Energy Stocks Gaining Traction Amid Improved Market Conditions

Energy stocks are reasserting their strength as macroeconomic conditions improve and demand drivers multiply. Recession fears are diminishing, with positive signs from tariff negotiations, creating a more favorable market environment that is benefiting energy companies.

One compelling factor fueling this optimism is the ongoing global expansion of data centers. This development is expected to spur a large increase in electricity demand. Infrastructure for artificial intelligence, cloud computing, and high-performance servers requires significant power, positioning utilities, natural gas providers, and midstream energy firms to benefit from this trend.

Recent trends in crude oil prices also indicate a possible bottom has been reached, adding further support to the energy sector.

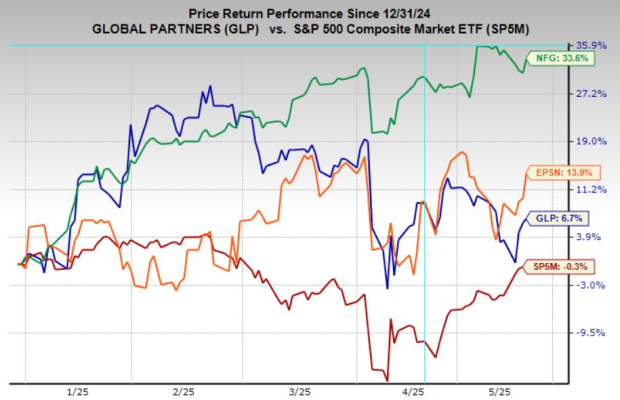

Several energy stocks are noteworthy for their strong fundamentals, fair valuations, and positive earnings momentum. Global Partners (GLP), National Fuel Gas (NFG), and Epsilon Energy (EPSN) all possess high Zacks Ranks and attractive growth forecasts, positioning them as promising opportunities in the current energy market.

Image Source: Zacks Investment Research

Crude Oil Prices Suggest Future Upside Potential

Crude oil prices faced significant decline in early April due to aggressive tariff announcements that lowered global growth expectations. However, renewed efforts by policymakers to ease trade tensions have led to a rebound in those growth forecasts, boosting optimism in energy markets.

Technically, crude oil appears to have found support. Recent price movements indicate a reversal off the $56 level, forming a double bottom—a bullish reversal pattern. This suggests that downward pressure may be weakening and a base is forming.

A clear resistance level around $64 has emerged, now serving as a significant breakout point. Continued improvement in growth expectations and data supporting stronger demand could push prices above $64, potentially leading to a sustained move toward $70.

Image Source: TradingView

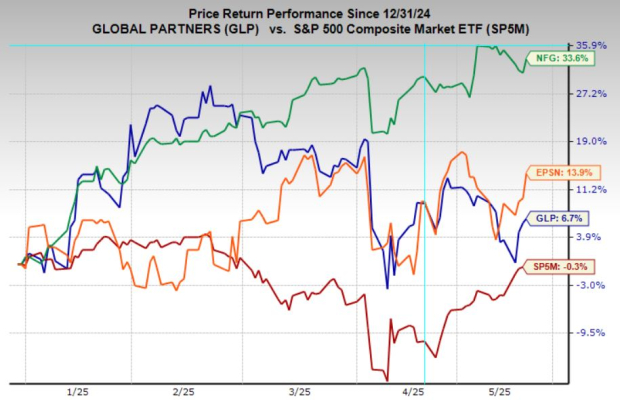

National Fuel Gas Company: Strong Fundamentals at a Discount

National Fuel Gas operates across exploration, production, and utility distribution. This diverse framework allows NFG to capitalize on various segments of the energy value chain, ensuring both stability and growth as demand for domestically sourced natural gas continues to rise.

Currently rated Zacks Rank #2 (Buy), the stock is experiencing a trend of upward earnings revisions, indicating increasing analyst confidence in the company’s future.

From a valuation perspective, NFG appears quite attractive. Shares are trading at just 11.7 times forward earnings, significantly lower than its 10-year median of 14 times and the industry’s average of 16.8 times. Coupled with a growth forecast projecting a 20.4% annual increase in earnings over the next three to five years, NFG presents a compelling investment case.

This combination of growth and value results in a PEG ratio of just 0.58, placing NFG in the undervalued category.

Image Source: Zacks Investment Research

Epsilon Energy: Positioned for a Significant Breakout

Epsilon Energy operates in the Appalachian Basin as a small-cap natural gas exploration and production firm. With a focus on capital efficiency, disciplined growth, and shareholder returns, Epsilon boasts a 3.7% dividend yield and a commitment to share buybacks, making it an appealing energy stock for a diverse range of investors.

Currently, EPSN holds a Zacks Rank #1 (Strong Buy), reflecting strong bullish sentiment from analysts. Earnings estimates have seen a significant increase, with current quarter projections rising by 38% in the last month and annual estimates rising by 9.1%. Valuation metrics remain sound, with shares trading at just 14.2 times forward earnings.

From a technical analysis perspective, Epsilon’s stock is forming a bullish flag pattern, and a breakout above the $7.30 resistance level would confirm this, likely triggering renewed buying interest and the potential for new highs.

Image Source: TradingView

Global Partners: Benefiting from Earnings Upgrades and Strong Yield

Global Partners operates as a diversified midstream energy company, engaged in the wholesale, distribution, and retail of petroleum products and renewable fuels.

Global Partners LP Stands Out with Robust Dividend and Earnings Growth

Global Partners LP (GLP) boasts a vertically integrated business model, featuring an extensive network of terminals and transportation assets, alongside over 1,600 retail locations in the Northeast. This structure provides stable cash flows and broad market exposure.

A notable aspect of GLP is its 6% dividend yield, which is not only attractive but also sustainable due to regular cash generation. The company has impressively increased its dividend at an average annual rate of 10% over the past five years, demonstrating management’s commitment to shareholder value.

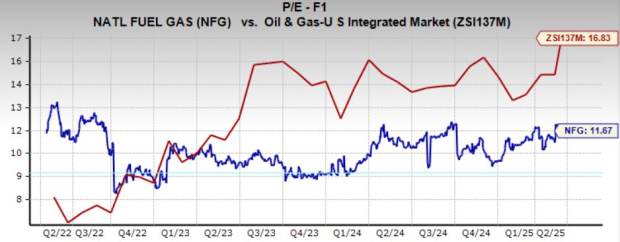

Furthermore, the stock holds a Zacks Rank #1 (Strong Buy), bolstered by a series of significant earnings estimate revisions from analysts. In recent days, current-quarter earnings estimates surged by 42.9%, with full-year 2025 projections up 24.6% and 2026 estimates rising by 22.2%.

Image Source: Zacks Investment Research

Analyzing Investment Potential in NFG, EPSN, and GLP

In the current market, improving macroeconomic conditions, rising energy demands from data centers, and supportive crude oil prices contribute to a favorable backdrop for energy stocks. National Fuel Gas (NFG), Epsilon Energy (EPSN), and Global Partners LP present a compelling combination of value, growth, and yield, each supported by a robust Zacks Rank and positive earnings momentum. Investors looking to leverage the next phase of the energy cycle should consider adding these three stocks to their watchlist.

Five Stocks Poised for Significant Gains

A select group of five stocks has been identified by Zacks experts as potential double-digit gainers, each with the potential to increase by 100% or more in 2024. While not every pick will achieve such drastic gains, previous recommendations have performed exceptionally well, with increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks in this report currently fly under Wall Street’s radar, offering investors a unique opportunity to enter at an early stage.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations? Download 7 Best Stocks for the Next 30 Days for free.

National Fuel Gas Company (NFG) : Free Stock Analysis Report

Global Partners LP (GLP) : Free Stock Analysis Report

Epsilon Energy Ltd. (EPSN) : Free Stock Analysis Report

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.