Alphabet: Leading the Charge in Quantum Computing and AI

The surge in quantum computing investments is remarkable, showcasing recent breakthroughs in this cutting-edge technology. At the same time, artificial intelligence (AI) continues to dominate discussions in the market, marking the early stages of a transformative shift. Investors aiming to capitalize on both trends face limited choices of companies to consider.

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) stands out as a prime candidate, offering exposure to both the quantum computing sector and the AI landscape.

Google Sparks Quantum Computing Investment Interest

Alphabet has played a pivotal role in energizing the recent wave of investment in quantum computing. In December, Google (an Alphabet subsidiary) revealed its Willow quantum chip accomplished a computing task that would take the fastest supercomputers an unimaginable 10 septillion years (10 followed by 25 zeros) to finish. While that figure is staggering, the technology behind it is what truly matters.

Quantum computers operate differently than traditional computers. Instead of bits, they utilize qubits, which can represent both 0s and 1s simultaneously. This characteristic gives quantum computing an edge in processing power, allowing it to manage vast amounts of information more efficiently than classical computing, which can only handle one value at a time.

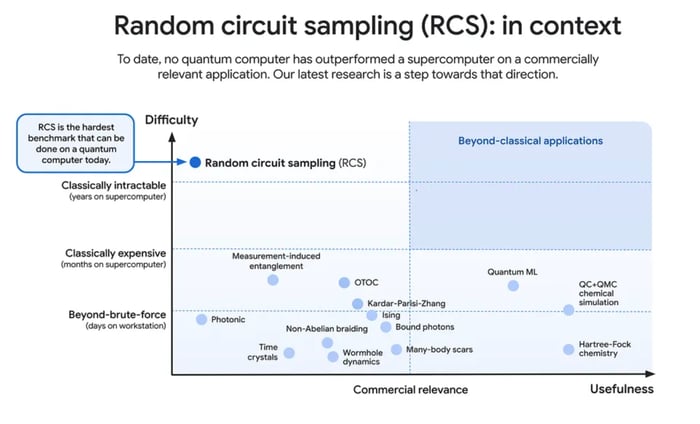

Nonetheless, the use of qubits introduces the risk of errors in calculations. Google has devised innovative strategies to mitigate this issue, showcasing the capabilities of quantum technology. Importantly, the company clarified that the showcased task serves more as a demonstration rather than a commercially viable application. The significance of this benchmark lies in demonstrating quantum computing’s potential, as reflected in the accompanying chart:

Image source: Alphabet.

Despite the significant strides made, practical applications of quantum computing remain years away. However, several companies are already harnessing quantum technologies for research purposes. Investing in Alphabet provides exposure to both the evolving quantum computing space and the booming AI sector, making it an attractive choice for investors.

Alphabet Reaps Rewards from AI Investments

As Alphabet vies for success in the generative AI market with its Gemini model, it is also positioned to gain significantly from businesses looking to invest in AI computing capabilities.

Google Cloud, Alphabet’s cloud services division, serves as the primary channel for benefiting from this trend. Many clients prefer not to invest in high-end AI servers and instead rent computing power from cloud providers. This flexible approach allows companies to adjust their computing needs according to demands. Given Google Cloud’s extensive client base, this setup creates advantages for all parties involved.

The cloud computing sector is thriving, projected to surpass $2 trillion by 2030. Google Cloud is recognized for providing top-tier computing resources and was among the first to roll out Nvidia‘s latest Blackwell GPUs. With a 30% year-over-year increase in cloud revenue, reaching $12 billion in Q4, it’s evident that this robust market is benefiting Alphabet significantly.

Beyond cloud services, Alphabet is integrating AI technologies into its traditional search business and enhancing advertising tools for clients. While it may not be at the forefront of the generative AI race, Alphabet remains positioned to excel in the broader AI landscape. Coupling AI advancements with the potential of quantum technologies creates an optimistic outlook for Alphabet’s stock.

GOOGL PE Ratio (Forward) data by YCharts

Despite its optimistic projections, the market values Alphabet differently, with its stock trading at an attractive 21 times forward earnings. Considering the potential growth from AI and quantum computing, this valuation appears reasonable for long-term investment.

This is Your Chance to Invest in a Promising Future

Have you ever felt like you missed out on investing in top stocks? You might be interested to know about our expert analysts who occasionally signal a “Double Down” stock recommendation for companies poised for growth. If you think you have already lost your chance to invest, now might be the ideal time to act.

- Nvidia: investing $1,000 when we issued a recommendation in 2009 would yield $350,809!*

- Apple: if you had invested $1,000 when we doubled down in 2008, you’d have $45,792!*

- Netflix: a $1,000 investment based on our 2004 recommendation would now be worth $562,853!*

Right now, we are issuing “Double Down” alerts for three promising companies. It might be your chance for a lucrative investment opportunity.

Learn more »

*Stock Advisor returns as of February 3, 2025

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.