AI Market Growth: Explore Key Investment Opportunities Now

Demand for artificial intelligence (AI) infrastructure, software, and services is poised for significant growth. This sector could represent one of the largest growth markets in history, driven particularly by business adoption.

Business Investment in AI Set to Surge

A recent survey by global consultancy McKinsey & Co. reveals that approximately 40% of businesses plan to increase their investments in AI, largely due to advancements in generative AI. This is substantial news, considering that various research from The Motley Fool indicates that under 10% of businesses nationwide currently utilize AI. Thus, we may observe an increase in AI adoption among businesses by nearly fivefold in the coming years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

If you aspire to benefit from the AI revolution, one particular stock deserves your attention.

Why Nvidia Stands Out in the AI Space

Many investors drawn to the AI phenomenon are familiar with Nvidia (NASDAQ: NVDA). Despite a recent correction, it maintains a substantial market cap of $2.7 trillion. Investors aware of Nvidia recognize its primary business in manufacturing graphics processing units (GPUs), essential for modern technology.

Currently, the most exciting application of Nvidia’s GPUs lies in machine learning, crucial for training and operating AI models. Without these tools, the current AI revolution would not be feasible. Nvidia has emerged as a leading supplier of GPUs for machine learning applications, capturing between 70% and 95% of this market segment.

Market share can fluctuate due to competition in the tech industry. Nonetheless, Nvidia’s GPUs are among the best for AI applications based on performance metrics and customer willingness to invest more for these products, evident from the company’s impressive gross margins in the mid-seventies percentage-wise.

Nvidia’s CUDA Advantage: A Competitive Edge

Importantly, Nvidia possesses a unique competitive advantage through its CUDA platform—Compute Unified Device Architecture. Developed in 2006, CUDA allows developers to customize chip performance for specific applications, creating a significant level of vendor lock-in over the years. Today, CUDA is regarded as the benchmark for GPU acceleration.

This ecosystem tightly integrates with CUDA, resulting in substantial “stickiness” that other GPU manufacturers struggle to match. Nvidia effectively controls both the hardware and software aspects of AI applications, enhancing its competitive strength beyond just chip performance.

Evaluating Nvidia Stock for Potential Investment

High-growth stocks, including Nvidia, often exhibit considerable volatility because their value is closely linked to market sentiment. Minor fluctuations can significantly alter a stock’s price multiples.

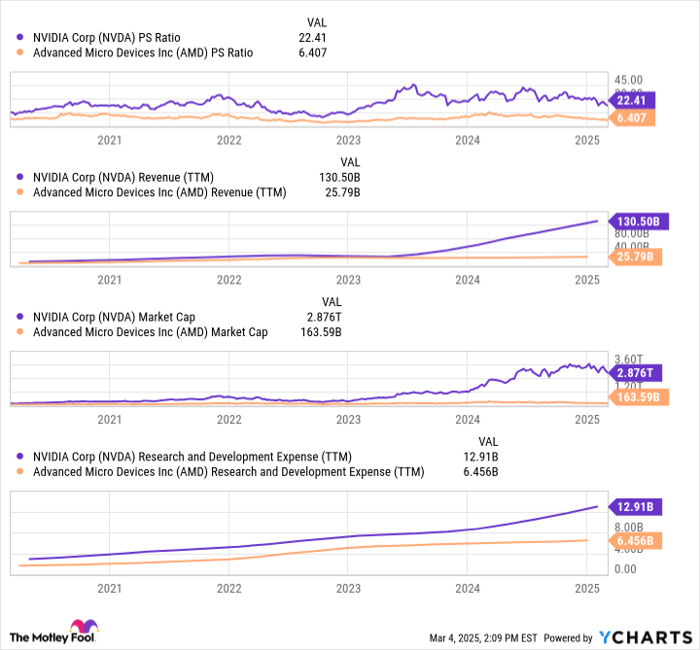

NVDA PS Ratio data by YCharts. PS Ratio = price-to-sales ratio. TTM = trailing 12 months.

After a recent pullback, Nvidia’s shares are priced lower than they have been in months. However, they still carry a valuation of 22.4 times sales, which is high compared to slower-growing rivals like Advanced Micro Devices.

The AI market is set for extensive growth over the next decades, and Nvidia’s CUDA advantage positions it well in this environment. Over time, Nvidia’s robust growth rates may make its current valuation appear more appealing. A long-term investment horizon could be advantageous for younger investors open to such opportunities.

While Nvidia presents an exciting investment opportunity, its price point may deter those seeking immediate visibility. Investors more cautious about volatility might consider alternative options.

Seize This Unique Investment Opportunity

Have you felt like you missed out on the chance to buy into top-performing stocks? This could be your moment.

Occasionally, our team of experts issues a “Double Down” Stock recommendation for companies anticipated to experience substantial growth. If you’re worried about missing the boat, now may be the best time to invest:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $299,728!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,754!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $480,061!*

Currently, we are issuing “Double Down” alerts for three formidable companies, and this might not be an opportunity to be missed.

Continue »

*Stock Advisor returns as of March 14, 2025

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.