Analyst Upgrade Boosts KLA’s Market Outlook

On October 31, 2024, Oppenheimer raised their rating for KLA (NasdaqGS:KLAC) from Perform to Outperform, indicating a more favorable outlook for the company.

Significant Price Target Increase Forecasted

As of October 21, 2024, KLA’s average one-year price target stands at $851.38 per share. Predictions range from a low of $681.75 to a high of $971.25. This average suggests a 27.79% potential increase from the most recent closing price of $666.23 per share.

Check out our list of companies showcasing the largest price target upside.

Financial Projections and Revenue Estimates

KLA is projected to generate annual revenue of $10,004MM, reflecting a decline of 2.47%. The expected non-GAAP earnings per share (EPS) is 23.19.

Institutional Investor Sentiment Towards KLA

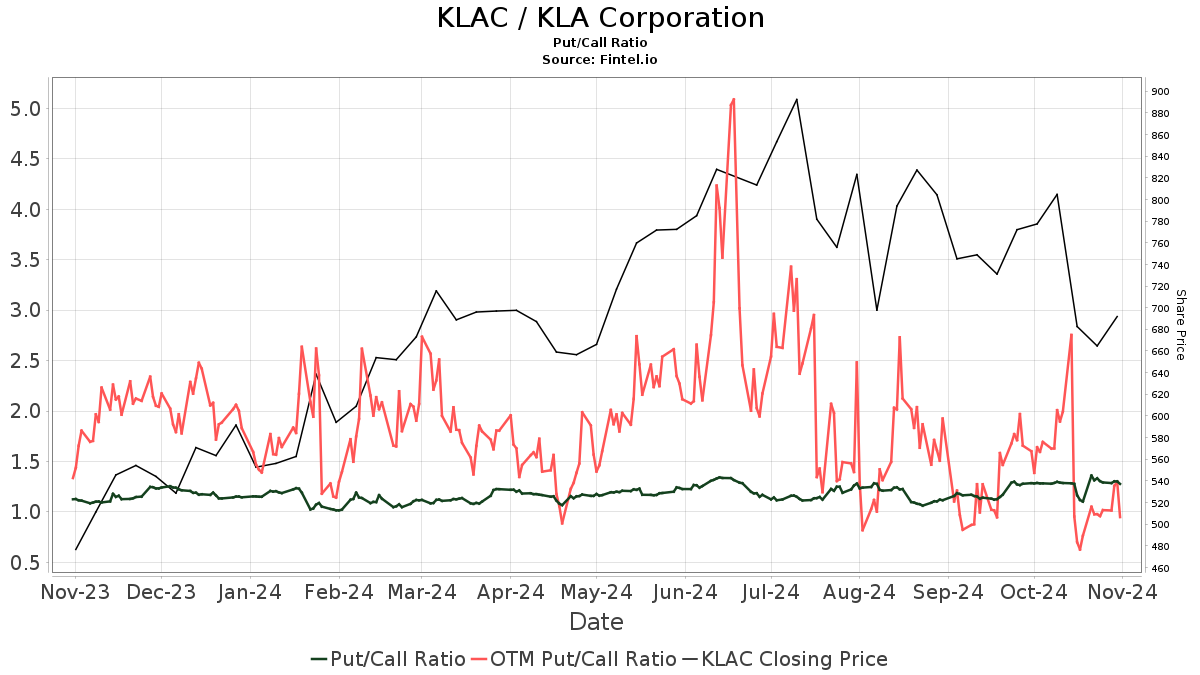

Currently, 2,637 funds and institutions hold positions in KLA, marking an increase of 42 holders, or 1.62%, over the last quarter. The average portfolio weight of all funds focusing on KLAC is now 0.53%, up by 2.43%. Institutional ownership increased by 1.17% in the past three months, totaling 138,652K shares.  However, the put/call ratio for KLAC is recorded at 1.30, indicating a generally bearish sentiment.

However, the put/call ratio for KLAC is recorded at 1.30, indicating a generally bearish sentiment.

Key Moves by Major Shareholders

Primecap Management currently owns 5,516K shares, equating to 4.12% ownership. In a prior filing, they reported 5,785K shares, showing a decrease of 4.88%. However, they raised their allocation in KLAC by 9.24% during the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 4,253K shares, representing 3.17% ownership. Previously, they reported a modest holding of 4,250K shares, reflecting a slight increase of 0.06%. Their allocation in KLAC has grown by 14.84% in the last quarter.

Capital International Investors owns 4,093K shares, or 3.05% of KLA. Their previous disclosure indicated 4,693K shares, reflecting a decrease of 14.67%. Nonetheless, they increased their portfolio allocation by 4.63% over the last quarter.

The Vanguard 500 Index Fund (VFINX) holds 3,456K shares, accounting for 2.58% of the company. Their previous ownership figures reported 3,408K shares, presenting a growth of 1.38%. They have also ramped up their allocation by 13.29% recently.

Vanguard’s PRIMECAP Fund (VPMCX) owns 3,362K shares, translating to 2.51% ownership. Their previous filing noted ownership of 3,498K shares, showing a decline of 4.02%. They adjusted their allocation upwards by 9.35% in the last quarter.

A Brief Overview of KLA

(This description is provided by the company.) KLA is a leader in developing equipment and services that drive innovation in the electronics sector. The company delivers advanced process control and enabling solutions for manufacturing various technology devices, including wafers, integrated circuits, and flat panel displays. KLA collaborates closely with industry partners globally, employing teams of experts to create solutions that foster progress.

Fintel offers a thorough investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses global fundamentals, analyst reports, ownership insights, fund sentiments, and more, enhancing investment decision-making. We also provide exclusive stock picks guided by advanced quantitative models, aiming to boost profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.