The Unraveling Drama of Opera Stock

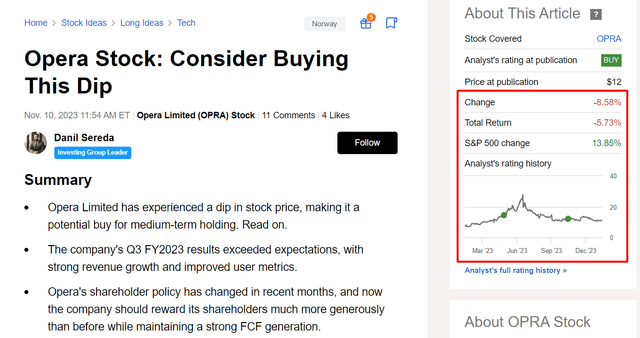

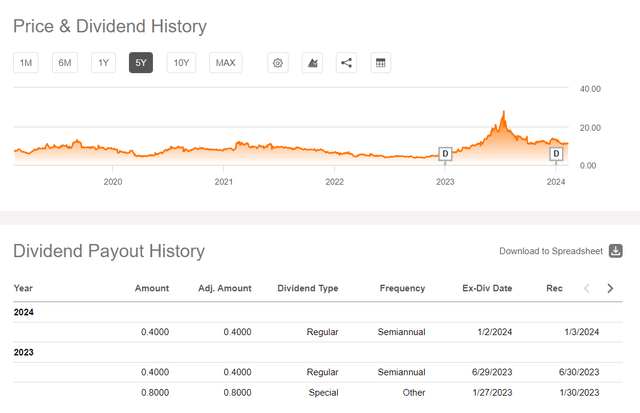

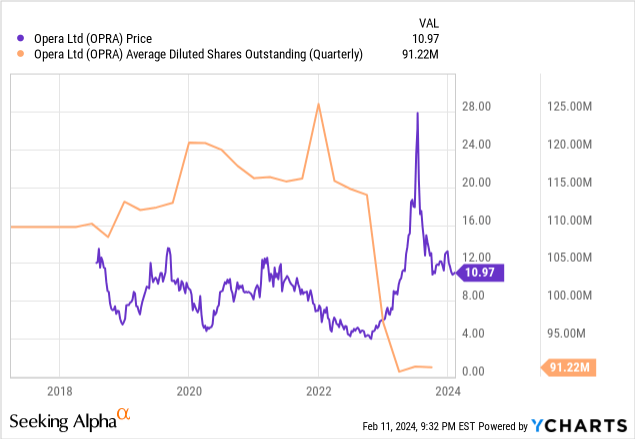

I last wrote about the rollercoaster ride of Opera Limited (NASDAQ:OPRA) in November 2023 and suggested investors consider buying the stock when it took a nosedive to $12 apiece. Since then, the stock’s value has tumbled further to $11, resulting in a total return of -5.73%, including dividends, which remains below the performance of the S&P 500 (SPY).

Despite the recent underperformance, my conviction in Opera stock being a compelling investment within the arena of high-yielding small-cap stocks remains unshaken. Additionally, with the stock’s price dropping further, its attractiveness in terms of valuation and anticipated growth has magnified, presenting an opportune moment for investors to consider.

Opera’s Underestimated Growth Story

In late October 2023, Opera Limited unveiled its Q3 FY2023 results, exhibiting a stellar streak of growth with its 11th consecutive quarter of over 20% revenue growth. Surpassing previous guidance, the company reported a quarterly revenue of $103 million, accompanied by an adjusted EBITDA margin of 23%. Once again, both the revenue and EPS consensus estimates were surpassed, solidifying the company’s upward trajectory.

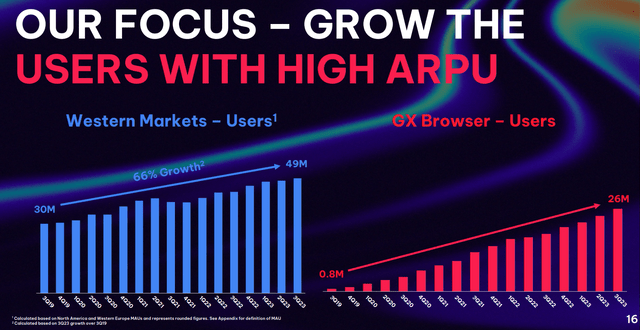

Opera’s robust quarterly results were fueled by its unwavering focus on operational excellence. The Opera GX browser observed a remarkable milestone, recording 26 million monthly active users (MAUs), representing around 8% of global internet users. Notably, the company witnessed substantial user base growth in North America and Europe, reflecting its ability to capture diverse market segments. This achievement underscores the company’s relentless drive to expand its user base in high ARPU segments alongside the continuous enhancement of Aria, its browser AI across all product portfolios. Furthermore, Opera’s advertising revenue surged by an impressive 24%, constituting 59% of the company’s total revenue. This growth can be attributed not only to the company’s monetization strategy but also to the expansion of the Opera Ads platform.

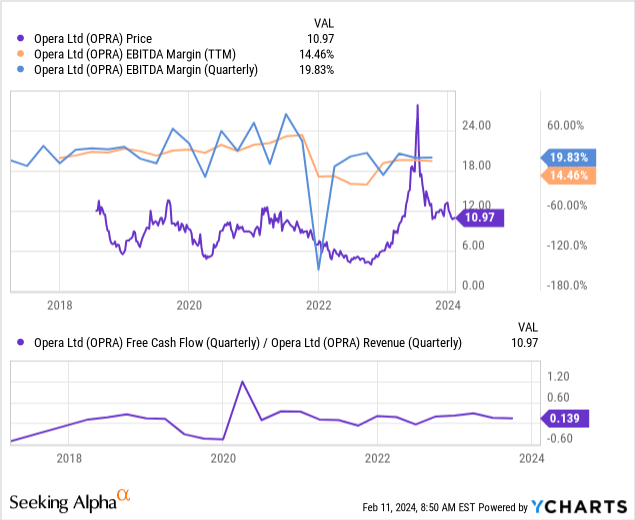

Opera’s Q3 results showed a 25% increase in operating expenses (OPEX), primarily driven by elevated professional services fees and augmented marketing and distribution expenses. Nevertheless, the company sustained a strong operating profit of $16.1 million. Additionally, with a net income of $16.8 million and an adjusted EBITDA of $23.8 million, Opera’s robust financial performance remains consistent. Its FCF amounted to $13.4 million in Q3 2023, underpinned by solid revenue growth and prudent spending practices, positioning Opera favorably for continued growth and innovation amidst the evolving internet consumer market landscape.

I foresee potential margin improvement for the company, with a potential slowdown in OPEX growth and sustained sales growth. Opera already generates 13.6% of revenue in the form of FCF, a stable figure without recent sharp declines, indicating a promising financial outlook.

Unlike most small caps, especially in its sector, Opera is a very shareholder-friendly company. The company demonstrated its commitment to shareholder value by returning a substantial $53 million through dividends and share repurchases during the latest quarter.

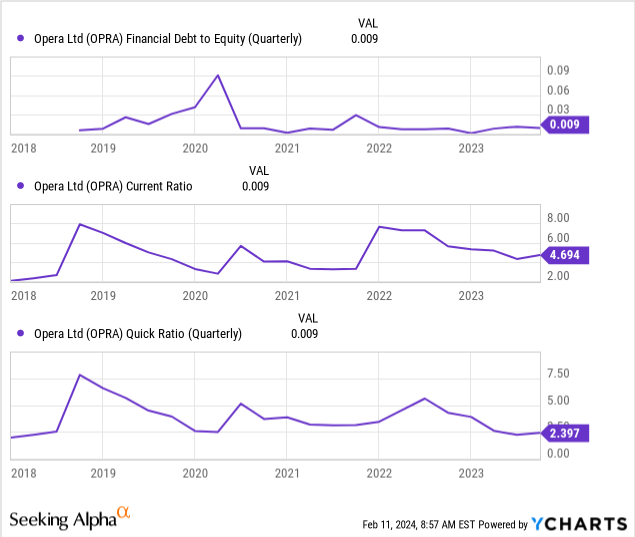

Analyzing the company’s balance sheet, there was a slight dip in liquidity, but with $83.5 million in cash and investments, Opera remains in solid financial shape, particularly with a debt-to-equity ratio of 0.09 and current and quick ratios at around 4.7 and 2.4 respectively.

Looking ahead, Opera has revised its full-year revenue guidance upwards to $394 – 397 million, demonstrating confidence in its growth trajectory. Similarly, the adjusted EBITDA guidance has been raised to $88 – 90 million, highlighting the company’s optimism regarding its profitability outlook.

For the fourth quarter, we

Opera Limited Set to Soar: Revenue and EBITDA Surging! Is This the Time to Invest?

Opera Limited recently reported impressive revenue and EBITDA numbers, hinting at a bright future for the company. The guidance for revenues, adjusted EBITDA, and marketing costs provide an optimistic outlook, prompting investors to consider the growth prospects of this tech giant.

Surpassing Guidance Expectations

Opera Limited’s revenue for the next fiscal quarter is expected to reach between $110 million to $113 million, signifying a 16% year-over-year upswing at the midpoint. Similarly, the adjusted EBITDA is projected to range from $22 million to $24 million, approximating a 21% margin at the midpoint. These figures indicate a substantial improvement from the company’s previous implicit Q4 guidance.

This optimistic forecast translates to the full-year revenue guidance of $394 million to $397 million, representing a 19% growth at the midpoint. Additionally, the full-year adjusted EBITDA guidance of $88 million to $90 million highlights a 23% margin at the midpoint. These numbers clearly depict a robust fiscal projection, instilling confidence in both the company’s management and investors.

Marketing Costs and Growth Initiatives

Opera’s success can be attributed to its strategic initiatives in AI, advertising platforms, and the Opera GX browser. Notably, Aria, the internally developed browser AI, is being implemented across various platforms, offering users new features while enhancing engagement. Furthermore, the Opera Ads advertising platform continues to attract advertisers globally, maximizing campaign performance through real-time bidding and partner inventories.

Despite the positive guidance, the management expects Q4 to represent the year’s highest in terms of marketing expenses, with a likely expenditure exceeding $30 million. However, the full-year marketing costs are anticipated to be below those of the prior year, an impressive achievement amidst the company’s robust revenue growth.

Investment Potential and Valuation Metrics

Looking at Opera Limited’s valuation metrics, it presents an attractive investment opportunity. With a projected ~46% decline in the EV/EBITDA multiple for the next year compared to the trailing twelve-month (TTM) multiple, the stock is currently trading at less than 9 times next year’s projected EBITDA. Furthermore, an anticipated reduction of 24.2% in the P/E ratio for the next year positions the stock at less than 12 times next year’s projected net earnings, reinforcing its undervalued status.

If the market consensus for FY2024 EPS reaches 95 cents and the P/E multiple expands to 15x, aligning with the current TTM figure, Opera Limited’s stock could reach a target price of $14.25, denoting an undervaluation of 30% compared to the current share price.

Risks and Rewards

Despite the immense growth potential, investing in Opera Limited entails essential risks. The tech landscape in which the company operates is highly competitive and constantly evolving, posing a threat to market position and profits if innovation falls behind or fails to align with consumer tastes. Moreover, the company’s global presence exposes it to various risks, including regulatory hurdles and currency fluctuations.

Furthermore, the constant threat of cybersecurity breaches and data privacy issues looms over the company, potentially impacting reputation, legal standing, and financial performance. These risks, though significant, are crucial considerations for potential investors.

Final Considerations

Despite the inherent risks, Opera Limited presents a significantly undervalued investment opportunity with a considerable growth potential. The positive guidance and compelling valuation metrics suggest a promising future for the company. As the company gears up to report its fourth-quarter results, it is a prime time for investors to assess the stock’s potential and consider their investment strategy.

As an investor contemplating the addition of Opera Limited to my portfolio, I firmly believe in the company’s growth story and encourage others to conduct their research and consider this opportunity with optimism. This untapped potential, amid the risks, presents a compelling risk-to-reward ratio, making Opera Limited a strong contender for investment consideration.

Thanks for reading!