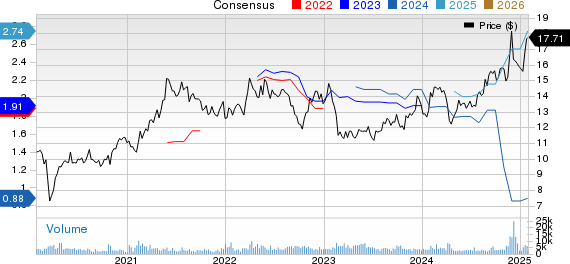

Ohio Valley Banc Corp. (OVBC) reported significant earnings growth for the quarter ending December 31, 2025, with net income rising 57.3% to $3.9 million, compared to $2.5 million a year earlier. Earnings per share (EPS) increased 58.5% to $0.84 from $0.53. For the full year 2025, net income reached $15.6 million, up 41.8% from $10.9 million in 2024, and EPS climbed 42.7% to $3.31. The stock gained 2.1% following the earnings announcement, outperforming the S&P 500’s 0.3% gain during the same period.

The company’s total interest income for Q4 2025 rose 14.1% to $22.9 million, supported by higher loan and securities portfolios. Key metrics include a net interest margin expansion to 4.18%, average earning assets increasing to $1.48 billion, and return on average assets improving to 1.00%. However, the non-performing loans ratio grew to 1.40% from 0.46% year-over-year, impacted by two commercial loans placed on nonaccrual status.

Ohio Valley Banc’s assets increased to $1.58 billion as of December 31, 2025, from $1.50 billion in the previous year. Shareholders’ equity also rose to $170.3 million, reflecting strong retained earnings growth. Management emphasized disciplined execution and community-focused banking as key contributors to the strong performance this year.