e.l.f. Beauty: A Growth Stock Worth Watching Amidst Market Fluctuations

Investing in a promising growth stock often requires patience, as a company’s true value might not be realized immediately. While impressive earnings and revenue growth may take time to be reflected in the stock price, enduring commitment to a growing business can yield significant returns.

One standout in the cosmetics sector is e.l.f. Beauty (NYSE: ELF). With a market cap of approximately $7.3 billion, e.l.f. has consistently demonstrated strong growth metrics, leading many to speculate on its future value.

Impressive Growth Over Two Years

Achieving growth for 23 consecutive quarters is no small feat, and e.l.f. has done just that. Not only has the company’s sales consistently increased, but it has also gained market share. Its affordable cosmetics line has become particularly appealing as inflation affects consumer budgets.

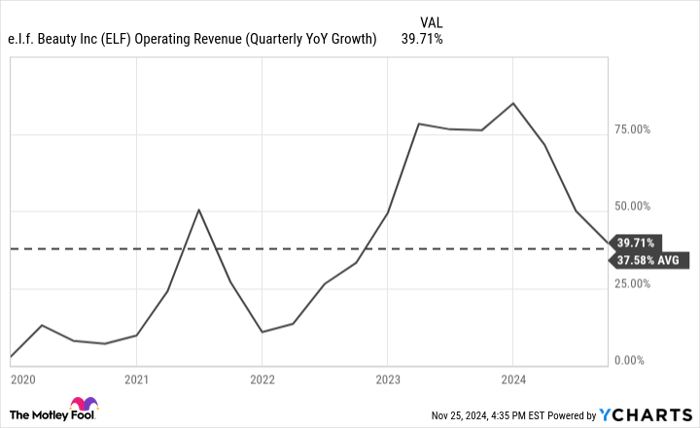

ELF Operating Revenue (Quarterly YoY Growth) data by YCharts.

While e.l.f.’s growth rate has slowed in recent years, it remains above the five-year average. Even at a rate of 40%, many companies would aspire to such figures. However, concerns over the slowdown have contributed to recent share price declines. For keen investors, this presents an opportunity, particularly as e.l.f. attracts a younger customer base.

Leading the Cosmetics Market Among Teens

My optimism for e.l.f. is supported not just by its financials, but also by consumer sentiment. The latest Piper Sandler ‘Taking Stock With Teens Survey’ reveals that e.l.f. is the leading cosmetics brand among U.S. teens, chosen by 35% of respondents, significantly above the second-best brand at 10%.

This appeal among younger consumers stems from a combination of quality and affordability. As these teens mature, they may remain loyal to e.l.f., translating to continued sales growth.

High Valuation with Growth Potential

Despite e.l.f.’s share price dropping over 30% in the past six months due to concerns about its cooling growth, sustaining above 40% growth is challenging for any company, especially with inflation impacting consumer spending.

The stock currently trades at around 70 times its trailing profits, which might seem steep. It may take time for e.l.f.’s earnings to align with its valuation. For investors, a buy-and-hold strategy may be viable. Patience is key as e.l.f. possesses essential factors for long-term success, like stable profits and a strong brand presence in a growing market.

Although e.l.f. may appear expensive currently, its growth potential indicates that it could be a worthwhile investment to simply buy and hold.

Should You Invest $1,000 in e.l.f. Beauty Now?

Before deciding to invest in e.l.f. Beauty, consider the following:

The Motley Fool Stock Advisor analyst team recently identified what they deem the 10 best stocks for investors at this time, and e.l.f. Beauty was not included. These selected stocks are projected to generate significant returns in the coming years.

For context, remember when Nvidia made this list on April 15, 2005… if you had invested $1,000 at that time, you’d have $829,378!*

Stock Advisor provides straightforward investment guidance, including insights on portfolio management and two new stock picks each month. The service has significantly outperformed the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of November 25, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends e.l.f. Beauty. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.