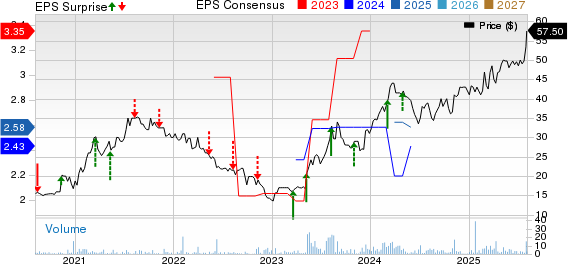

Optex Systems Sees Significant Earnings Growth and Stock Surge

Shares of Optex Systems Holdings, Inc. (OPXS) have increased by 19.1% since the company released its earnings for the quarter ending March 30, 2025. This growth notably surpassed the S&P 500’s mere 1% change during the same timeframe. Over the past month, OPXS stock has surged 42.9%, significantly outperforming the S&P 500’s 11.4% rise. Investor enthusiasm has been fueled by the company’s strong quarterly results and positive management insights.

Quarterly Financial Highlights

For the fiscal second quarter ended March 30, 2025, Optex reported earnings per share of 26 cents, an increase from 16 cents a year earlier. The company’s revenue saw a year-over-year rise of 25.9%, totaling $10.7 million compared to $8.5 million in the same quarter last year. Net income grew by 66.5%, reaching $1.8 million, up from $1.1 million a year earlier. Additionally, gross profit rose by 31.4% to $3.4 million, with gross margin expanding by 130 basis points to 31.3%. This expansion was driven by heightened sales volume and improved absorption of fixed costs. Operating income experienced a 65% increase to $2.2 million, reflecting enhanced efficiency across both operational segments.

Operational Metrics Support Strong Performance

Further strength in Optex’s growth narrative is evidenced by its six-month results. Revenues increased by 22.2% year-over-year to $18.9 million for the six months ended March 30, 2025, while net income rose by 74.9% to $2.6 million. The gross margin for this period improved to 29%, up from 27.4% the previous year, driven by increased product demand and optimized production processes. Adjusted EBITDA also demonstrated robust profitability, climbing 49.6% to $3.6 million.

Backlog and Future Contracts

As of March 30, 2025, the backlog was reported at $41.1 million, a decrease of 7% from $44.2 million as of both March 31 and September 29, 2024. In a strategic move, management announced a $5.7 million laser filter contract with the Applied Optics Center, scheduled for delivery between August 2025 and December 2026.

Management Insights on Performance

CEO Danny Schoening attributed the solid quarterly performance to improved periscope production capacity and increased demand for laser filter products, particularly at the Applied Optics Center. He emphasized the company’s operational execution and commitment to meeting customer expectations. The focus on maintaining high product quality and customer support has been crucial for Optex’s recent success.

Key Drivers of Growth

The quarterly revenue growth stemmed primarily from increased periscope production and stronger demand for laser filter products. The rise in gross profit was largely facilitated by better absorption of fixed costs associated with higher revenue. Efficient scaling of production at the company’s facilities in Richardson played a significant role, with inventory levels reducing to $13.9 million from $14.9 million as of September 29, 2024. This decline further indicates improved inventory management.

Financial Strategy and Position

During the quarter, Optex undertook measures to enhance its balance sheet by repaying $1 million against its credit facility, resulting in zero outstanding debt as of March 30, 2025. By the end of the quarter, the company held $3.5 million in cash and a working capital of $17.9 million, an increase from $15.1 million at the end of fiscal 2024. These actions reflect a prudent financial strategy focused on maintaining liquidity while covering operational needs.

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.