Understanding Analyst Ratings: What Do They Mean for ServiceNow?

Wall Street analysts’ recommendations play a significant role in guiding investor decisions on stocks. Changes in these ratings can greatly influence stock prices, but how reliable are they really?

Before evaluating the credibility of these recommendations, let’s take a look at what analysts are saying about ServiceNow NOW.

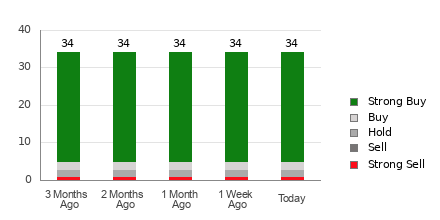

Currently, ServiceNow has an average brokerage recommendation (ABR) of 1.29, which is calculated on a scale from 1 to 5, where 1 is Strong Buy and 5 is Strong Sell. This score is based on recommendations made by 34 brokerage firms, suggesting a leaning between Strong Buy and Buy.

Out of those 34 recommendations, 29 fall under Strong Buy and two under Buy. This indicates that 85.3% of recommendations are Strong Buy, while only 5.9% are Buy.

Current Trends in Brokerage Recommendations for ServiceNow

While the ABR suggests buying ServiceNow, investors should exercise caution in making decisions based solely on this metric. Research shows that brokerage recommendations have limited effectiveness in helping investors choose stocks with high price appreciation potential.

Why is that the case? Brokerage firms often have substantial interests in the companies they cover, leading to a bias in favor of positive ratings. For every “Strong Sell” recommendation, it appears there are about five “Strong Buy” recommendations issued by these firms.

This disparity suggests that interests may not be aligned with retail investors, limiting the utility of these ratings for predicting stock price movements. Therefore, it’s advisable to use this information to complement your own analysis or incorporate it with tools known for their predictive power.

The Zacks Rank, a proprietary stock rating model with a strong track record, categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This method can effectively indicate a stock’s price performance in the near term, making it beneficial to use the ABR alongside Zacks Rank for informed investment decisions.

Distinguishing Between ABR and Zacks Rank

While both the ABR and Zacks Rank use a 1-5 scale, they measure different aspects.

The ABR is purely based on brokerage analyst recommendations, often shown with decimals (e.g., 1.28). In contrast, the Zacks Rank uses a quantitative model that focuses on earnings estimate revisions and is displayed in whole numbers from 1 to 5.

Due to analyst optimism, brokerage ratings typically skew positively, often failing to align with realistic market trends. Many investors find that these analyst recommendations don’t always provide reliable guidance.

In contrast, the Zacks Rank hinges on earnings estimate revisions, which empirical research links closely to movements in stock prices. This model offers a balanced view across all stocks being evaluated for earnings estimates within the current year.

Additionally, the timeliness of the two metrics varies. The ABR may not reflect the most current data, whereas the Zacks Rank is frequently updated based on the latest earnings estimates, making it a more immediate indicator of potential price direction.

Assessing Investment Viability for ServiceNow

For ServiceNow, the Zacks Consensus Estimate for the current year remains unchanged at $13.75 over the past month. This lack of change suggests that analysts are holding steady in their outlook on the company’s earnings prospects, potentially indicating that the stock may perform in line with the broader market.

The recent stability in the consensus estimate, alongside other factors, has resulted in a Zacks Rank of #3 (Hold) for ServiceNow. Given this, investors might consider being cautious despite the favorable Buy-equivalent ABR.

To read this article on Zacks.com, click here.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.