“`html

A recent study by MetLife Investment Management indicates that institutional buyers may control up to 40% of all single-family homes available for rent in the U.S. by 2030. This trend is concerning for individual landlords and first-time homebuyers as these firms continue to acquire high-value properties in major markets.

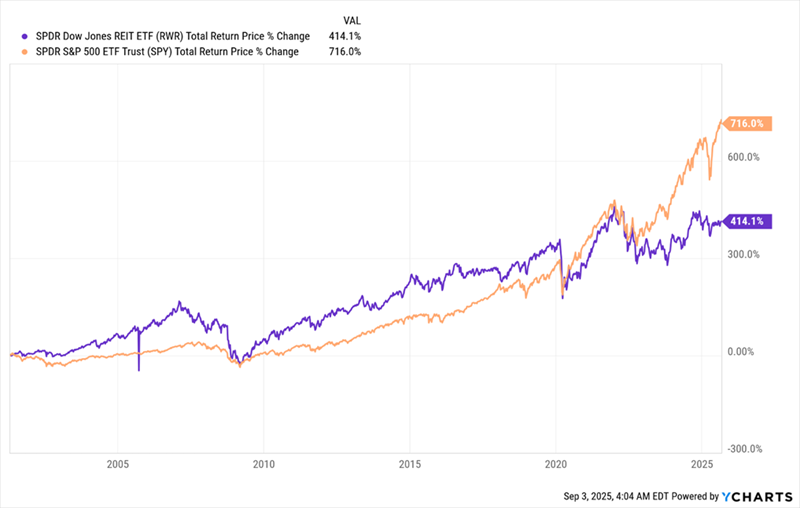

In light of these developments, many investors are turning to closed-end funds (CEFs) that focus on real estate investment trusts (REITs) as a more advantageous option. These funds average an 8% yield, while some targeted CEFs, like the Nuveen Real Asset Income and Growth Fund (JRI), currently yield 11.9%. JRI is diversified across 460 holdings, exceeding the total return of comparable investment vehicles like the SPDR Dow Jones REIT ETF (RWR) in recent years.

As interest rates are expected to decrease, demand for real estate is predicted to increase, making it a timely opportunity for investors to consider buying into CEFs like JRI.

“`