Oracle Struggles with Q3 Fiscal 2025 Financial Performance

Oracle (ORCL) reported disappointing third-quarter fiscal 2025 results, failing to meet analyst expectations for both earnings and revenue. The company’s non-GAAP earnings reached $1.47 per share, falling short of the Zacks Consensus Estimate by 0.68%, while revenues of $14.13 billion missed predictions by 1.59%. Despite Oracle’s attempt to highlight growth in its Oracle Cloud Infrastructure (“OCI”) business, the overall performance indicates significant challenges as the company faces heightened expectations tied to its elevated stock price.

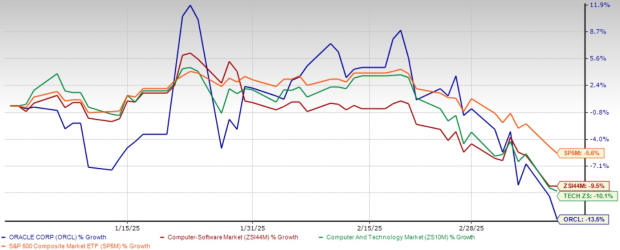

The earnings miss arrives at a troubling time for Oracle’s investors, as the stock has declined by 13.5% year-to-date, contrasting sharply with its impressive 58% surge in 2024. The volatile after-hours trading post-announcement saw shares initially jump 6% before reversing by 3.7%, reflecting growing concerns about Oracle’s financial trajectory.

Year-to-Date Performance

Image Source: Zacks Investment Research

Valuation Concerns Amid Slowing Growth

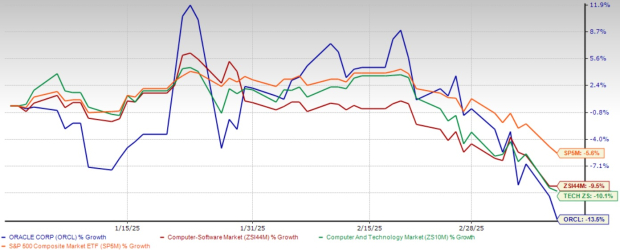

One of the most alarming aspects of Oracle’s current standing is its valuation, trading at an EV/EBITDA multiple of 19.12x, which greatly exceeds the Zacks Computer-Software industry average of 15.57x. This higher multiple implies that investors expect robust future growth, yet Oracle is increasingly struggling to meet these growth benchmarks.

ORCL’s EV/EBITDA TTM Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

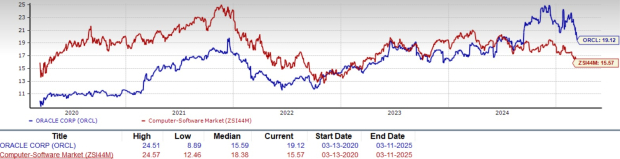

The third-quarter results inevitably raise crucial questions about whether Oracle can sustain its high valuation amidst a competitive cloud market. Although Oracle claims to have signed sales contracts exceeding $48 billion in the third quarter and reported a 63% increase in remaining performance obligations (RPO) to over $130 billion, actual revenue growth remains modest at just 6% year over year (8% in constant currency).

The Zacks Consensus Estimate for Oracle’s fiscal 2025 revenues stands at $57.64 billion, indicating an expected year-over-year growth of 8.84%. Meanwhile, the earnings consensus mark for fiscal 2025 is $6.21 per share, slightly down from predictions over the last month, representing a year-over-year increase of 11.69%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

Operational Challenges Amid Capacity Constraints

Oracle is facing execution challenges that undermine its claims of cloud leadership. During the earnings call, management admitted that component delays have hindered cloud capacity expansion this year—a significant concern for a company positioning itself as a key infrastructure provider for AI workloads. Competitors like Amazon.com (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) are rapidly expanding their infrastructures to cater to the growing demand for AI services, whereas Oracle’s supply chain issues may jeopardize its market position.

The company’s capital expenditures surged to $5.9 billion in the third quarter alone, paralleling its operating cash flow for the same period. Management forecasts that capital spending will escalate to around $16 billion for fiscal 2025—more than double last year’s CapEx. This increased spending affects free cash flow, which has declined by 53% on a trailing 12-month basis.

Investor Warning Signs

Oracle’s disappointing earnings, coupled with significant capital expenditures and sluggish growth, present a troubling scenario for investors. While management promotes substantial AI-related contracts with companies such as AMD, OpenAI, and Meta, the transition of these contracts into substantial revenue growth remains uncertain.

Moreover, the company’s dependency on a small number of significant AI clients introduces concentration risks, indicating that its growth may rest on a few high-profile deals instead of a broad-based adoption across various sectors.

Consider Selling Before Further Declines

The third-quarter results should serve as a wake-up call for Oracle investors. The company’s high valuation leaves little room for missteps, yet Oracle is exhibiting troubling operational difficulties. Competing cloud infrastructure providers continue to rapidly innovate, while Oracle’s growth remains stagnant despite significant capital investments, suggesting a weakened fundamental case for the stock.

Additionally, Oracle’s modest 4% earnings growth (7% in constant currency) is insufficient to justify its elevated valuation. As the reality of Oracle’s growth prospects becomes clearer, investors who profited from the 2024 rally may want to capitalize on gains now, rather than risk further disappointment that could compel a major valuation correction.

Considering these unfavorable trends, Oracle’s Zacks Rank of #4 (Sell) appears warranted. Investors should evaluate exiting positions while the prevailing enthusiasm for AI helps support the stock price, rather than waiting for more evidence that Oracle’s ambitious claims are misaligned with its financial realities.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was selected by a Zacks expert as a top pick to gain +100% or more in 2024. While not every selection can succeed, previous recommendations have produced gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks mentioned in this report are under the radar of Wall Street, providing a unique opportunity to invest early.

Today, see These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

Oracle Corporation (ORCL): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.