Ormat Technologies, Inc. ORA revealed that it has completed the previously announced acquisition of a portfolio of geothermal and solar assets from Enel Green Power North America (EGPNA), a subsidiary of Enel SpA. The purchase price of the equity interest in the portfolio assets amounted to $271 million.

According to the agreement, the acquired assets comprise two contracted operating geothermal power plants, one triple hybrid geothermal, solar PV, and solar thermal power plant with a total geothermal capacity of nearly 40 megawatts (“MW”) and Solar PV of 20 MW, two Solar assets with a total nameplate capacity of 40 MW and two greenfield development assets. The new additions are set to bolster the Ormat Technologies Electricity segment Generating Portfolio to 1,215 MW.

ORA, currently carrying a Zacks Rank #3 (Hold), has funded the acquisition through available cash and proceeds received from the issue of $200 million in long-term debts.

The assets acquired by Ormat will be immediately accretive to the earnings and EBITDA of the company. It plans to improve the performance of the acquired asset portfolio through a series of operational enhancement and optimization initiatives.

Transition in Energy Space

The utility space is currently undergoing a transition. Most of the utilities are utilizing more renewable sources of energy to produce electricity, contributing to lower emissions. The U.S. Energy Information Administration’s report reveals that renewable sources will contribute 24% of U.S. electricity generation, up from 21% in 2022.

Due to the construction of large utility-scale renewable projects, the U.S. Energy Information Administration predicts that solar and wind generation together in 2024 will surpass electric power generation from coal for the first time ever, exceeding coal by nearly 90 billion kWh.

It is evident that utilities operating in the space are gradually adding more renewable assets to their generation portfolio and shutting down old coal plants.

Utilities like NextEra Energy NEE, Dominion Energy D and Duke Energy DUK, among others, are building up a significant renewable asset portfolio and continuing to lower emissions in the process.

NextEra Energy, through its unit Energy Resources, continues to work on its strategy of making a long-term investment in clean energy assets. The company expects to add 33-42 gigawatts (“GW”) of new renewables in the 2023-2026 time frame to the generation portfolio via clean energy investments.

Dominion Energy’s long-term objective is to add 24 GW of battery storage, solar, hydro, and wind projects by 2036 and increase the renewable energy capacity by more than 15% per year over the next 15 years, on average.

Duke Energy has taken the initiative to expand its renewable asset base and aims to reach its target of net-zero carbon emissions from electric generation by 2050.

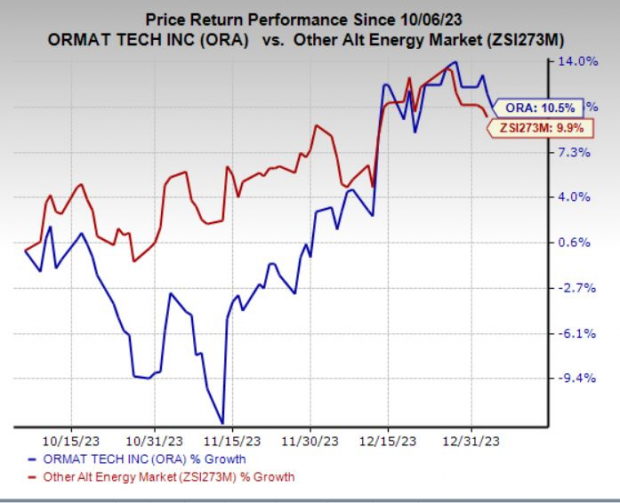

Price Performance

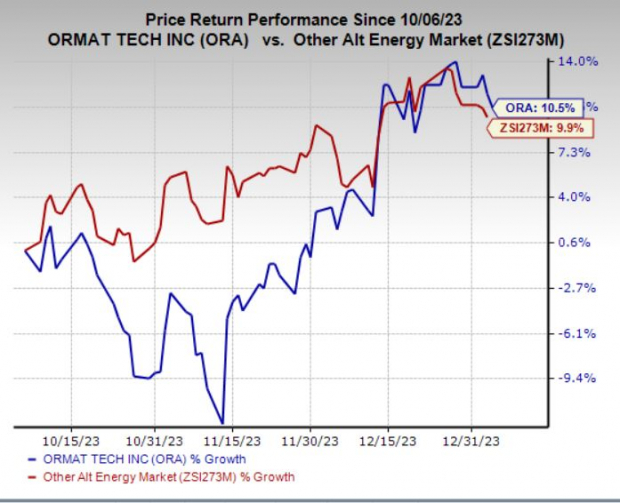

Ormat Technologies shares have gained 10.5% in the last three months, outperforming the industry’s growth of 9.9%.

Image Source: Zacks Investment Research

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more. They’ve already closed 162 positions with double- and triple-digit gains in 2023 alone.

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

Ormat Technologies, Inc. (ORA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.