Today’s market is more like a casino … why young people are treating it this way … the specific market with the greatest gambling … how to find the biggest winners

Can you guess who said the following?

For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young.

The casino now resides in many homes and daily tempts the occupants.

Got your answer?

Congrats if you guessed “Warren Buffett.”

The Oracle of Omaha wrote this in his latest annual letter to Berkshire Hathaway shareholders back in February.

It’s the “for whatever reasons,” that I find interesting

There are likely all sorts of answers, but I think I can accurately pinpoint at least one…

Let’s investigate a chart together.

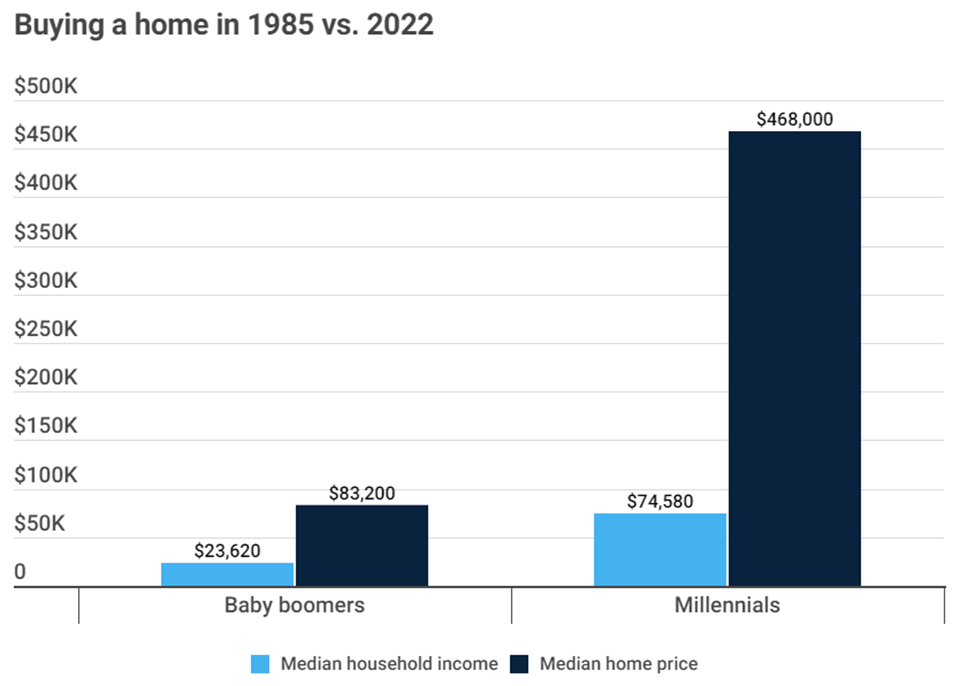

You’re about to see a comparison of the median income earned in 1985 relative to the average home price then. The chart will then compare that to the same metrics in 2022.

Income is light blue. Median home price is dark blue.

Source: Clever Real Estate

Here’s Clever Real Estate:

That increase — going from 3.5 years’ worth of income to 6.3 years’ worth of income — means homes are 80% more expensive for millennials than they were for their parents’ generation.

For homes to be as affordable as they were in 1985, the median household would need to earn $134,000 per year — nearly double the current median of $74,580.

It’s not just home prices that have become more expensive relative to median incomes

It feels like just about everything is eating up disposable income today.

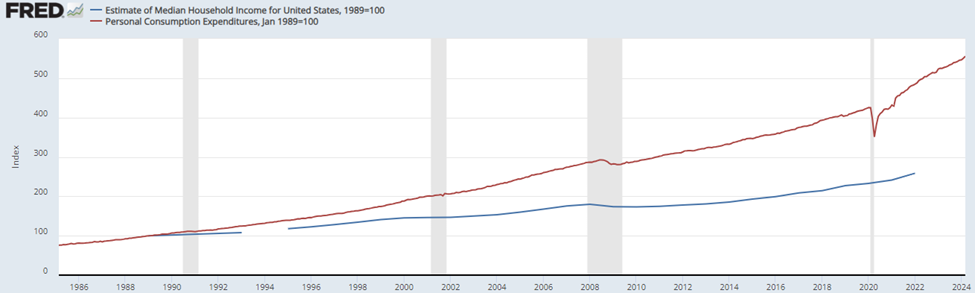

To illustrate, let’s crudely compare “what you make” to “what you spend.”

We’ll do this by evaluating the Estimate of Median Household Income to Personal Consumption Expenditures.

The chart below dates to 1985, and we’re indexing the data to enable comparison.

Please note that the Fed’s data for median income isn’t updated beyond 2022 but you can still get a sense for its trajectory.

Median income in blue while expenditures are in red.

Source: Federal Reserve data

In short, “what you spend” crushes “what you make.”

Might this be a contributing factor to why younger Americans are treating the stock market as a casino?

Without a casino-type windfall, the lifestyle that older generations took for granted is miles beyond reach for young adults today.

If you believe yesterday’s pathway to the American Dream of “work hard, save, and it will pay off” doesn’t work anymore, then gambling for the big windfall isn’t quite so crazy.

Here’s ABC News with a survey about the American Dream:

Barely more than a quarter of Americans say the American dream still holds true — about half as many as said so 13 years ago.

Defined as “if you work hard, you’ll get ahead,” just 27% in a new ABC News/Ipsos poll say the American dream still holds, down sharply from 50% when the question first was asked in 2010. Eighteen percent now say it never held true, up from 4%.

The rest, 52%, say the promise used to hold true but no longer does, up 9 points. Taken together, 69% say the American dream does not hold true today, up 22 points.

But rather than join in with this glum mood, let’s refocus on the investment markets.

What’s the impact of this casino approach to investing? And taken a step farther, how can we use it to our advantage?

The “game-ification” of the investment markets, and how to ride it

Let’s jump to our hypergrowth expert, Luke Lango:

Consumers are increasingly gamifying everything these days.

Look no further than the meme stock craze comeback of the past week.

GameStop (GME) and AMC (AMC) both shot up hundreds of percent in a matter of days all because a famous trader tweeted about them.

Folks are out there buying GameStop and AMC hoping to strike it rich. It’s become a betting game.

Or how about sports betting? That is absolutely surging these days.

Indeed, in 2023, Americans wagered a record $120 billion on sports bets. That’s up nearly 30% year-over-year.

Now, there are all sorts of angles we could take here.

For example, we could profile top gaming stocks… or discuss how to track and follow where Millennials are directing their next short squeeze (think GameStop) … or we could circle back to the “cash-strapped” aspect of Millennials and look at companies benefiting from the rise of buy-now-pay-later, which is having its moment in the sun.

But for today, let’s zero in on the biggest casino of all.

The Venn Diagram overlap of financially frustrated young adults, a casino approach to investments, and striking it rich overnight leads us to one corner of the market…

Altcoins.

This is where many young adults go to gamble big in hopes of winning bigger. That’s because when a specific altcoin becomes the focal point of their bets, the resulting run-up in price can be extraordinary.

I’ll show you that in a moment, but first, let’s be candid…

Wading into the altcoin market should be done with your “risk on” capital. And same with visiting a casino, you’d be wise to bring no more money than you’re comfortable losing if your bets go the wrong way.

But the fantastic thing about the altcoin market is that you don’t need to bet big to win big.

To illustrate, below are the top five altcoin gainers over the last three months according to CoinRanking.com:

- OpenPlatform (OPEN) – 6,212%

- POPCAT (POPCAT) – 5,026%

- Catacoin (CAT) – 2,062%

- Solama (SOLAMA) – 1,417% (This is different than “Solana”)

- DEGEN (DEGEN) – 1,388%

The biggest winner is up more than 6,000%. That’s enough to turn $500 into more than $30,000 – again, in just three months.

So, let’s say you’re aware of the risk and you position-size wisely. How do you find the best altcoins?

It’s all about momentum, not value

One of the biggest knocks against cryptocurrencies is that they have zero intrinsic value.

To remove this as a barrier to making money from altcoins, let’s momentarily accept this as true.

So, rather than view an altcoin as a storehouse of value, let’s rebrand it…

It’s a temporary-yet-potentially-robust tool for wealth-building.

Given this “temporary” aspect, catching these altcoins at the right time is paramount. So, how do we do that?

If you want to do it yourself, there are various indicators online that help identify which altcoins are on the move.

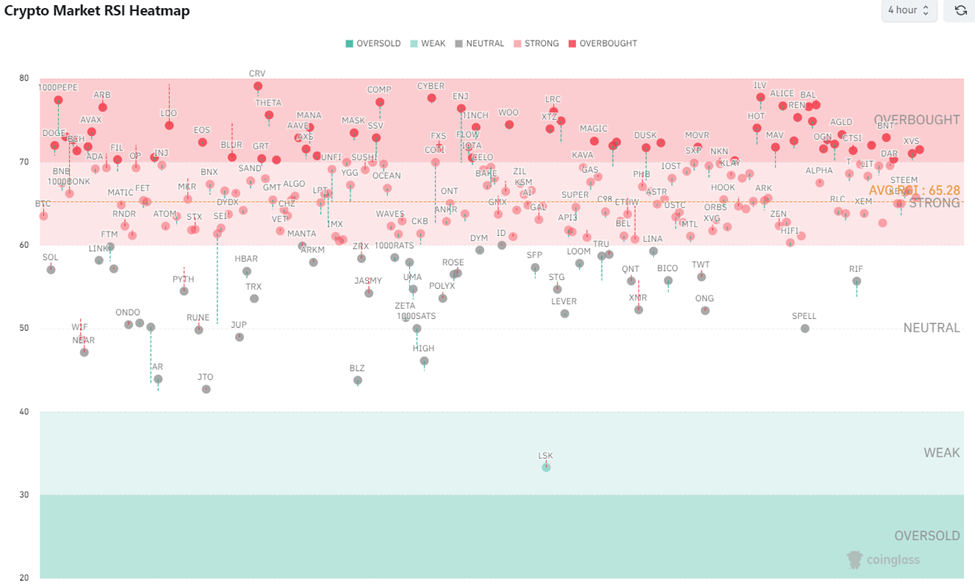

For example, CoinGlass.com offers a suite of charting tools. Below is its Relative Strength Indicator Chart.

If I were using this, I’d look for a crypto in the “strong” (light red) category that has a tail suggesting surging bullishness.

Source: CoinGlass.com

We have no affiliation with CoinGlass. It’s one of many online tools you can find.

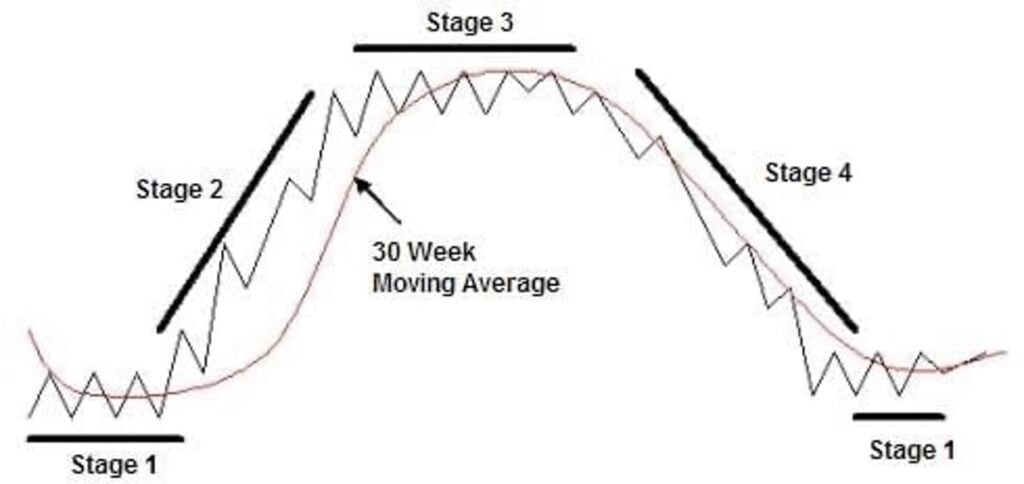

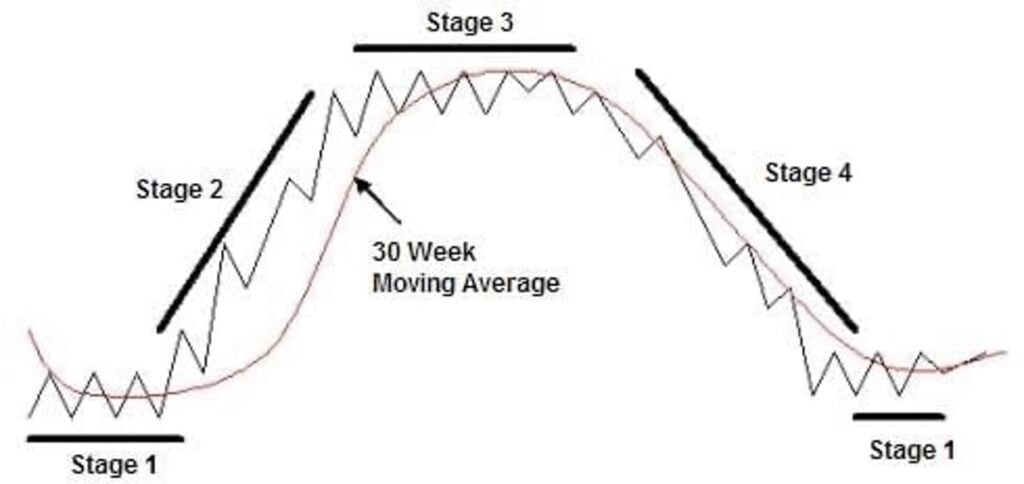

In Luke’s altcoin service Crypto Trader, he uses a market approach called “stage analysis” to find surging altcoins

If you’re less familiar with this investment style, it’s straightforward…

At any given point in time, an asset is either going up, down, or sideways.

To that end, it’s always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages an asset is in at any given point in time, and then buying only when it’s climbing higher in Stage 2.

Here’s how Luke describes it in Crypto Trader:

(Note how he treats altcoins in the same manner we referenced a moment ago – as wealth-building tools, not long-term storehouses of intrinsic value.)

Our Crypto Trader system focuses on the one thing that really matters for your wealth…

A price breakout.

At the end of the day, the only thing that will make a difference to your portfolio is whether the cryptos you own rise in value while you own them.

That’s why we only buy cryptos that our stage-analysis system deems to be on the verge of breaking out and entering new, major bullish uptrends.

I’ll add that Luke’s latest two picks from Tuesday of last week are already up, respectively, 7% and 32%.

Now, one thing we haven’t even touched on in this Digest is the recent excitement around a potential ETF that tracks the spot price of Ethereum.

In recent days, crypto insiders have begun speculating that the SEC will reverse its stance and approve a 19b-4 filing, which would allow an Ethereum-tracking ETF to be listed on the exchange.

This could happen as soon as tomorrow. If it does, look for even more firepower behind related smaller altcoins.

In any case, be aware of how these stiff financial headwinds are affecting younger Americans, and influencing their attitudes

But not just for the altcoin and stock market.

There are countless other spider webs that have the potential to impact your wallet, either directly or peripherally. Here are just three, all from the Cato Institute:

- Young adults’ view on our capitalist system: barely half of Americans under 45 now have favorable views of capitalism compared to 76% of seniors.

- Young adults’ view on wealth: 52% of Americans under 30 report that “most” rich people became rich “by taking advantage of other people.” They are also about 20–35 points more likely than seniors to get “angry” when the topic of rich people comes up.

- Young adults’ view on taxes: 53% of Americans under 30 are in favor of redistributing wealth from the rich to the poor. This is the only age group that feels this way as a majority. Only 20% of seniors agree.

Perhaps the pendulum will eventually swing back the other way. But for now, take note of the direction things are moving…and get ready for more casino-like investment markets.

Have a good evening,

Jeff Remsburg