Nasdaq Composite Faces Correction as Tech Stocks Struggle

After reaching a peak on December 16, the Nasdaq Composite—reflecting nearly all stocks traded on the Nasdaq exchange—has entered a correction phase. Currently, the index is down approximately 9% year-to-date and has fallen about 13% from its peak in December.

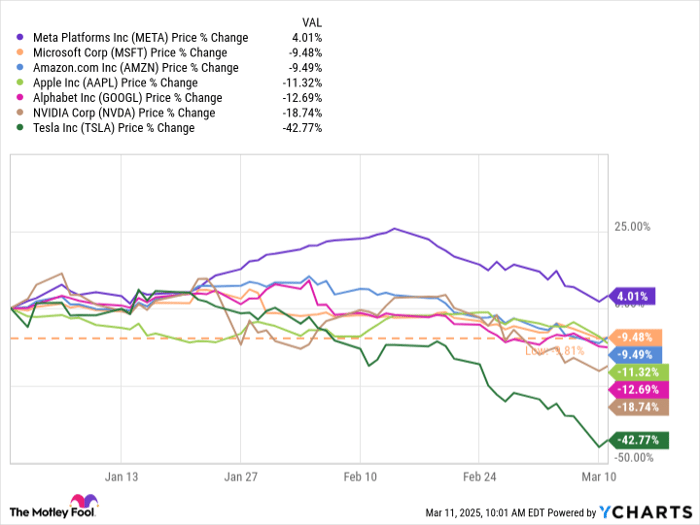

Given the Nasdaq’s heavy emphasis on technology, it is not surprising that many major tech stocks have mirrored this downward trend. The “Magnificent Seven,” comprising Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), and Tesla (NASDAQ: TSLA), have mostly declined this year, with Meta being the exception.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

META data by YCharts.

I don’t think the drop in the Magnificent Seven stocks signals a reason to panic. Each of these stocks has faced similar downturns before, and they are likely to recover over time. This environment presents an opportunity for investors to consider buying on the dip.

In fact, I find potential for each of the remaining six stocks in the Magnificent Seven and would recommend considering purchases. However, I advise caution with Tesla Stock, which I would avoid for the time being.

Positive Outlook for Most Magnificent Seven Stocks

For the remaining six companies in the Magnificent Seven, strong growth drivers and competitive advantages enhance their appeal:

- Apple: This company ranks among the most profitable globally, bolstered by a rapidly expanding services segment beyond hardware sales.

- Microsoft: With its extensive tech ecosystem essential to corporate functions, Microsoft’s partnership with OpenAI positions it well for AI advances.

- Nvidia: Its graphics processing units (GPUs) and data center hardware are critical components in building AI infrastructure for future development.

- Amazon: Not only a leader in e-commerce, but Amazon also stands out in cloud computing and is growing in the advertising sector.

- Meta: As a major player in digital advertising, Meta is significantly investing in AI infrastructure to enhance its business and advance its metaverse vision.

- Alphabet: Google continues to lead in search, its cloud service is gaining momentum, and YouTube dominates digital video content and streaming.

While these summaries simplify complex business dynamics, my confidence in each of these brands contrasts starkly with my view of Tesla.

International Competition Affects Tesla’s Sales

Tesla primarily generates revenue from passenger electric vehicles (EVs), with many sales occurring internationally. Recently, however, its international sales have declined. Markets in China, Norway, Denmark, Sweden, and Germany have all reported decreased sales figures.

Growing competition in the EV market, with firms like BYD in China and Volkswagen in Germany introducing their own models, is a significant factor. These competitors often offer lower-priced options while providing comparable performance, leading to shifting consumer preferences.

In the fourth quarter of 2024, Tesla reported automotive revenue of approximately $19.8 billion, reflecting an 8% decrease year-over-year. Although total revenue rose by 2% to $25.7 billion, the 23% drop in operating income raised concerns among investors, continuing a troubling trend for the company.

TSLA Revenue (Quarterly) data by YCharts.

Challenging Tesla’s Current Valuation

Even with a decline of over 42% this year, Tesla remains highly valued compared to other stocks in the Magnificent Seven. Its price-to-earnings (P/E) ratio clearly indicates that it is the most expensive stock in the group.

TSLA PE Ratio (Annual) data by YCharts.

Investing in Tesla seems challenging at this high valuation, especially given its stalled earnings growth. In contrast, the other Magnificent Seven stocks exhibit more promising earnings potential and a clearer outlook for their businesses.

Investment in Tesla represents a bet on a vision, which carries risks. Exercise caution, given the uncertainties surrounding the company and its current expensive price tag.

A Second Chance at Potentially Lucrative Opportunities

Have you ever felt as though you missed out on investing in top-performing stocks? Here’s your chance to consider the following recommendations.

Occasionally, our expert team issues a “Double Down” Stock recommendation for companies projected for growth. If you’re concerned about missed opportunities, now may be the optimal time to invest before the moment passes. The data supports these recommendations:

- Nvidia: Investing $1,000 when we doubled down in 2009 would yield $282,016!

- Apple: An investment of $1,000 from our 2008 recommendation would be worth $41,869!

- Netflix: If you invested $1,000 following our 2004 recommendation, it would have grown to $482,720!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this opportunity may not come around again soon.

Continue »

*Stock Advisor returns as of March 10, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool also recommends BYD Company and Volkswagen AG and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.