Why Amazon’s Cloud Business Makes It a Top Investment Choice for 2025

An investment strategy doesn’t need to be complex. Sometimes, a few key reasons can make a stock worth buying. For Amazon (NASDAQ: AMZN), I believe there is one standout reason it should thrive: Amazon Web Services (AWS).

The Ongoing Growth of Cloud Computing

AWS is Amazon’s cloud computing service that offers scalable computing power to its clients. It allows businesses to access the necessary computing resources for daily operations and even temporarily use powerful GPUs (graphics processing units) for specific tasks like AI model training. This flexibility is crucial as not every company requires a permanent server for these functions, thus making cloud services like AWS a wise choice.

Businesses that leverage AWS don’t have to manage server failures, maintenance, or hire extra staff for these purposes; Amazon handles all of that.

However, the transition to cloud-based systems is still in its infancy. Grand View Research and others predict significant expansion in the cloud market in the coming years, estimating growth from $602 billion in 2023 to $2.39 trillion by 2030. This translates to a robust compound annual growth rate (CAGR) of 21.2%—a remarkable figure in such a large industry.

Although AWS won’t capture the entire market share, it currently leads in infrastructure, positioning Amazon favorably amidst the cloud computing surge. This shift in computing infrastructure, combined with the rising demand from various AI applications, significantly benefits AWS, reinforcing its critical role within Amazon’s business.

AWS Drives Amazon’s Stock Performance

Numerous firms compete in the cloud computing space, but AWS stands out as a crucial profit driver for Amazon. The company’s primary sales come from lower-margin commerce, while AWS contributes a substantial profit boost.

In the third quarter, AWS represented 17% of Amazon’s total sales but generated an impressive 60% of operating income. With an operating margin of 38%, AWS significantly outperforms Amazon’s North American commerce segment, which has a margin of just 5.9%. If AWS can sustain its margins and continue growing at the current pace of 19% year-over-year, Amazon is likely to see ongoing profit growth.

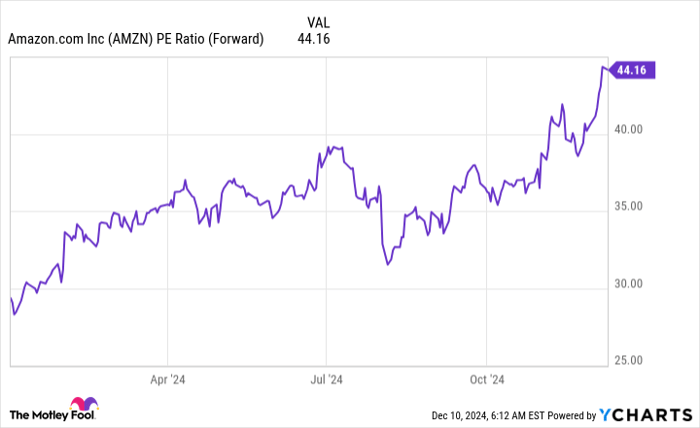

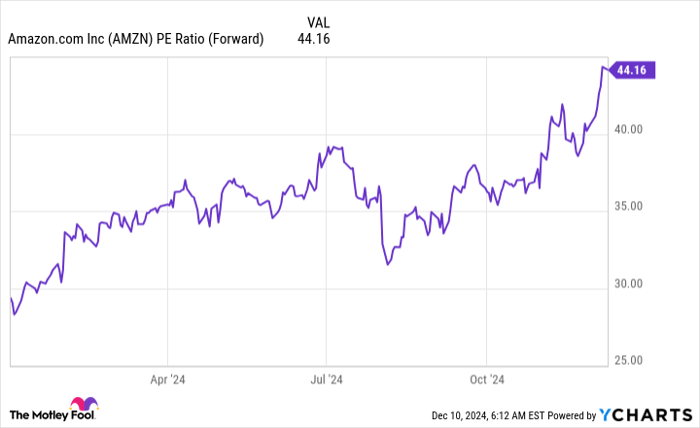

This strong performance explains why Amazon shares command a higher valuation compared to other tech stocks:

AMZN PE Ratio (Forward) data by YCharts

Currently valued at 44 times forward earnings, Amazon stock isn’t considered cheap. Nevertheless, given that over half of its profits come from a high-margin and fast-growing sector, it’s understandable that Amazon’s valuation parallels that of Nvidia.

As cloud computing is expected to experience significant expansion in the next several years, AWS is strategically positioned to benefit. This solid foundation makes a compelling case for purchasing and holding Amazon stock as we approach 2025, alongside other potential reasons for investment.

Is Now the Right Time to Invest $1,000 in Amazon?

Before making a decision to buy Amazon stock, consider this:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for current investment… and Amazon is not included. The selected stocks may offer substantial returns in the foreseeable future.

For context, when Nvidia was chosen for this list on April 15, 2005, a $1,000 investment at that time would have turned into $841,692!*

Stock Advisor offers a straightforward strategy for investors, providing portfolio-building guidance, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s returns*.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Amazon. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.