Why Uber’s Recent Decline Could Be a Once-in-a-Lifetime Buying Opportunity

Uber Technologies (NYSE: UBER) is renowned for being the largest ride-hailing platform globally. In addition to its core services, it also includes Uber Eats for food delivery and Uber Freight for commercial logistics.

Despite recently stumbling 8% from its all-time high set just last month, the situation could signal a significant chance for savvy investors. This decline aligns with Donald Trump’s election victory and offers a potential financial upside for the company.

A Transformative Moment in Mobility

In the third quarter of 2024, Uber reported a record 161 million monthly active users. These users completed over 2.8 billion trips, generating $40.9 billion in gross bookings.

Gross bookings reflect total customer spending on the Uber app. This figure includes driver earnings for ride-shares and the cost of food for deliveries, which Uber does not retain. After accounting for expenses, Uber’s revenue for the quarter reached $11.2 billion, marking a 20% increase from the previous year.

The mobility industry is on the verge of change, heavily influenced by advancements in autonomous vehicle technology. Currently, Uber offers limited self-driving ride-sharing and food delivery, but availability is expected to expand considerably.

In the same quarter, Uber drivers collectively earned $18 billion, making it the company’s largest expense. If autonomous vehicles can remove this cost, Uber stands to retain more revenue from each ride, fundamentally reshaping its financial landscape.

Image source: Getty Images.

The Interplay of Autonomous Driving, Politics, and Industry Competition

Autonomous driving technologies, President-elect Trump’s regulatory stance, and entrepreneurs like Elon Musk are intricately connected. Trump’s administration may adopt a less restrictive approach to regulation and could expedite the development of self-driving technologies. Musk, a prominent supporter of Trump, aims to establish a ride-hailing network for Tesla’s autonomous vehicles.

While some investors worry that regulatory changes might benefit Tesla and hurt Uber, I maintain that Uber’s extensive ride-sharing network is its greatest asset. Companies developing autonomous vehicles will likely need to integrate with Uber to reach the most considerable user base.

Uber has already established partnerships with 14 leading autonomous vehicle companies, including Alphabet’s Waymo. Consumers can now hail fully autonomous vehicles via the Uber app in Phoenix, with expansions to Austin and Atlanta planned for early 2025.

Unlike Tesla, which lacks formal approval for full self-driving services in any state, Waymo conducts over 100,000 autonomous rides weekly. Therefore, Uber’s partnerships position it as a frontrunner in the sector.

Positive Outlook from Wall Street

While broad adoption of autonomous vehicles will take time, even with potential regulatory relief, Uber must demonstrate that self-driving cars can be a safe and reliable alternative to human drivers. Still, the long-term trend toward autonomy appears promising due to significant cost benefits.

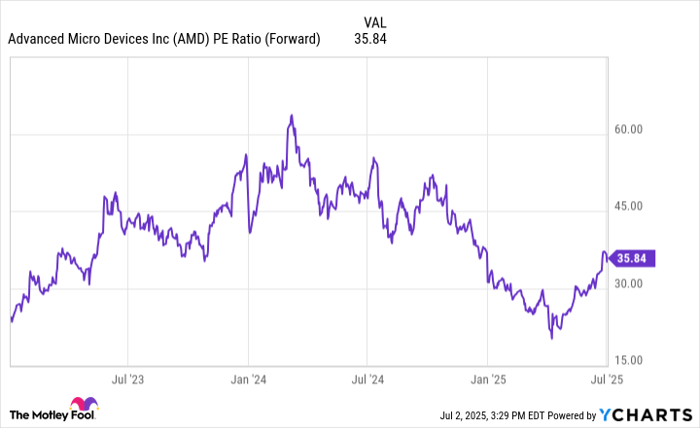

Given Uber’s recent price drop, it may present an enticing opportunity for long-term investors. Currently, its price-to-sales ratio (P/S) sits at 3.6, less than half its peak ratio of around 10. Additionally, it’s a 15% discount compared to its average P/S of 4.3 since going public in 2019.

UBER PS ratio data by YCharts.

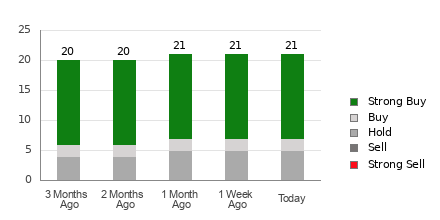

Wall Street analysts are overwhelmingly optimistic about Uber. According to The Wall Street Journal, out of 56 analysts covering the company, 45 have assigned it the highest buy rating, with five more in the overweight category, and only six recommending a hold.

They project an average price target of $91.16 for the next 12 to 18 months, indicating a 27% upside from current trading levels. The highest target of $120 suggests a potential increase of 67%.

For those who believe in the future of autonomous driving, adding Uber to their investment portfolios before the new year could be wise. If the Trump administration proceeds with deregulating the industry soon after taking office in January, Uber’s current P/S discount could diminish rapidly as investor optimism returns.

Seize this Potentially Lucrative Opportunity

Have you ever felt like you missed out on investing in successful companies? If so, there’s a chance to change that now.

Our expert analysts sometimes issue a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you think you missed your shot before, now may be the ideal time to invest as these opportunities don’t come around often. The numbers tell a compelling story:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you would have $350,915!*

- Apple: A $1,000 investment when we doubled down in 2008 would now be worth $44,492!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you would have $473,142!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Tesla, and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.