“`html

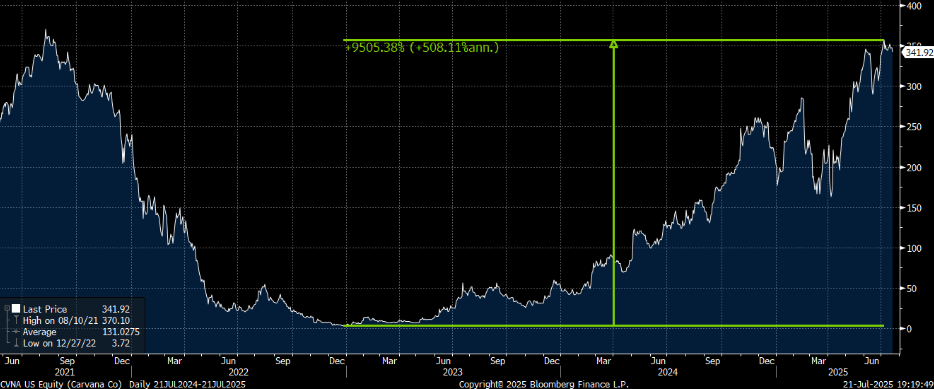

Opendoor (OPEN) experienced a significant surge in stock price, jumping from approximately $0.50 in late June to nearly $5 within a month, marking a ~10X gain. This rally is reminiscent of the comeback seen in Carvana (CVNA), which rose dramatically after being heavily shorted and undervalued.

Both companies share a similar business model, focusing on the buying and reselling of physical assets using technology to streamline operations. While Opendoor faced severe losses in 2022 due to rising mortgage rates and declining homebuyer interest, it has since refocused its business strategy, reportedly reducing inventory and streamlining processes. Experts predict that as mortgage rates decline from around 6.7% to 5.8% by late 2026, the housing market, currently experiencing tight inventory levels, may rebound alongside demand.

Opendoor’s recent success is attributed not just to market fluctuations but also to its advanced Automated Valuation Model (AVM), which positions it as a tech-driven company in the real estate sector. Analysts suggest that if consumer demand rises with lower rates, Opendoor could see continued growth and a potential shift in narrative, transitioning from a perceived “meme stock” to a technological disruptor in real estate.

“`