AI Adoption Opens New Investment Opportunities in Amazon

After making headlines in the Stock market, artificial intelligence (AI) is now expanding into real-world applications. Modern AI tools encompass large language models, virtual agents, robotic workers, self-driving vehicles, and more.

According to research from February by The Motley Fool, AI’s usage rate in the United States stands at approximately 6.8%. This figure is anticipated to increase to 9.3% in the next six months.

Where to invest $1,000 right now? Our analyst team has revealed their picks for the 10 best stocks to buy currently. Learn More »

This indicates that the investment landscape for AI is just beginning to develop. For Gen Z investors born between 1996 and 2012, there is a significant opportunity here to build wealth by identifying companies poised to maximize AI’s potential in the coming decades. Potential investors under 18 will likely require a parent to assist in setting up a brokerage account to purchase stocks.

When seeking an AI Stock, simplicity can often be key. Amazon (NASDAQ: AMZN), although known for its e-commerce and cloud computing prowess, may surprise investors with its AI advantages over the years ahead.

Here are reasons why Amazon could be a prime AI Stock option for Gen Z investors, who have ample time until retirement to hold onto promising investments.

Amazon’s Cloud Leadership Enhances Its AI Position

Amazon stands out among AI stocks due to its preeminent cloud computing platform, Amazon Web Services (AWS), which commands roughly 30% of the global market. AWS serves as Amazon’s largest profit center and is vital for its business model. As more companies switch from on-site servers to cloud solutions, AI applications are set to significantly drive this shift.

In essence, increased AI adoption should lead to higher cloud usage.

According to analysts at Goldman Sachs, AI initiatives could propel cloud revenue to $2 trillion by 2030. If Amazon maintains its 30% share, it could see revenue of about $600 billion. In 2024, AWS generated revenues of $107 billion. If predictions hold true over the next five years, AWS might experience substantial growth. Given its profitability, AWS should also contribute positively to Amazon’s earnings growth.

AI’s Potential to Improve Retail Margins

Amazon is widely recognized for its dominance in e-commerce, capturing an estimated 40% of online shopping in the United States, while retail giant Walmart ranks second with only 10.5%. Leveraging its vast scale and supply chain, Amazon excels in providing competitive prices, broad selection, and rapid delivery.

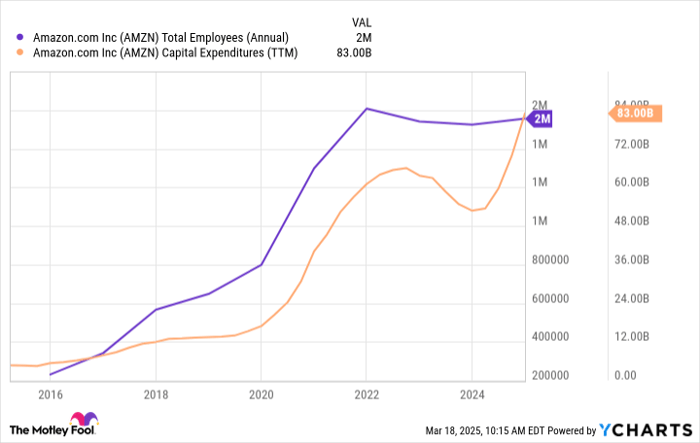

However, this competitive edge comes at a cost. The company invested heavily in its supply chain during the pandemic years (2020-2021), resulting in a significant increase in employee numbers:

AMZN Total Employees (Annual) data by YCharts; TTM = trailing 12 months.

While Amazon typically sells products at thin margins, the integration of AI could enhance the margins within its retail segment. Potential AI applications to reduce costs include:

- Self-driving vehicles and delivery drones.

- Automated order fulfillment in distribution centers.

- Virtual customer service representatives and shopping assistants.

Amazon has already begun to explore and implement AI and automation in these areas. Continued investment in these technologies is essential, especially since e-commerce represents a mere 16% of total retail spending in the U.S. The e-commerce sector has been on a growth trajectory for nearly three decades and holds promise for continued expansion.

Amazon’s Current Value Proposition

Recent fluctuations in the Stock market have negatively impacted Amazon’s price momentum, with shares currently about 20% off their peak. Nevertheless, the company’s earnings indicate a robust business that is likely to endure. Analysts project an average earnings growth of 21% for Amazon over the long term, while the stock is trading at a price-to-earnings ratio of 34.

Utilizing the price/earnings-to-growth ratio (PEG) gives insight into a stock’s valuation relative to anticipated growth. I typically invest in high-quality stocks with PEG ratios between 2.0 and 2.5; Amazon’s PEG stands at 1.7, placing it comfortably within my range.

This makes the Stock a sensible short-term buy, particularly for long-term investors who aim to benefit from Amazon’s growth opportunities in cloud computing, e-commerce, and AI over the decades ahead.

Is Amazon a Smart $1,000 Investment Now?

Before deciding to invest in Stock of Amazon, keep in mind the following:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to purchase right now, and Amazon is not included. The stocks on their list have the potential for significant returns in the coming years.

For example, when Nvidia was featured on this list on April 15, 2005, an investment of $1,000 at that time would now be worth $721,394!*

Stock Advisor offers investors a straightforward guide for success, with advice on building a portfolio, updates from analysts, and two new Stock recommendations each month. Since 2002, the Stock Advisor service has quadrupled the returns of the S&P 500. Don’t miss out on their latest top 10 stock list available upon joining Stock Advisor.

*Stock Advisor returns as of March 18, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool. Justin Pope does not hold positions in any stocks mentioned. The Motley Fool recommends Amazon, Goldman Sachs Group, and Walmart and has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.