Tilray Brands: Analyzing the Numbers Behind the Struggles

While stories often drive stock prices, key financial metrics can reveal significant insights about a company’s potential. For investors interested in Tilray Brands (NASDAQ: TLRY), one crucial figure stands out. Let’s explore this number and what it means for your investment decisions.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Why Investment Success Matters

Successful companies typically make investments that yield higher returns than their costs. This attracts investors and convinces lenders to offer favorable loans. Conversely, businesses that fail to do this may struggle to gain investor confidence.

Investors often need to be patient, as some ventures take time to become profitable. For a multinational cannabis and alcohol company like Tilray, essential investments include cultivation technology, manufacturing equipment, and retail operations. These purchases are designed to create shareholder value through product sales.

Unfortunately, Tilray has faced challenges. Its trailing-12-month return on invested capital (ROIC) sits at negative 5.5%, and its three-year average is even more concerning at negative 9.4%. This indicates that the company has not added value for its shareholders, warranting caution for potential investors.

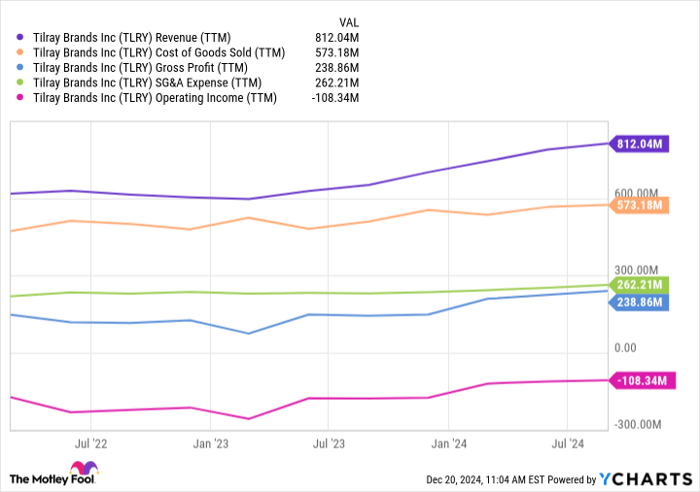

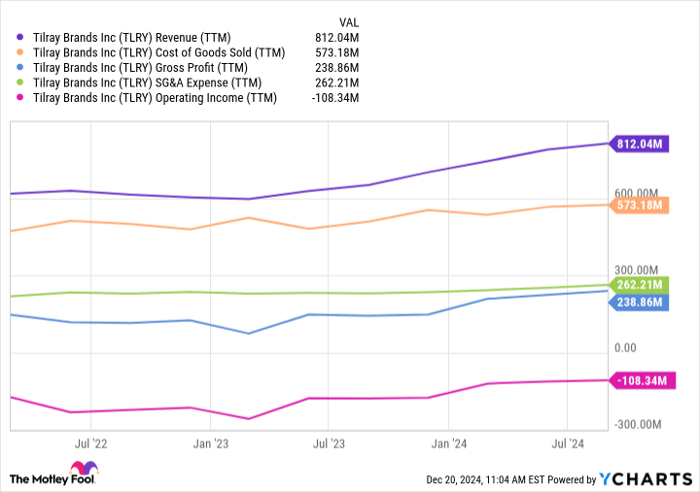

One significant reason for Tilray’s struggles is its operational losses, amounting to $108.3 million during the TTM period. Despite generating revenue, high selling, general, and administrative (SG&A) expenses hinder overall profitability. This chart illustrates the situation:

TLRY Revenue (TTM) data by YCharts

The lack of competitive advantages is evident, particularly as Tilray competes in saturated markets—the recreational and medicinal marijuana sectors in Canada and the North American alcoholic beverage industry. Without a strong brand identity or customer loyalty, the company struggles to maintain market presence without resorting to price cuts or heavy marketing expenditures.

Potential for Recovery Remains

There’s still hope for Tilray’s turnaround.

In the coming years, strategic investments could improve its ROIC. Consumer loyalty might also develop over time, allowing the company to reduce marketing costs and avoid losing market share. Additionally, potential marijuana legalization in the U.S. could greatly enhance Tilray’s market opportunities.

Financially, Tilray isn’t under immediate pressure to achieve profitability. As of the fiscal first quarter, it holds $287.9 million in long-term debt while also having $280.1 million in cash and short-term investments. Its TTM cash outflow of $82.2 million suggests that it can continue expanding without straining its resources right away.

However, investors should be prepared for a longer wait before efficiency and profitability might improve. If considering this stock, you may need patience as returns are unlikely to materialize quickly amidst significant risk.

Should You Invest $1,000 in Tilray Brands Right Now?

Before diving into an investment in Tilray Brands, reflect on this:

The Motley Fool Stock Advisor analyst team recently highlighted 10 stock recommendations for investors—but Tilray Brands wasn’t included. Those ten stocks have potential for significant returns in the near future.

For instance, if Nvidia had made the list on April 15, 2005, a $1,000 investment would have grown to an astonishing $825,513*!

Stock Advisor provides straightforward investment guidance, equipping investors with tools for building a successful portfolio, regular updates from analysts, and two new stock picks every month. Since 2002, Stock Advisor has outperformed the S&P 500 by more than four times.*

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.