Pacira BioSciences, Inc. PCRX reported first-quarter 2024 adjusted earnings of 62 cents per share, which missed the Zacks Consensus Estimate of 64 cents. The company had reported adjusted earnings of 49 cents per share in the year-ago quarter.

Total revenues amounted to $167.1 million, which increased 4% year over year and surpassed the Zacks Consensus Estimate of $165 million.

Quarter in Detail

Pacira’s top line comprises product sales and royalty revenues. The company recognizes product revenues from the sales of its three marketed drugs: Exparel, Zilretta and iovera.

Exparel’s net product sales were $132.4 million, which rose 2% from the year-ago quarter and missed both the Zacks Consensus Estimate of $134.6 million and our estimate of $133.3 million. Revenues generated from Exparel sales were negatively impacted by contracted discounts and vial mix, which led to the low sales growth rate in the reported quarter.

Exparel (bupivacaine liposome injectable suspension) is indicated in patients aged six years and older for single-dose infiltration to produce postsurgical local analgesia and in adults as an interscalene brachial plexus nerve block to produce postsurgical regional analgesia.

Zilretta’s net product sales came in at $25.8 million, up 6% year over year. Pacira completed the acquisition of Flexion Therapeutics in November 2021, following which, the former began recognizing Zilretta sales. The reported figure missed the Zacks Consensus Estimate of $26.7 million but beat our model estimate of $24.4 million.

Net product sales of iovera were $5 million, up 26% from the year-ago quarter. The figure marginally missed the Zacks Consensus Estimate of $5.2 million and matched our model estimate.

Revenues generated from the sales of bupivacaine liposome injectable suspension to third-party licenses were pegged at $2.5 million, up significantly from the year-ago quarter’s figure.

Royalty revenues amounted to $1.3 million in the reported quarter, up 42% year over year.

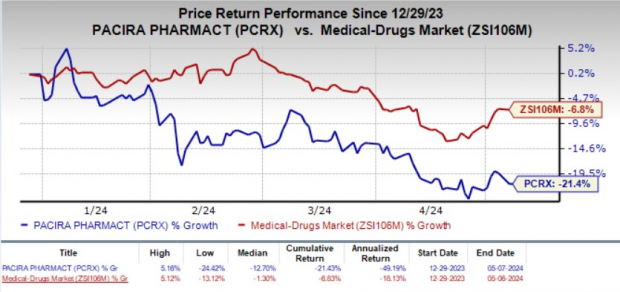

Year to date, shares of Pacira have plunged 21.4% compared with the industry’s 6.8% decline.

Image Source: Zacks Investment Research

Research and development (R&D) expenses (excluding stock-based compensation) came in at $16.4 million, up 8% from the year-ago quarter. The uptick can be attributed to start-up activities for the planned phase III study of Zilretta in shoulder osteoarthritis.

Selling, general and administrative (SG&A) expenses (excluding stock-based compensation) of $63.8 million also increased 2% year over year, largely due to a rise in professional and legal fees.

As of Mar 31, 2024, Pacira had cash, cash equivalents and available-for-sale investments of $325.9 million compared with $281 million as of Dec 31, 2023.

2024 Guidance Reaffirmed

Pacira reiterated its previously announced financial guidance for 2024. It expects total revenues in the band of $680-$705 million for the full year.

The company anticipates adjusted R&D expenses between $70 million and $80 million, while adjusted SG&A expenses are expected in the range of $245-$265 million.

The adjusted gross margin of the company is projected between 74% and 76% in 2024.

Pacira BioSciences, Inc. Price and EPS Surprise

Pacira BioSciences, Inc. price-eps-surprise | Pacira BioSciences, Inc. Quote

Recent Updates

Along with the first-quarter earnings release, Pacira announced that it has entered into a share repurchase program that authorizes the company to purchase up to an aggregate of $150 million of its outstanding common stock.

During the reported quarter, the FDA granted the Regenerative Medicine Advance Therapy designation to its novel gene therapy product candidate,PCRX-201 (enekinragene inzadenovec), which is currently being developed to treat osteoarthritis of the knee.

Zacks Rank and Stocks to Consider

Pacira currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the drug/biotech industry are Ligand Pharmaceuticals LGND, ANI Pharmaceuticals ANIP and Annovis Bio ANVS. While LGND sports a Zacks Rank #1 (Strong Buy), ANIP & ANVS carry a Zacks Rank #2 (Buy) each, at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for Ligand’s 2024 earnings per share has remained constant at $4.56. During the same time frame, the estimate for Ligand’s 2025 earnings per share has remained constant at $5.27. Year to date, shares of LGND have gained 2.5%.

Ligand beat estimates in each of the trailing four quarters, delivering an average surprise of 56.02%.

In the past 30 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share have risen from $4.43 to $4.44. Meanwhile, during the same period, the estimate for ANI Pharmaceuticals’ 2025 earnings per share has remained constant at $5.04. Year to date, shares of ANIP have climbed 21%.

ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering an average surprise of 109.06%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.35 to $2.93. During the same period, the estimate for Annovis’ 2025 loss per share has widened from $2.82 to $2.83. Year to date, shares of ANVS have plunged 71.4%.

ANVS beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Top 5 Dividend Stocks for Your Retirement

Zacks targets 5 well-established companies with solid fundamentals and a history of raising dividends. More importantly, they have the resources and will to likely pay them in the future.

Click now for a Special Report packed with unconventional wisdom and insights you simply won’t get from your neighborhood financial planner.

See our Top 5 now – the report is FREE >>

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Pacira BioSciences, Inc. (PCRX) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.