The average one-year price target for Optimum Communications (NYSE:OPTU) has been revised to $2.20 per share, a decrease of 13.92% from the prior estimate of $2.56, as of December 18, 2025. The new forecast ranges from a low of $1.01 to a high of $5.25 per share, representing a potential 16.00% increase from the latest closing price of $1.90 per share.

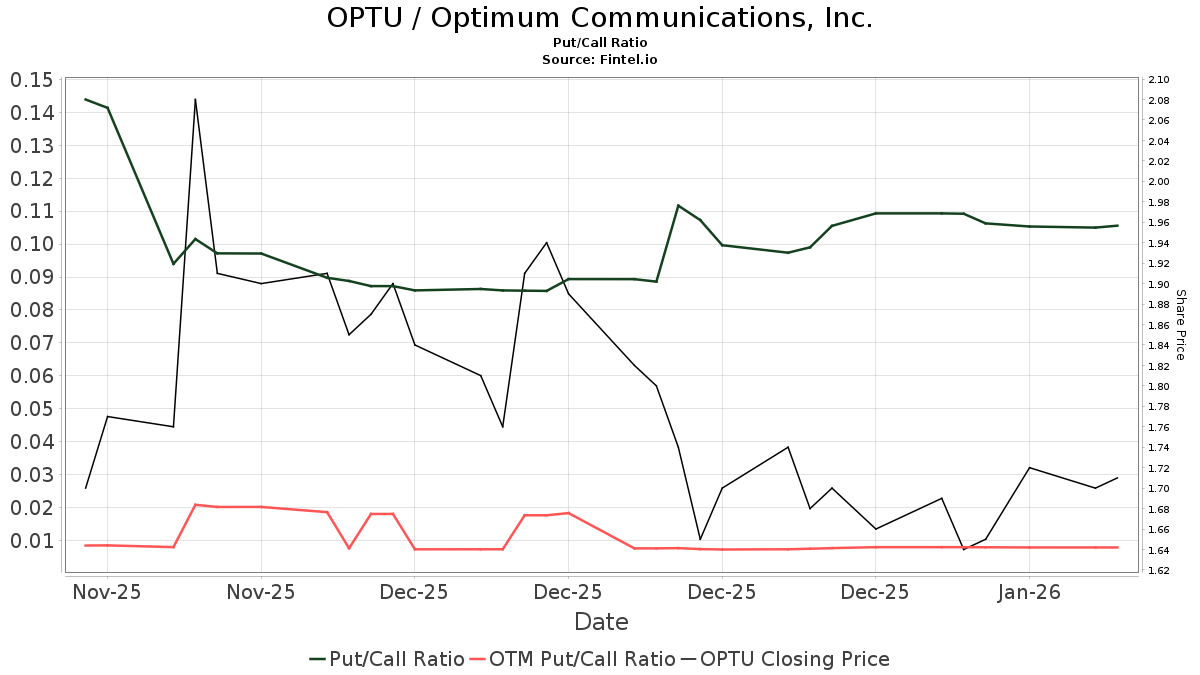

Currently, 325 funds report positions in Optimum Communications, reflecting a decline of 9 funds or 2.69% in the last quarter. Institutional ownership increased by 1.57% over the past three months, totaling 320,178,000 shares. The put/call ratio of OPTU stands at 0.11, indicating a bullish outlook among investors.

Key stakeholders include Empyrean Capital Partners, holding 23,100,000 shares (8.09% ownership); Deutsche Bank, which raised its holdings from 10,544,000 to 12,968,000 shares (4.54% ownership); and Millennium Management, increasing its shareholding from 8,752,000 to 11,464,000 shares (4.02% ownership). Other notable changes include Apollo Management and Nomura Holdings, which decreased their allocations by 11.33% and 17.33%, respectively.