Finding Value in Undervalued Companies

When a stock’s Relative Strength Index (RSI) falls below 30, it may indicate overselling and potential undervaluation, presenting opportunities for investors.

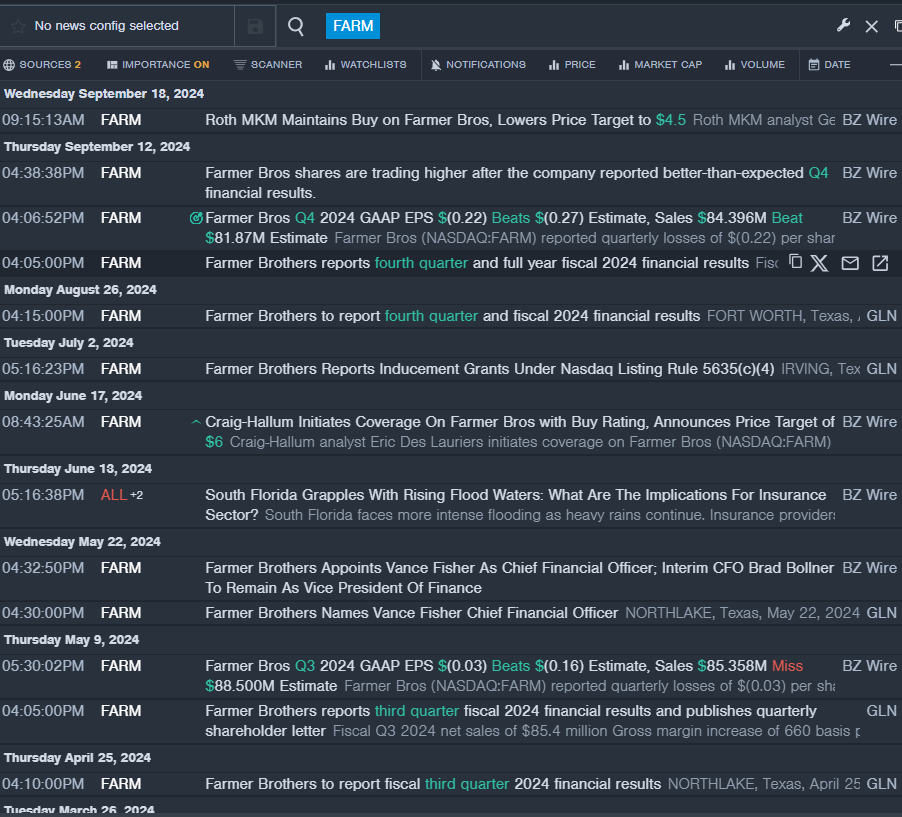

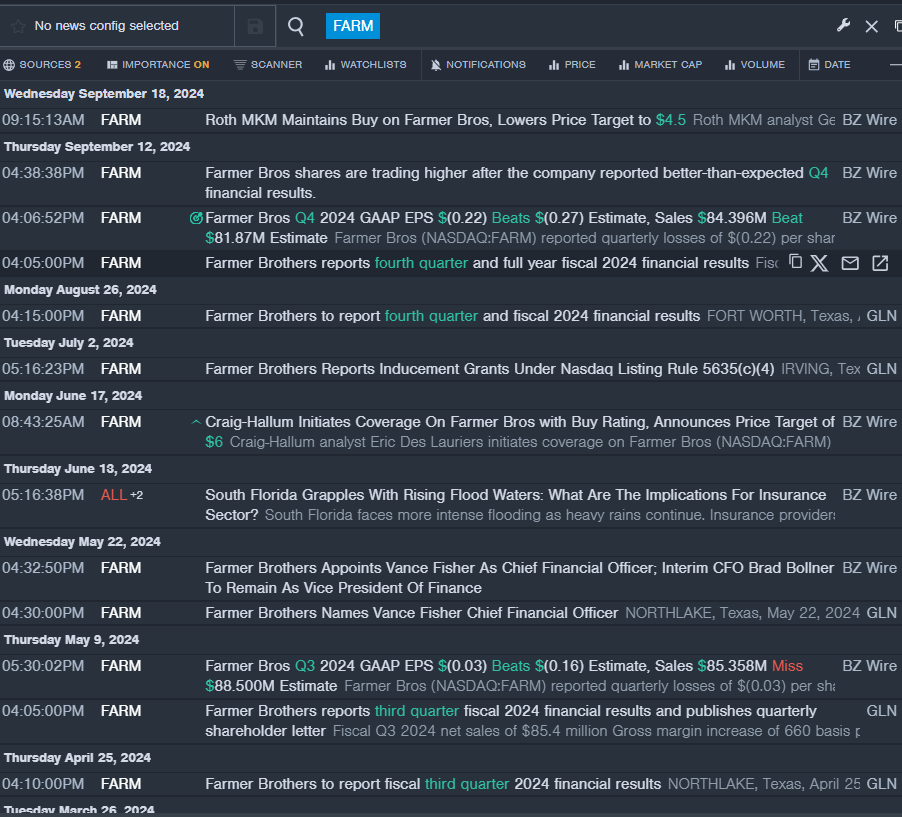

Farmer Bros Co (FARM)

- Farmer Bros reported strong fourth-quarter financial results, driving improved gross margins and profitability. The stock fell about 30% in the past month, reaching a 52-week low of $1.85.

- RSI Value: 27.27

- FARM Price Action: Shares closed at $1.89 on Thursday.

- Benzinga Pro provided real-time updates on Farmer Bros news.

British American Tobacco PLC (BTI)

- British American Tobacco reported a decrease in adjusted EPS and a 6% stock drop over five days, hitting a 52-week low of $28.25.

- RSI Value: 24.49

- BTI Price Action: Shares closed at $35.11 on Thursday.

- Benzinga Pro’s tools tracked the trend in British American Tobacco stock.

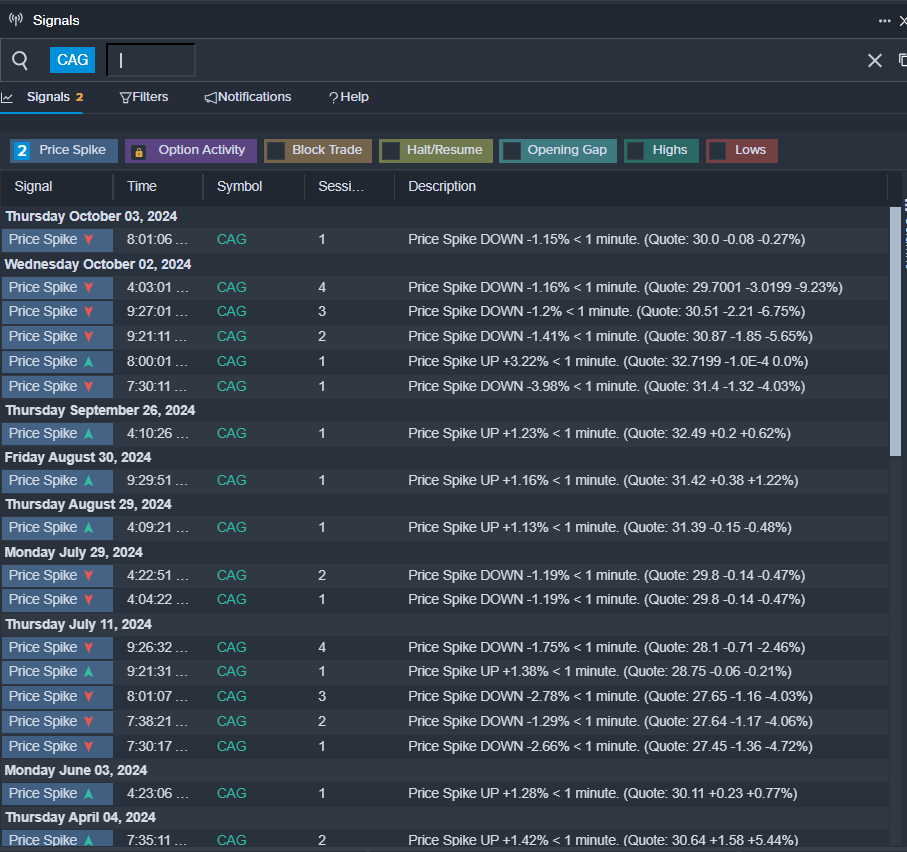

Conagra Brands Inc (CAG)

- ConAgra Brands reported below-expectation first-quarter results but affirmed its fiscal 2025 guidance. The stock fell around 10% in five days, hitting a 52-week low of $25.16.

- RSI Value: 25.52

- CAG Price Action: Shares closed at $29.35 on Thursday.

- Benzinga Pro’s signals hinted at a potential breakout in Conagra Brands shares.

Read Next:

Market News and Data provided by Benzinga APIs