now trading at a price-to-earnings (P/E) ratio of 19, down from 26 last year, and is cheaper than the S&P 500’s average P/E of 28.

Investors can expect dividends while awaiting a resurgence in demand, which could ultimately drive earnings growth and enhance stock valuation.

Is Now the Time to Invest in PepsiCo?

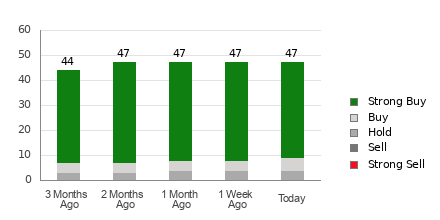

Before investing $1,000 in PepsiCo, consider that it was not included in a recent analyst list of ten top stocks for investment.

Historical examples show that companies on this list, like Netflix and Nvidia, have yielded substantial returns for early investors.

The potential return for PepsiCo remains attractive, particularly for those willing to endure short-term earnings fluctuations.

Lawrence Rothman, CFA has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.