Key Points

-

Meta Platforms (NASDAQ: META) reported a revenue increase of 24% to $59.9 billion in its latest earnings report.

-

Operating income rose 6% to $24.7 billion, with a projected revenue of $53.5 billion to $56.5 billion for Q1, indicating potential 30% growth.

-

Meta’s stock trades at a price-to-earnings ratio of 25.4, lower than the S&P 500’s 28.1.

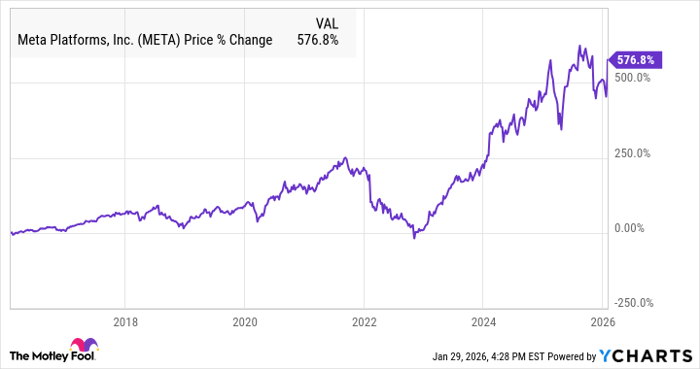

Meta Platforms (NASDAQ: META) has seen its stock value increase nearly 2,000% since its IPO in 2012, but despite strong growth, it trades at a significant discount compared to its peers in the “Magnificent Seven.” As reported on October 26, 2023, the company achieved a revenue of $59.9 billion for the latest quarter, attributed partly to AI-driven advertising enhancements.

Despite ongoing scrutiny and challenges, including scandals and regulatory issues, the firm has maintained double-digit revenue growth. Investors look to its guidance for Q1 2024, indicating a possible revenue growth rate of 30%, the fastest in five years, while the stock remains undervalued with a P/E ratio of 25.4 against the broader market average of 28.1.