Investing Insight: The Star Power of the Vanguard Growth ETF

The U.S. stock market has several key benchmarks, but none are as closely watched as the S&P 500. This index monitors the largest 500 American companies on U.S. stock exchanges and is considered the primary benchmark for overall market performance.

When stocks or exchange-traded funds (ETFs) evaluate their results, they usually compare them against the S&P 500. Higher returns signal good performance, while lower returns indicate underperformance.

If you seek an ETF that consistently achieves above-average returns, look no further than the Vanguard Growth ETF (NYSEMKT: VUG).

Large-Cap Growth Stocks: A Winning Combination

This ETF is designed specifically for growth stocks, focusing on large-cap companies. This is significant, as the size of these businesses often translates to advantages not typically found in smaller growth stocks.

Many associate growth stocks with young, recently public companies, but this isn’t the full story. A growth stock is any stock that displays fast financial growth compared to its industry and has the potential to outperform the market. The company’s size is less relevant.

By investing in large-cap growth stocks, this ETF allows you to put your money into solid companies with good financial health and established business models, all while striving to outperform the S&P 500. It’s an ideal investment approach.

Proven Performance Against the S&P 500

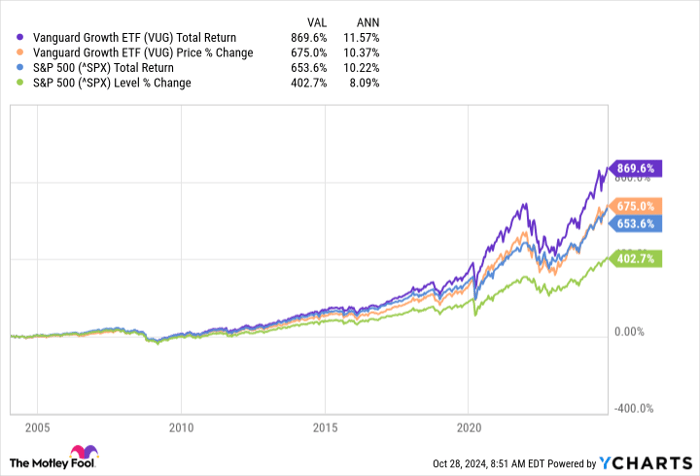

Since its inception in January 2004, the Vanguard Growth ETF has demonstrated impressive performance compared to the S&P 500.

VUG Total Return Level data by YCharts

Having a history of beating the market adds credibility to this ETF’s claims. With two decades of experience, it has gained the trust of investors seeking returns that exceed market averages.

While past performance is no guarantee of future success, this ETF’s potential looks promising. Approximately 57.7% of the ETF is concentrated in the tech sector, which has been a continuous driver of growth. With advances in artificial intelligence, the cloud market booming, and rising cybersecurity needs, the tech industry presents numerous growth opportunities.

Despite its tech focus, the ETF also invests in companies across the other 10 major sectors, providing balance and potential support when necessary.

| Sector | Percentage of the ETF |

|---|---|

| Consumer discretionary | 18.4% |

| Industrials | 8.5% |

| Healthcare | 7% |

| Financials | 2.7% |

| Real estate | 1.6% |

| Basic materials | 1.3% |

| Energy | 1% |

| Telecommunications | 0.9% |

| Consumer staples | 0.6% |

| Utilities | 0.2% |

| Other | 0.1% |

Source: Vanguard. Percentages as of Sept. 30.

Understanding the Impact of Top Holdings

This ETF has many positive attributes, but one area to consider is the concentration among its top holdings. Below are the top 10 holdings and their respective percentages within the ETF:

| Company | Percentage of the ETF |

|---|---|

| Apple | 12.05% |

| Microsoft | 11.41% |

| NVIDIA | 9.99% |

| Amazon | 5.99% |

| Meta | 4.73% |

| Alphabet (Class A) | 3.30% |

| Eli Lilly | 2.87% |

| Alphabet (Class C) | 2.70% |

| Tesla | 2.70% |

| Visa | 1.70% |

Source: Vanguard. Holdings as of Sept. 30.

In total, the top 10 holdings account for over 57% of the ETF, while the top 10 holdings of the S&P 500 make up just over 34%. The focus here should be on how Apple, Microsoft, and NVIDIA constitute roughly one-third of this 183-stock ETF.

These companies are exemplary, each boasting a history of impressive returns. However, a downside arises during market downturns, as was seen in 2022 when many large-cap growth stocks underwent a significant sell-off.

VUG data by YCharts

This ETF should not form the backbone of most portfolios due to its concentration, but it can serve as an excellent supplement for those wishing to capitalize on the tech sector’s high-flying stocks.

A Second Chance at Major Investment Opportunities

Have you ever felt like you’ve missed your chance to invest in top-performing stocks? If so, this may be your moment.

Our analysts occasionally identify what they call a “Double Down” stock—companies they believe are poised for significant growth. If you think opportunities have passed you by, it’s worth considering investing now before it’s too late. Historical data shows promising returns:

- Amazon: A $1,000 investment when we doubled down in 2010 would be worth $21,706!*

- Apple: A $1,000 investment made during our 2008 prediction would now be worth $43,529!*

- Netflix: A $1,000 investment at our double down in 2004 would be valued at $406,486!*

Right now, we’re issuing “Double Down” alerts for three exceptional companies, and these chances may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook, is the sister of Meta Platforms CEO Mark Zuckerberg and serves on The Motley Fool’s board of directors. Stefon Walters holds positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool also recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.