It’s a difficult time for the junior mining exploration companies in Canada. According to Jeff Killeen, policy and program director for PDAC, there hasn’t been a single financing above C$125 million on the TSX Venture Exchange in the past year. Deals at the C$200 million level were once common, but are now a rarity. The struggles are not limited to the actual availability of capital but also concern the size of deals being made, as Killeen highlighted in a recent interview. The figures paint a stark contrast with the past, where the TSX Venture Exchange used to be a bustling hub of financial activity for junior miners.

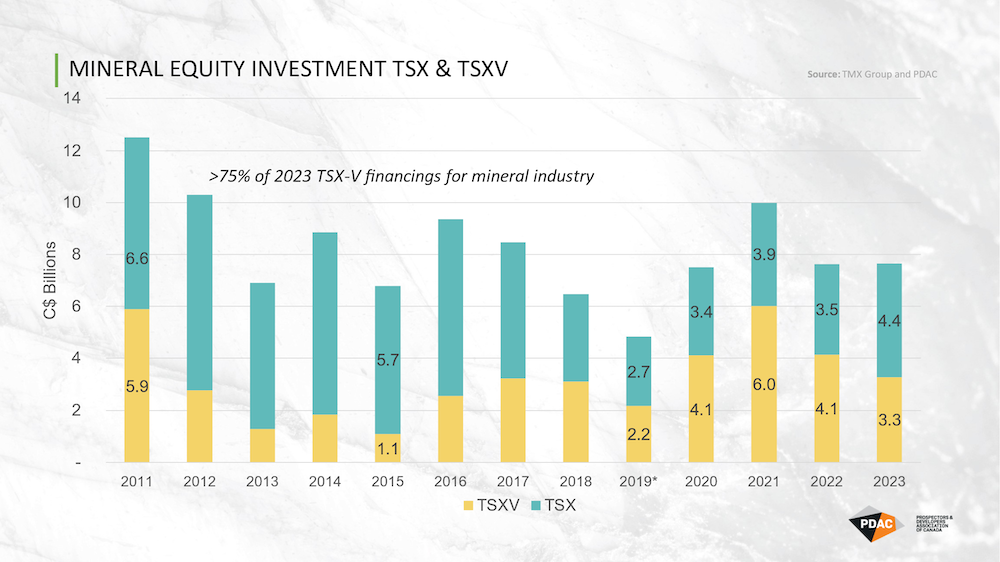

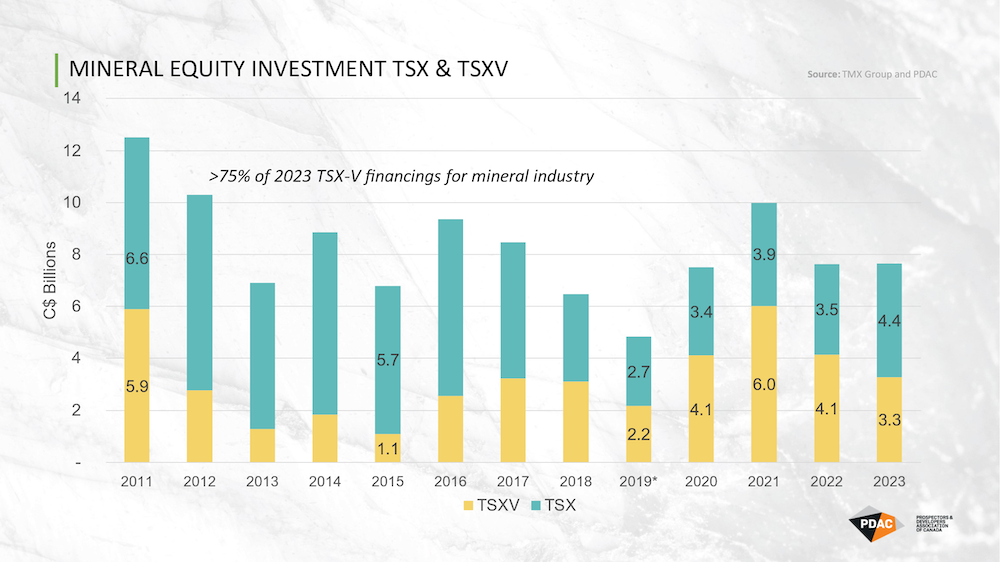

The challenges that these junior mining exploration companies face are further compounded by the fact that there has been a consistent decline in total financing on the TSX Venture over the past three years. This decline has now led to the exchange falling far behind the main board in equity raised for the first time since 2017. Even though the state of risk capital seems grim overall, junior miners managed to be the silver lining, accounting for three-quarters of all funds raised on the Venture Exchange last year.

The numbers paint a mixed picture. On one hand, nearly C$8 billion in equity was raised on all Canadian exchanges last year for mining, marking a slight increase from 2022 and aligning with the 10-year average for fundraising. However, the availability of capital hasn’t significantly improved over the last decade, leaving the junior miners grappling with adverse market conditions.

According to Killeen, there seems to be a shift in the dynamics of capital availability in the mining sector. Despite precious metals exploration still attracting the majority of funding, other metals such as base and battery metals plus uranium have seen a significant uptick in capital allocation. In fact, the total capital for these metals has nearly tripled since 2020, reaching nearly C$2 billion. On the other hand, funding for precious metals exploration shrunk by 19% last year alone, hinting at a significant shift in investor sentiment toward different types of mining projects.

The shifting landscape is also being reflected at the international level, with Killeen mentioning an increasing interest among international delegates coming to the PDAC convention. This renewed global attention is indicative of the growing global commitment to harness mineral resources for advancing electrification, clean technology, and emissions reduction goals.

PDAC is cognizant of the challenges faced by junior miners and has taken proactive steps to ease their burden. This year, for the first time, the Investors Exchange floor will host corporate presentations, aiming to facilitate better connections between juniors and potential investors. PDAC has also planned a series of critical minerals-related sessions that integrate different facets of the mining industry, aiming to provide a multifaceted approach to address the industry’s challenges.

Government Advocacy and Support

It’s not all doom and gloom, though. The Canadian federal government has recently introduced policies and incentives amounting to comprehensive support for mineral companies as part of its Critical Minerals Strategy. This historic move includes a commitment of C$3.8 billion in total spending aimed at bolstering the entire mineral supply chain, from exploration through to project construction.

However, there are also calls for improvements in the current support packages. For instance, the C$1.5 billion over seven years Critical Mineral Infrastructure Fund needs a revamp, especially considering the substantial costs associated with critical mineral infrastructure. This is crucial given the competitiveness of the global mining landscape.

Furthermore, there is a push to expand the scope of support to include polymetallic projects in the Clean Technology Manufacturing input tax credit, ensuring a level playing field for various mining ventures. PDAC is also actively advocating for regulatory changes to safeguard junior miners from the impact of short-selling activities. This issue has already elicited substantial industry support and is expected to be addressed by regulators in the near future.

Optimism Amid Challenges

Despite the short-term hurdles posed by fluctuating commodity prices, there is a sense of cautious optimism in the mining industry. Jeff Killeen remains hopeful for the medium to long-term prospects of junior miners, emphasizing the rapidly shifting global support for mineral exploration and mining endeavors.

The current environment might be challenging, but the broader outlook is extraordinarily promising, with a global commitment toward the future growth of the mineral industry. This change in sentiment positions the industry for a potentially bright future, fostering hope for the junior mining sector in Canada.