Maximizing Income: Covered Calls Strategy for Patterson-UTI Energy Shareholders

Exploring Options: Boost Your Returns with PTEN’s Covered Call

Shareholders of Patterson-UTI Energy Inc. (Symbol: PTEN) aiming to increase their income beyond the stock’s 4.1% annualized dividend yield have an interesting opportunity. By selling the January 2026 covered call at the $10 strike price, investors can collect a premium of 85 cents per share. This strategy could provide an annualized return of 9.9% based on the current stock price, resulting in a potential total return of 14% annually if the stock is not called away. On the downside, any gains beyond $10 would be forfeited if the stock does rise that high. However, PTEN would need to climb 28% from its current position for that scenario to occur. If called, shareholders would ultimately enjoy a total return of 38.9%, including any dividends received prior to the call.

It’s important to note that dividend payments are often unpredictable, reflecting each company’s profitability. For Patterson-UTI Energy Inc., examining its dividend history could provide insights into the sustainability of the current 4.1% payout.

The chart below illustrates PTEN’s trailing twelve-month trading history, highlighting the $10 strike in red:

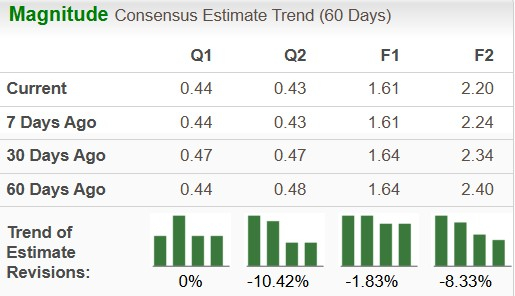

This chart, along with an analysis of PTEN’s historical volatility, serves as a valuable resource. Selling the January 2026 covered call at the $10 strike might offer a reasonable risk-reward balance. Notably, we have calculated the trailing twelve-month volatility for Patterson-UTI Energy Inc. at 41%, considering the last 250 trading days and today’s stock price of $7.79. For more options ideas at different expirations, visit the PTEN Stock Options page on StockOptionsChannel.com.

During mid-afternoon trading on Monday, the put volume among S&P 500 components reached 1.05 million contracts, while call volume was at 2.09 million, resulting in a put:call ratio of 0.50. This figure is significantly lower than the long-term median put:call ratio of 0.65, indicating that traders are favoring call options more heavily today.

Explore which 15 call and put options are trending among traders.

![]() Top YieldBoost Calls of Stocks Conducting Buybacks »

Top YieldBoost Calls of Stocks Conducting Buybacks »

Also see:

- Funds Holding ADHD

- TPR DMA

- PRTC market cap history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.