Nvidia’s Strong Earnings Highlight Continued Growth Potential for Investors

Chipmaker Nvidia (NASDAQ: NVDA) has witnessed exceptional growth in recent years. The company’s success in artificial intelligence (AI) has propelled Nvidia to one of the most valuable companies globally, with a market capitalization nearing $3 trillion.

However, some investors are expressing concerns that, after a staggering 1,600% increase over the past five years, Nvidia may have reached its peak, and investing now could be too late. Yet, Nvidia’s latest earnings report illustrates the company’s robust performance and potential for further growth, even for new investors today.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Nvidia Achieves $72.9 Billion in Fiscal 2025 Profit

Nvidia’s financial performance in fiscal 2025 is noteworthy, with a total profit of $72.9 billion—more than the company’s cumulative earnings over the previous decade. This impressive growth in profit is not just about increased revenue; it highlights the robust margins that allow growth to effectively translate into net income.

For the fourth quarter ending January 26, 2025, Nvidia reported that sales surged to $130.5 billion for the entire fiscal year. Comparatively, net income rose sharply from $29.8 billion the previous year to $72.9 billion. Over the past ten fiscal years, Nvidia’s total profit was around $61 billion, emphasizing the significance of its most recent figures.

The current scale and financial health of Nvidia poise the company to navigate rising costs and explore additional growth avenues, including potential acquisitions. Given the extensive opportunities in the market, it becomes clear why Nvidia’s valuation has the potential to increase further, despite prevailing market skepticism.

Improving Valuation Amidst Recent Stock Decline

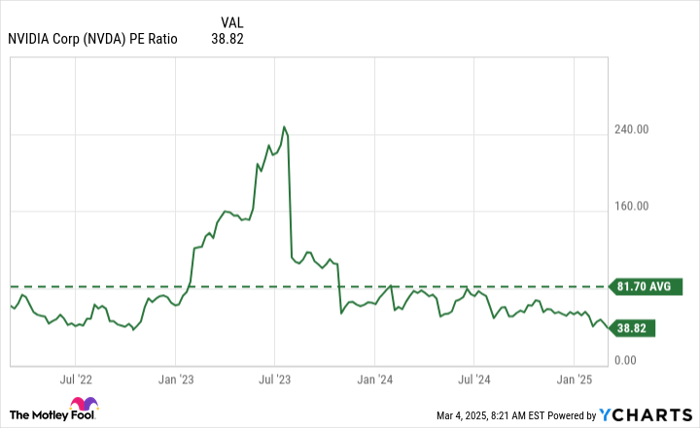

Nvidia’s stock has dropped by 15% since the beginning of the year, partly due to investor anxieties about the economy and potential slowdowns in AI spending. These factors have contributed to caution among investors regarding Nvidia’s performance. Nonetheless, when assessing the company’s rapid earnings growth alongside its declining stock price, the valuation appears more attractive than it did a year or two ago.

NVDA PE Ratio data by YCharts

Nvidia’s stock is currently trading below its historical price-to-earnings (P/E) multiple, which bears out the idea that a fast-growing company with a high P/E could become much cheaper in the future as its earnings expand.

Is Now the Right Time to Purchase Nvidia Stock?

The market is grappling with risks from tariffs and potential trade wars, which could affect all sectors. This scenario increases the risk of further declines for Nvidia and similar growth companies that rely on substantial growth to appeal to investors; any deceleration can significantly influence their valuations.

While Nvidia’s stock might experience continued volatility due to broader economic uncertainties, the company itself remains solidly positioned for long-term growth. This makes Nvidia a potentially advantageous purchase today, although investors should prepare for more fluctuations in the short term.

Second Chances: A Potentially Lucrative Investment Opportunity

If you’ve ever felt you missed out on top-performing stocks, this might be your moment.

Occasionally, our team of analysts issues a strong “Double Down” recommendation for companies expected to see significant gains. If you’re concerned about missing investment opportunities, consider this your chance to act before it’s too late. The data illustrates the potential:

- Nvidia: An investment of $1,000 in 2009 would be worth $300,764 today!*

- Apple: A $1,000 investment in 2008 would now be $44,730!*

- Netflix: If you invested $1,000 in 2004, it would now be $524,504!*

We are currently issuing “Double Down” alerts for three promising companies, creating a potentially rare investment opportunity.

Continue »

*Stock Advisor returns as of March 3, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.